Stock markets around the world rose in March with Canada leading the way. The Canadian dollar had another strong month and the new federal government revealed their first budget with a headline grabbing deficit.

March 2016 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for March |

Return for 2016 |

| Oil Price (USD) | $38.34 | +13.60% | +0.63% |

| Gold Price (USD) | $1,235.60 | +0.10% | +16.54% |

| US 3 month T-bill | +0.21% | -0.12%* | +0.05%* |

| US 10 year Bond | +1.78% | +0.04%* | -0.49%* |

| USD/CAD FX rate | 1.2987 | -4.02% | -6.16% |

| EUR/CAD FX rate | 1.4777 | +0.38% | -1.68% |

| CBOE Volatility Index (VIX) | 13.95 | -32.12% | -23.39% |

*Absolute change in yield, not the return from holding the security.

Stock markets rose around the world in March, helping to recover some of the losses sustained in January and February. The Canadian dollar continued to gain ground and is now back below 1.30 to the US dollar. The recovery in the Loonie was largely due to the recovery in oil and the unexpectedly strong GDP report for January.

Most equity markets we track were positive in March, with Canadian and emerging markets leading the way. Canadian small cap continued to show strength, gaining 7.1% for the month. The S&P/TSX Composite was up a bit less at +4.9%. US markets were up between 6% and 8%, with small cap outperforming. European equities were less strong; the MSCI EAFE index was up 2.5% and MSCI Europe was +1.6%. Germany was the strongest of the major European markets at +5.0%, but it is still down for 2016 by more than 7%. Japan was also strong at +4.6%. Note that all of the preceding figures are in their home currency, not Canadian dollars.

Bond markets also performed well in March, led by corporate investment grade and high yield bonds. The broad FTSE/TMX Universe Bond Index was up 0.8%, while the corporate bond indexes were up between 0.8% to 3.0%. Investment grade bonds in the US were also positive, with high yield performing very well. Credit spreads narrowed significantly and most of the high yield indexes posted returns for March between 4.4% and 10.2%.

After several months of negative performance, oil finished the month up 13.6% and is now slightly positive for 2016. Gold was flat in March while platinum and silver were up 4.4% and 3.6%, respectively. With most commodities in positive territory for March, the broad Bloomberg Commodity Index was up +3.8%.

The Canadian Dollar strengthened in March to 1.2987 to the US dollar. Against the Euro it was little changed at 1.4777.

Market Commentary

The biggest financial news for Canadians in March was the release of the federal government’s budget. In addition to the previously announced income tax rate changes, the government implemented many of the promises announced during the election campaign. The headline announcements include the implementation of the new Canada Child Tax Benefit, elimination of income splitting for couples with children under 18, rollback of the previous government’s plan to increase the age of eligibility for Old Age Security (OAS) to 67 from 65 and a 10% increase to Guaranteed Income Supplement (GIS) payments (if income is under $17,304 you don’t qualify), plus spending on infrastructure and may other areas.

One of the less talked about changes was the closing of a loophole that allowed corporate class mutual funds that permitted switches between classes on a tax deferred basis. When you sell the majority of investments, including most mutual funds, you pay tax if there was a gain on that investment. Corporate class mutual funds, as the name suggests are structured as a corporation with many different share classes, each of which had a different investment strategy. By investing in the corporate class structure you could switch between different investment strategies without paying any tax. These mostly appealed to people investing outside an RRSP or TFSA, generally people with large incomes who the government has decided should pay more tax.

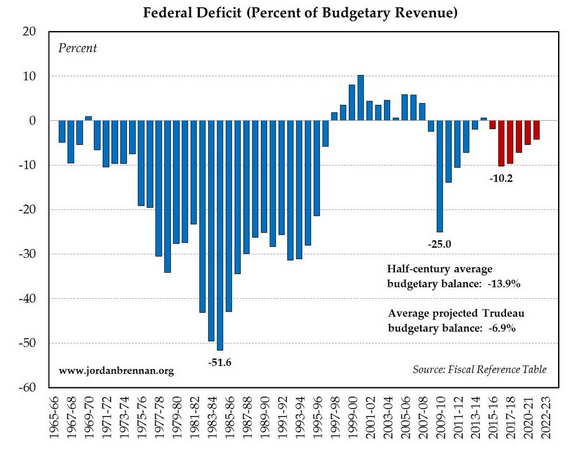

The result of the budget is a projected deficit of $29.4 billion. That is a pretty big number when compared to past deficits. $6 billion of that deficit is a forecast allowance that is the result of conservative economic forecasts which assumes lower economic growth than most private sector economists, and lower oil prices thanmost private sector forecasts. So if none of that allowance is needed the deficit would shrink to $23.4 billion.

While the magnitude of the deficit in dollar terms is very large, relative to the revenue in the budget, the deficit is one of the smaller ones in the last 50 years. To put it into perspective, if your household income was $50,000 and you overspent by $10,000 that would be much worse than if you overspent by $10,000 when your income was $130,000.

March Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate ticked up 0.1% to 7.3% in March as 2,300 jobs were lost; worryingly 51,800 full time jobs were lost and were almost entirely replaced with part time jobs.

Building permit activity declined -9.8% in January, while housing starts rose by a staggering 28.8% in February. Housing prices were up again in January by +0.1%, or +1.8% over the last year.

Inflation was up 0.2% in February. On an annual basis, the inflation rate was +1.4%, less than the Bank of Canada’s target rate of 2%. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was up +1.9% for the last year. Retail sales rose 2.1% in January and were up 6.4% for the year.

The January GDP report for Canada was an unexpectedly strong +0.6%, double the average of economists’ expected growth of +0.3%. With inflation staying low and excess capacity remaining in the economy, the Bank of Canada left interest rates unchanged at +0.5%.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics