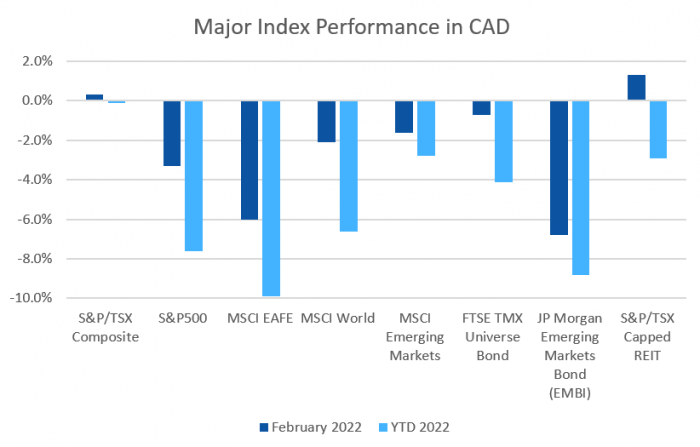

February was almost a carbon copy of January, albeit a faint copy; almost all equity markets were down as were bond markets.

February 2022 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for February 2022 | 2022 YTD Return |

|---|---|---|---|

| Oil Price (USD) | $95.95 | +8.85% | +27.58% |

| Gold Price (USD) | $1,907.85 | +6.29% | +4.33% |

| US 3 month T-bill | +0.35% | +0.13%* | +0.29%* |

| US 10 year Bond | +1.83% | +0.04%* | +0.31%* |

| USD/CAD FX rate | 1.2698 | -0.17% | +0.16% |

| EUR/CAD FX rate | 1.4238 | -0.15% | -1.06% |

| CBOE Volatility Index (VIX) | 30.15 | +21.43% | +75.09% |

*Absolute change in yield, not the return from holding the security.

February was almost a carbon copy of January, albeit a faint copy; almost all equity markets were down as were bond markets.

The S&P/TSX Composite was one of the “bright” spots, gaining +0.3% in February, making it one of the few markets now down less than a few percentage points for 2022. Helped by strength in oil prices, the S&P/TSX Small Cap gained +5.4%. US markets were hit harder; the large cap S&P500 lost -3.0% (in USD) in February bringing the YTD return to -8.0%. The index of US small cap stocks, the Russell 2000, gained +1.0%, and the tech focused Nasdaq lost -3.4% bringing its year to date losses into the double digits (-12.1%).

The broad index of EAFE (Europe, Australasia & Far East) stocks lost -2.4% in February (-6.0% for 2022). Out of the EAFE regions, European stocks were a little worse off at -3.2% for February, meanwhile British stocks were basically flat (-0.1%), putting them at +1.0% in 2022 so far. Japanese stocks declined -0.3%. Emerging market stocks lost -2.4%, and are down -4.2% in 2022 making them one of the better performers this year.

Bond markets are beginning to digest the prospect of higher interest rates, which sent bonds lower. If you have significant exposure in long-term bonds, now would be a good time to start shifting exposure to short-term bonds (under 3 years). Fortunately, the ModernAdvisor Core and SRI portfolios have been in short-term Canadian bonds for some time.

The major Canadian bond index, the FTSE/TMX Universe Bond Index lost -0.7% in February, bringing the YTD loss to -4.1%. The FTSE/TMX Short-term Bond Index lost -0.2% in February. In the US, investors sold the higher grade bonds heavily again, while high yield was spared the worst of the losses. US investment grade bonds, like US stocks, were among the worst performers in the fixed income world. The ICE BoA AAA index lost -2.1% for February, bringing the YTD loss to -6.2%. The BBB index performed a little worse for the month at -3.4%. High yield bonds lost -0.9% in February for the HY Master II Index and the CCC and lower (the real junky stuff) Index. Emerging market bonds were down -6.8% for February, their worst month since the pandemic began in March 2020. For the year, EM bonds are down -8.8% putting them on track for their worst month since the 2007 Asian crisis.

REITs were one of positives in February, gaining +1.3% for the month.

Oil had a strong month, gaining +8.8% in February, nearing the US $100 per barrel level for the first time since July 2014. Gold gained +6.3% in February. The diversified Bloomberg Commodities Index gained +6.2% in February, largely on the strength in oil.

In February the Canadian Dollar (CAD) gained +0.2 against the US Dollar and the Euro.

