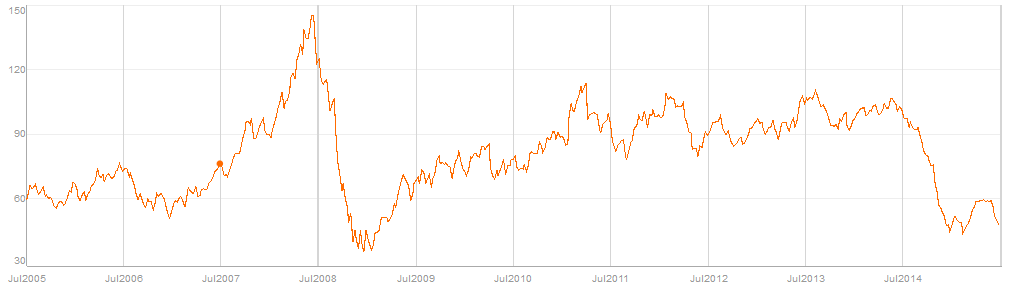

The price of oil has dropped 50% in the last 12 months from around $100 to less than $50.

If you think that oil prices are going to recover, how can you take advantage of that?

You could buy oil the way oil traders do and buy oil futures or options thereon. Trading oil futures or options is complicated and often involves leverage in the form of margin. Therefore it is only suitable for professional or advanced traders. Fortunately, ETF providers have created ETFs that hold oil futures that provide an easy way to invest in the commodity itself.

An alternative to buying oil, is to buy shares of oil producing companies. Most oil companies have debt and are thus leveraged to changes in the price of oil. So if oil prices rise their stock prices often rise even faster. Unfortunately, the opposite is also often true. When oil prices drop, oil producer stock prices drop even more.

Unless you have the expertise and time to analyze individual company stocks, you would want to spread your risk around and buy a basket of stocks. The best way to do this is through an ETF that is invested in oil companies.

Your Oil ETF Choices in Canada

ETFs That Invest in Oil Futures

Horizons NYMEX Crude Oil ETF (HUC)

This oil ETF invests indirectly in NYMEX light sweet crude oil futures contracts using forward agreements from Canadian banks. The forward agreements provide the ETF with the return on the December futures contract in exchange for a predefined cash payment. Since the crude oil futures are traded in USD, the ETF hedges the currency exposure back to CAD. The cost is somewhat reasonable given that this is not a passively managed ETF.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.86% | 0.40% | 0.30% | 1.56% |

Horizons BetaPro NYMEX Crude Oil Bull Plus ETF (HOU)

This oil ETF seeks to provide 200% of the DAILY performance of the near month NYMEX light sweet crude oil futures contract. It does this through forward agreements with Canadian banks. Since it is rebalanced daily, holding it for longer periods of time may not give you the result you’re looking for even if oil prices rise. Since the crude oil futures are traded in USD, the ETF hedges the currency exposure back to CAD.

This ETF is fairly expensive:

| MER | TER | Bid/Ask Spread | Total Cost |

| 1.39% | 0.76% | 0.17% | 2.32% |

Auspice Canadian Crude Oil Index ETF (CCX)

This is a new ETF from a managed futures specialist with experience creating futures-based ETFs. As it was launched in May 2015, there is little history and no MER or TER available yet. The Management fee is 0.50% less than what Horizons charges on HOU, so the MER will likely be less as well.

Since this ETF is designed to track Canadian crude, a heavy crude that is more difficult to refine into gasoline and other products than Light Sweet Crude, it typically trades at a discount to the widely quoted prices for WTI Crude and Brent Crude. Because of that, the ETF many not rise as quickly as those oil widely quoted oil prices.

United States Oil Fund, LP (USO)

This is the largest US-based oil ETF, and it is designed to track WTI Crude Oil using the near month NYMEX light sweet crude oil futures contract. Unlike the other choices above, this fund is structured as a limited partnership. That means it distributes its taxable income to the limited partners (shareholders) the same way mutual funds and ETFs do and you have to include it in your income. Since USO doesn’t actually distribute any cash, withholding tax doesn’t apply. Which is fortunate since the withholding taxes on US LPs is currently 39.6% and holding one in an RRSP or TFSA does not exempt you from the US withholding tax, and since those accounts are not taxed in Canada you cannot claim a credit for it on your tax return.

