Question. Hi, I keep hearing about RRSPs in the news lately, and I know the contribution deadline is getting close. I’m wondering if should contribute to my RRSP this year, and if so, how can I figure out how much to contribute? Do you have any advice or suggestions for me?

Answer. Indeed, it’s that time of year again, and the deadline for 2019 RRSP contributions is fast approaching. Although it is now 2020, the rule states that contributions made in the first 60 days of 2020 can still be attributed to the 2019 tax year. And this year, because the 60th day of 2020 falls on a weekend, the deadline to make an RRSP contribution for the 2019 tax year is March 2nd, 2020.

Of course, you can still contribute to your RRSP after that date. The only difference is that, any contributions made after March 2nd cannot be attributed to the 2019 tax year, and therefore cannot be claimed as a deduction against your 2019 income. Furthermore, contributions made prior to March 2nd don’t have to be attributed to the 2019 tax year. That is, RRSP contributions made within the first 60 days of 2020 can be claimed against either your 2019 or your 2020 (or later) income – the choice is yours.

How Much CAN You Contribute to Your RRSP?

The amount you can contribute to your RRSP for the 2019 tax year is indicated on your previous years’ Notice of Assessment (NOA). If you don’t have it, you can get a copy of your Notice of Assessment from the CRA.

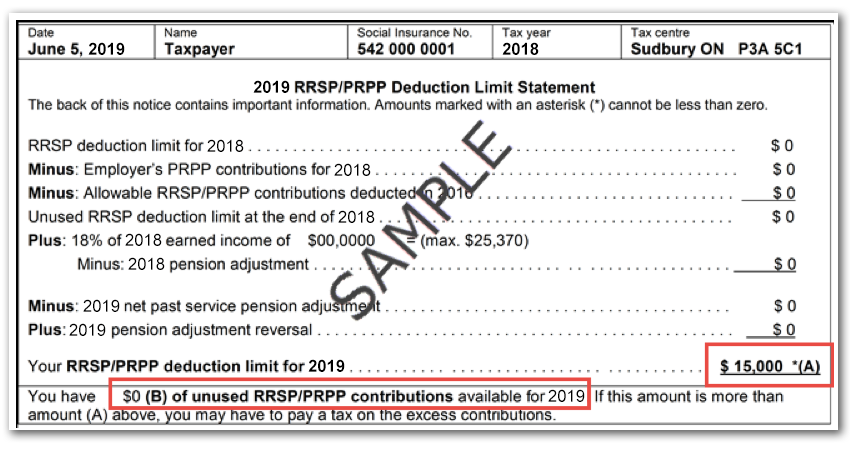

As you can see from the sample below, your NOA includes your “RRSP/PRPP Deduction Limit Statement”, which includes two key pieces of information:

- Your RRSP/PRPP deduction limit for 2019 – this is the maximum RRSP (or Pooled Registered Pension Plan) contribution you can deduct against your income for the 2019 tax year;

- Your unused RRSP/PRPP contributions for 2019 – this is the total of any amounts you have previously contributed to your RRSP, but have not yet claimed as a deduction.

Regarding the point about unused contributions, this is relevant because not all RRSP contributions must be deducted in the same tax year in which the contribution is made. That is, you can contribute an amount to your RRSP now, and deduct it in a future year. However, this strategy is generally not advisable as there is an inherent risk of double-taxation. For example, if you encountered any unforeseen circumstances and had to withdraw those funds from your RRSP, you would still pay taxes upon withdrawal, even though you had not yet claimed a deduction upon contribution.

How Much SHOULD You Contribute?

Of course, just because you can contribute a certain amount to your RRSP doesn’t mean that you should. In order to make that determination, one of the most important considerations is your income.

Traditional wisdom states that your income is typically higher during your working years than in your retirement years. So, if you’re in a higher marginal tax rate when you make an RRSP contribution, and a lower rate when you make the withdrawal, the RRSP offers an additional tax benefit – the taxes saved upon contribution will be greater than the taxes paid upon withdrawal, resulting in an overall tax savings.

However, if your current income is fairly low, for you, the opposite may be true. You could end up paying more taxes upon withdrawal from your RRSP than you saved upon contribution. In short, although everyone’s situation is unique, RRSP contributions are typically more beneficial to those with higher incomes.

What If You Don’t Have Enough Money?

One of the most common reasons we don’t contribute to our RRSPs is that we simply don’t have enough cash available to make the contribution. If this sounds like you, there are a few potential strategies you may want to consider:

- Make your contribution “in-kind” – This means transferring existing investments from your non-registered account into your RRSP, rather than contributing cash. This strategy can work very well, but there is a potential tax trap: the denial of capital losses on in-kind contributions. Remember, an in-kind transfer is considered a deemed disposition, which means a capital gain or loss is realized on the investment when it is transferred from your non-registered account into your RRSP. However, gains and losses are not treated equally when it comes to in-kind contributions. If you have a capital gain, that gain is taxable and will have to be declared and taxed accordingly. But if you have a capital loss, that loss will be denied. That is, you cannot claim a capital loss on an in-kind contribution. To avoid this trap, make sure you do not contribute investments in-kind if those investments are in a loss position.

- RRSP loan – Borrowing money to contribute to your RRSP can be a good option for some, but is certainly not recommended for all. Before taking out an RRSP loan, consider the following:

- Age – in general, RRSP loans make less sense for older folks (60+), simply because the investment will not likely have time for any meaningful growth before retirement.

- Interest rate – how much is the interest rate on the loan? The higher the rate, the less valuable this strategy will be, as borrowing costs will be higher, negating any potential benefits of the strategy.

- Investments chosen – what type of investments will you purchase inside the RRSP, and what rate of return do you expect to earn? This is somewhat related to the previous point – For example, it would generally not make sense to take out a loan with an interest rate of 3% to invest in a GIC that pays 1%.

- Your cash flow – remember that an RRSP loan is another debt obligation, and another regular monthly payment. If you’re already stretched thin, it may not make sense for you to take on the burden of another regular payment.

- Tax deductibility – recall that, unlike some investment loans for non-registered accounts, the interest paid on RRSP loans is not tax deductible and offers no additional tax advantages.

- Dollar Cost Average (DCA) – One of the best ways to commit to making regular RRSP contributions is to set up a monthly pre-authorized contribution plan. For example, let’s say you plan to make a $6,000 contribution to your RRSP this year. Instead of waiting until the last minute and scrambling to find the cash, you can simply setup a pre-authorized contribution of $500 per month, on whatever day of the month is most convenient for you – For example, to coincide with your regular pay schedule. This practice of investing the same amount of money at regular intervals is known as dollar cost averaging. Perhaps the most important benefit to a dollar cost averaging RRSP contribution plan is that it takes the stress out of searching for last minute contributions, and reinforces the discipline of regular investing.Additionally, if you know in advance how much you will contribute to your RRSP, you can better manage your taxes by instructing your employer to withhold less taxes. The way to do this is with a T1213 – Request to Reduce Tax Deductions at Source. Rather than paying too much taxes all year and then waiting for a refund, the T1213 can help you account for your RRSP contributions in advance, and thereby pay a more appropriate level of taxes throughout the year.

Bottom Line

How much should you contribute to your RRSP this year? And what type of investments should you purchase inside your RRSP? Setting up your RRSP contributions is a breeze with ModernAdvisor. If you want some help in figuring out what’s best in your own personal situation, and would like to speak to a Chartered Financial Analyst or Certified Financial Planner, just ask us.