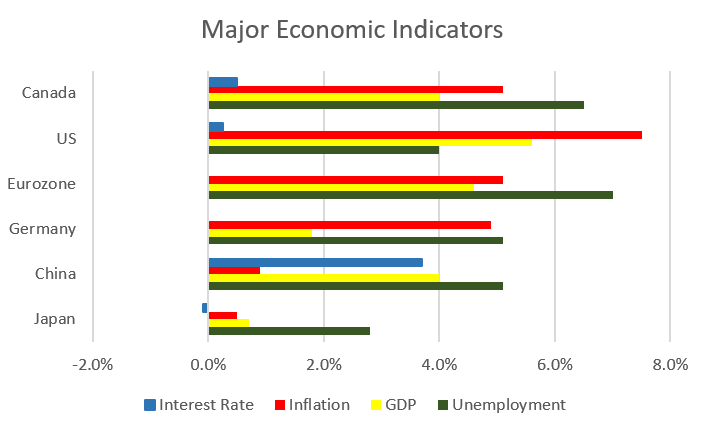

February 2022 Economic Indicator Recap

Below are the readings received in February for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

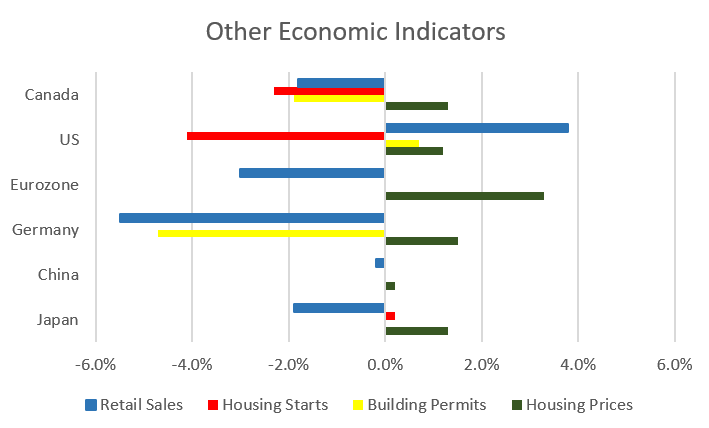

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate rose in January, the first increase in eight months, climbing half a percent to 6.5%. The economy lost 200,100 jobs, almost double the forecasted drop of 117,000. 83,000 full time jobs were lost, along with 117,100 part time jobs. The job losses were concentrated in the services sector, with accommodation and food services suffering most.

Housing prices across Canada were up +1.3% in January, with all 11 major markets contributing to the gains. The top gainers were Toronto (+2.4%), Victoria (+2.2%), and Hamilton (+1.9%). The annual national price gain for the 12 months ended January 31 was +16.6%; Halifax was almost double that at +31.7%.

It seems that the sky high cost of building materials continues to impact new home construction. The level of new housing starts dropped -2.3% to 230,700 units in January. Urban housing starts dropped -5%, driven by multifamily (condo and townhouse) construction. The value of building permits issued declined -1.9% in December to $11.2 billion, down from the record of $11.4 billion set in November. This was driven by a -2.7% decline in residential construction.

The inflation rate for January was +0.9%, and +5.1% on an annual basis – the highest annual inflation rate since September 1991! Pandemic related challenges continue to weigh on supply chains, restricting supply of some products and driving up prices. Energy prices were also a major contributor, as gasoline prices rose +31.7%. Prices again rose in all eight components of the index. The largest increases were seen in transportation (+8.2%), food (+5.7%), and housing (+6.2%). Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +4.3%.

Retail sales were down -1.8% in December, with 8 of 11 sectors posting declines. Declines were seen at furniture and home furnishing stores, and clothing stores. Compared to a year ago retail sales were up +8.6%.

Canada’s GDP was flat in December, following sixth consecutive positive months. The services sectors gained +0.1%, while manufacturing declined -0.1%.

As expected, after months of inflation higher than we’ve seen in more than a decade, the Bank of Canada raised interest rates +0.25% to +0.50% at the March 2nd meeting. The benchmark interest rate is expected to remain at its current low levels until into second half of 2022. The BoC expects inflation to remain elevated for the first half of 2022, after which they expect inflation to ease, although the invasion of Ukraine and the rapid rise in energy prices creates additional uncertainty for interest rate forecasters.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics