Commentary

Results from the Bank of Canada’s Q3 Business Outlook Survey released in October showed business sentiment was weak with high interest rates expected to weigh on consumer demand. Q3 GDP released at the end of November showed the economy contracted at a -1.1% annualized pace in the third quarter, wiping out most of the Q2 revised +1.4% increase. Many see the Canadian economy as having entered a period of technical recession or mild slowdown.

As widely expected, the Bank of Canada kept interest rates unchanged at its December meeting. With slow to no growth expected, the debate is starting to shift to how long rates will remain at restrictive levels and predictions for rate cuts sometime in 2024. Much of that depends on inflation which came in at a 3.1% annual pace in November (unchanged from October) and slightly above expectations. Sticky inflation in certain areas of the economy, such as mortgage interest costs and rent, is a challenge even though there are signs of a cooling economy. Unemployment ticked up to 5.8% in November as job creation fails to keep pace with population growth.

US economic activity continued to expand at a solid pace; Q3 GDP rose at a 5.2% annualized rate, boosted by consumer spending. The Federal Reserve noted however that growth and economic activity appears to be slowing in the fourth quarter. The Fed left their policy rate unchanged at the December meeting but the tone was notably dovish, confirming the policy rate is at or near its peak. After all, rates are at the highest level in 22 years. Inflation is being tamed even if it still remains above the Feds 2% target.

US consumer prices were up by 0.1% (month over month) in November and up 3.1% from a year ago. Unemployment in November was at a near historic low of 3.7% with job creation above expectations (199,000 versus 190,000) after a soft October employment report (155,000 versus 170,000 expected). Overall, the relatively resilient US economy and the expectation of lower interest rates has created optimism for the so-called soft landing, helping to push the yield on long term bonds lower, and the S&P 500 higher; it was up nine straight weeks to finish the year.

Taken altogether, the path forward is still to be determined as movements in interest rates are one of the main factors driving financial markets lately. Central banks are staying on the sidelines for now but with an improving inflation picture globally the focus is on how long rates will remain high and how quickly rates may be cut as inflation continues to come under control.

Market Update

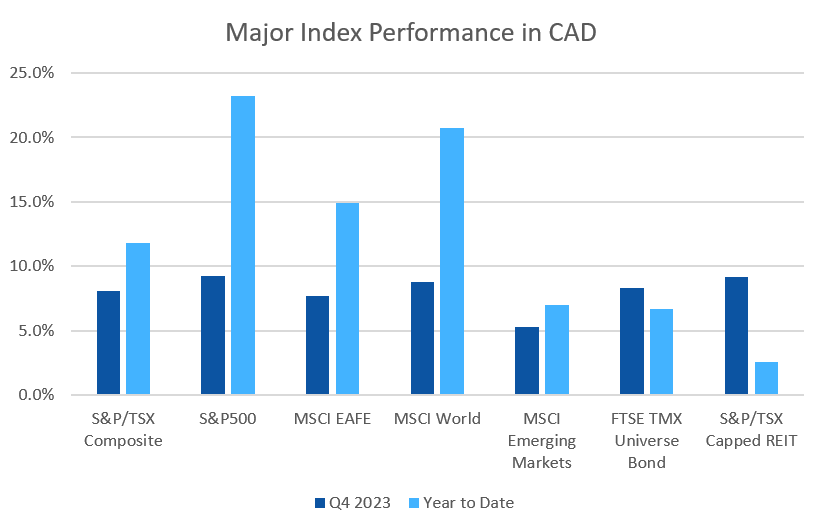

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

The fourth quarter was a welcome way to finish 2023 after the difficult third quarter, strong performance allowed many indexes to finish the year in positive territory.

Canadian stocks were up strongly, with the S&P/TSX Composite Index gaining +8.1% in the fourth quarter, and +11.8% for 2023. Large caps were the top performers with small caps lagging (+2.1% for 2023). The TSX Venture was one of the few indexes down for 2023; it lost -3.0% for the year. The US stock market indexes had a very strong year; the S&P500 gained +26.3% (+11.7% for Q4 alone). The tech heavy Nasdaq gained +43.4% for 2023, its best year since 2009, but despite the strong performance it still has +4% to gain before it reaches the peak seen in Q4 of 2021.

EAFE stocks (Europe, Australasia, and Far East) showed less strength than those in North America, gaining +4.6% in Q4 and +13.0% in 2023. European stocks were in line with EAFE overall: gaining +5.3% in the fourth quarter and +11.2% for 2023. The standout among the EAFE regions was Japan, which gained +5.0% in Q4 and +28.2% for 2023. Emerging market stocks continued to be a laggard, gaining only +7.1% for 2023. Despite being a screaming bargain, many investors continue to overlook their potential, maybe the analysts will be right in 2024.

Many analysts now believe that interest rates have peaked and are forecasting several interest rate cuts by mid 2024. The FTSE/TMX Universe Index was up +8.3% in the fourth quarter, its best quarter in the last 30 years(!), helping to salvage the year for Canadian bonds which finished the year up +6.7%. The FTSE/TMX Short Term Index was up +4.1% in Q4 and +5.0% for 2023 – better or at least comparable to many high interest savings accounts. US fixed income performed similarly: the Bank of America indexes were positive for Q4 and 2023 as a whole: +8.4% in Q4 and +6.5% for 2023 for the AAA index and +8.2% and +9.5% for the BBB index. The riskier high yield indexes performed better, the BoA CCC index was up +6.6% (+20.4% for 2023) and +7.1% (+13.5% for 2023) for the US High Yield Master II.

Oil was the worst performer in Q4, losing -21.1%, and -11.0% for 2023. The diversified Bloomberg Commodities Index was down -5.9% in Q4 and -12.6% for 2023.

Portfolio Performance

Performance of the ModernAdvisor portfolios was strong in the fourth quarter, with higher risk portfolios performing better, as expected with strong equity markets.

Our Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned +5.7%, +8.6%, and +8.0% in the quarter respectively. For 2023 Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned +11.8%, +13.3%, and +16.1% respectively.

Our balanced Core, Socially Responsible, and Harmony portfolios (Risk Level 6) returned +6.1%, +6.8%, and +7.4%, respectively. For 2023 Core, Socially Responsible, and Harmony portfolios Risk Level 6 returned +10.0%, +9.8%, and +12.3%, respectively.

Our conservative (Risk Level 2) Core, Socially Responsible, and Harmony portfolios returned +3.8%, +4.9%, and +3.1%, respectively. For 2023 Core, Socially Responsible, and Harmony portfolios Risk Level 2 returned +5.4%, +5.7%, and +7.1%, respectively.

For more details about the performance of our portfolios, see our portfolio factsheets here.