Most investors know that they should have bonds in their portfolios. But what is the best way to do that? First we will tell you what you need to know about bonds and the ETF choices for Canadian bonds. Finally, we tell you our favourite Canadian bond ETFs for your portfolio.

What is a bond?

Like a loan, a bond is an agreement where the borrower agrees to repay the amount borrowed, along with interest. Another way to look at it is, a bond is a loan that has been carved up into smaller pieces that many investors can own – the same way the ownership of a company is carved up into shares.

Bonds are typically sold (issued) in $100 dollar increments (called face value) and then the price fluctuates as investors buy and sell the bonds.

Key Terms to Know

The key terms to be familiar with are: coupon (interest) rate, term to maturity, yield, price, duration, and credit rating.

Coupon: not to be confused with yield, this is the interest paid on the bond’s face value. For example, if a bond’s coupon rate was 2.5%, the bond would pay $2.50 in interest per year on each $100 bond, which would typically be paid twice a year in payments of $1.25.

Term to Maturity: this is the remaining time until the bond must be repaid.

Yield: this is the current yield on the bond, taking into account the price of the bond, interest payments received and any income earned on investing the interest payments.

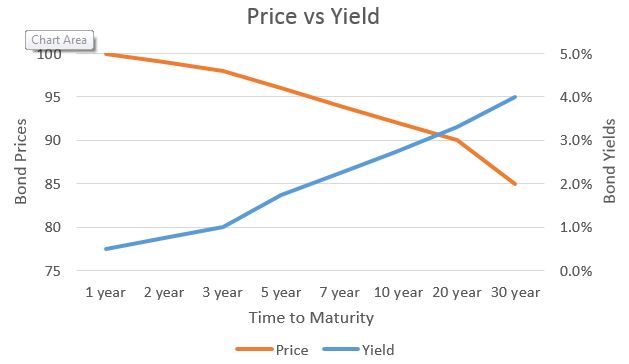

Price: Bonds are typically priced based on a face value of $100. Bonds trading for less than $100 are said to be trading at a discount and those trading for more than $100 are trading at a premium. However, it is rare to see bonds quoted on price. Usually what you see quoted is the yield. Bond prices and bond yields have an inverse relationship: when bond prices rise, yields drop, and when bond prices drop, yields rise.

Credit Rating: the creditworthiness of borrowers is often rated by several independent credit rating agencies. Borrowers with higher credit ratings (AAA, AA, A) can borrow at lower interest rates than those with lower credit ratings (BB, B, CCC).

Duration: this measures a bond’s sensitivity to changes in interest rates. As interest rates rise, bond prices fall, and vice versa. Shorter duration bonds have less interest rate risk than longer duration bonds. Investors and fund managers that are concerned about interest rates rising will reduce the duration of their portfolio by selling bonds that have higher durations and buying those that have shorter durations. Conversely, if you were not concerned that interest rates will rise, you could earn a higher rate of return by increasing the duration of your portfolio.

How to Include Bonds in Your Portfolio

Trading bonds is more difficult than trading stocks. Bonds are not traded on an exchange and are instead often traded over the phone or using a Bloomberg terminal. Trading smaller amounts, say $5,000 is more expensive than trading in $50,000 or $100,000 blocks, so it is best let to the professional traders. That is why buying a bond fund or bond ETF is best for most individual investors.

There are many different types of bond ETFs available in Canada. You can buy broadly diversified ones that cover the whole bond market, or just government or corporate bonds. You can choose ETFs that own only short or long term bonds, ones that own bond ladders and or ones that combine these various features, such as a 1-5 year laddered corporate bond ETF.

Diversified Bond ETFs

These ETFs attempt to cover the whole bond market. Since the governments in Canada (Federal, Provincial and Municipal) are by far the largest issuers of bonds, government bonds tend to dominate broad bond indexes like the FTSE/TMX Universe Bond Index. Most broad bond indexes also include some corporate bonds and securitized bonds.

iShares Canadian Universe Bond Index ETF (XBB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.33% | 0.00% | 0.09% | 0.42% |

The oldest ETF of this type in Canada is the iShares Canadian Universe Bond Index ETF. Launched in November 2000, this ETF holds about 70% of its assets in government bonds and 30% in corporate bonds. XBB’s holdings have an average term to maturity of 10.4 years and a duration of 7.4 years. Since XBB’s launch in 2000, Vanguard and BMO have introduced broad bond ETFs will similar metrics and slightly lower fees.

BMO Aggregate Bond Index ETF (ZAG)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.23% | 0.01% | 0.13% | 0.37% |

Vanguard Canadian Aggregate Bond Index ETF (VAB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.19% | 0.00% | 0.04% | 0.23% |

If you are concerned about interest rates rising, you should consider bond ETF that holds mostly short term bonds such as iShares Canadian Short Term Bond Index ETF. Similar to XBB, XSB has the majority of its holdings in government bonds. The key difference is that the weighted average term to maturity is only 3.0 years and duration is 2.9 years. Vanguard also offers a short term bond ETF which has lower fees.

iShares Canadian Short Term Bond Index ETF (XSB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.28% | 0.00% | 0.07% | 0.35% |

Vanguard Canadian Short-Term Bond Index ETF (VSB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.15% | 0.00% | 0.04% | 0.19% |

Less popular are long-term bond ETFs. These ETFs tend to have the majority of their holdings in bonds that have maturities longer than 20 years. If you have a very long investing horizon, like a pension fund, you might be interested in long-bonds, but most investors don’t have a holding period that long.

iShares Core Canadian Long Term Bond Index ETF (XLB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.28% | 0.00% | 0.34% | 0.62% |

Corporate Bond ETFs

If you are looking to increase your returns, a higher weighting to corporate bonds is a good option. While the credit ratings on corporate bonds are sometimes a little lower than governments, there are still many high quality companies that offer bonds. Banks, insurance companies, telecom companies and REITs tend to be the largest non-government issuers in Canada.

iShares Canadian Corporate Bond Index ETF (XCB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.46% | 0.00% | 0.05% | 0.51% |

The largest corporate bond ETF in Canada is the iShares Canadian Corporate Bond Index ETF. It invests solely in corporate bonds and has a duration is a little shorter than the medium term diversified funds like XBB, ZAG and VAB, and yield is a bit higher.

Like with Diversified Bond ETFs, you can find short term, medium term and long term corporate bond ETFs. BMO does a good job of covering many of the possible time horizons for both corporate and government bonds.

Government Bond ETFs

You can also find ETFs that invest only in government bonds. The broadest ETF in this sector is the iShares Canadian Government Bond Index ETF (XGB). It holds bonds of various maturities and isn’t concentrated in long or short term bonds, the average term is 11 years.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.40% | 0.00% | 0.14% | 0.54% |

If you want to focus on short, medium or long term government bonds, BMO offers ETFs that hold only short, medium or long term bonds from the federal government, as well as ETFs that hold only provincial government bonds.

Bond Ladder ETFs

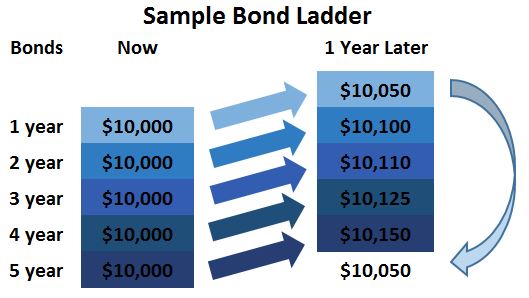

A common way to invest in bonds (and GICs) is to create a ladder. If you had a 5 year time horizon and $50,000 to invest, you would create a 5 year ladder by buying $10,000 each of 1 year, 2 year, 3 year, 4 year and 5 year bonds to start.

In 1 year when the 1 year bond has matured you would reinvest it in a 5 year bond. Your original 2 year bond is now your 1 year bond, the 3 year bond is now the 2 year, etc. Since longer term bonds have better yields, this allows you to always have part of your money earning the best possible return, while not locking all of your money in for 5 years. Should interest rates go up you can take advantage of the higher interest rates when your 1 year bond matures.

iShares offers 5 and 10 year laddered bond ETFs that focus on the government and corporate bond markets separately. MERs for these ETFs range from 0.17% to 0.28%, and bid/ask spreads range from 0.04% to 0.36%, so you total cost is anywhere from 0.21% to 0.64%.

Real Return Bond ETFs

One of the major benefits of having your investments in something other than cash, is the ability to protect your investments from inflation. When selecting investments, you want to make sure that they return more than inflation (usually 1-3%) so that your purchasing power in the future is the same as it is today.

Real Return Bonds offer a unique way to do this. In exchange for a lower interest rate, the bond’s principal value increases if inflation increases. For simplicity, let’s consider a 1 year bond purchased on January 1 for $100. If inflation was 2% for the year, when the bond matured on December 31, you would receive $102, instead of $100, plus any interest paid.

iShares and BMO offer Real Return Bond ETFs in Canada. While these ETFs offer inflation protection, they contain mostly long-term bonds and therefore have higher levels of interest rate risk. They also are more expensive to trade than many of the other bond ETFs, as evidenced by their large bid/ask spreads.

BMO Real Return Bond Index ETF (ZRR)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.29% | 0.00% | 0.63% | 0.92% |

iShares Canadian Real Return Bond Index ETF (XRB)

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.39% | 0.00% | 0.50% | 0.89% |

Our Favourites

As you can see, there are a lot of different types of bond ETFs to choose from. For most investors a diversified bond ETF would be the best choice. If you would like a bit more yield, you can select a bond ETF that just invests in corporate bonds. If you are concerned more about inflation than rising interest rates, you might want a bond ETF that invests in real return bonds as your main bond ETF holding.

For broad exposure to medium to long term bonds we would suggest the Vanguard Canadian Aggregate Bond Index ETF (VAB). While not as big as iShares’ offering, VAB has the lowest MER in this category and the lowest bid/ask spread.

Interest rates in Canada are expected to remain low through 2016 as the Bank of Canada is not expected to raise interest rates until well into 2017. You may be safe holding a longer-term bond ETF until sometime in 2016, when you would likely want to switch to a short-term bond fund.

For broad exposure to short term bonds, we would suggest the Vanguard Canadian Short-Term Bond Index ETF (VSB). While not as big as iShares’ offering, VSB has the lowest MER in this category and is tied for the lowest bid/ask spread.