This is a less expensive option than the Canadian-based funds, but keep in mind that many brokers charge up to 2% commission when converting CAD into USD and vice versa. That is, the exchange rate that is widely quoted on the news and financial websites is the rate that large traders like banks can trade at, it is not the retail cash rate. For example, if the exchange rate showing on the Bank of Canada’s website is 1.3000, then the rate available to you might be 1.3260 to buy a US dollar.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.72% | 0.02% | 0.06% | 0.80% |

ETFs That Invest in Oil Stocks

BMO S&P/TSX Equal Weight Oil & Gas ETF (ZEO)

This oil ETF invests in the broad oil industry in Canada and includes companies in the drilling, oil field services, integrated companies, exploration and production, refining and marketing, and storage and transportation sectors. It owns familiar companies like: Canadian Oil Sands, Imperial Oil, Encana, Suncor and Enbridge.

Since this ETF is more passive than those that trade futures, the cost is much lower.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.62% | 0.00% | 0.19% | 0.81% |

BMO Junior Oil Index ETF (ZJO)

This oil ETF invests in companies involved in the oil and gas industry in North America that have more than 50% of their revenues from oil-related activities. If you are looking primarily for exposure to Canadian companies, ZEO is a better choice, as ZJO is only 25% Canadian. Since 75% of the holdings are in US companies, foreign withholding tax applies to dividends received on their stocks.

This ETF also has a large component in tanker companies. If the demand for oil increases, shipping rates will increase, but since the exposure to oil producers is lower it may not be as correlated to oil prices.

| MER | TER | Bid/Ask Spread | Withholding Tax | Total Cost |

| 0.63% | 0.00% | 0.31% | 0.04% | 0.98% |

First Asset Can-Energy Covered Call ETF (OXF)

This ETF buys the 25 largest companies in the S&P/TSX Capped Energy Index and writes covered-call options on those stocks to generate additional income.

A call option is a derivative that allows the holder of the call to buy the underlying security at a set price within a specified time frame. The party that sold/created the option is obligated to sell the underlying security at that specified price, regardless of what the current price is. If the option is not exercised, the seller keeps the amount received for the option. Writing call options adds an additional level of risk to the ETF, but it does provide for a steady stream of income.

Historically, most of OXF’s distributions have been return of capital, and the rest are eligible dividends, so its distributions are very tax efficient. However, all of the active trading adds up to higher cost.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.71% | 0.56% | 0.59% | 1.86% |

Horizons S&P/TSX Capped Energy Index ETF (HXE)

This ETF seeks to replicate the performance of the S&P/ TSX Capped Energy Index by using total return swaps (a type of derivative) from Canadian banks. The banks agree to pay the ETF the return on the index in cash, in exchange for an upfront fee. Using the total return swap makes the ETF more tax efficient since it does not receive any dividends and all gains are taxed as capital gains. However, if you are looking for dividends then consider ZEO instead.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.39% | 0.00% | 0.27% | 0.66% |

Horizons BetaPro S&P/TSX Capped Energy Bull Plus ETF (HEU)

This oil ETF seeks to provide 200% of the DAILY performance of the S&P/TSX Capped Energy Index. Like the other Horizons funds its uses a forward agreement to get exposure to the index and doesn’t actually own any of the stocks. Forward agreements are a fairly expensive way to get access to an index, but are an efficient way to get non-recourse leverage and there is no income to pay tax on other than capital gains.

Since it is rebalanced daily, holding it for longer periods of time may not give you the result you’re looking for even if oil prices rise. Plus this ETF is more expensive than many mutual funds.

| MER | TER | Bid/Ask Spread | Total Cost |

| 1.50% | 0.60% | 0.39% | 2.49% |

Horizons Canadian Midstream Oil & Gas Index ETF (HOG)

This ETF is focused on the Canadian oil and gas midstream sector which includes companies who are involved in the transportation, storage, and wholesale marketing of crude oil, natural gas and other refined petroleum products. This includes pipeline companies and other transportation systems that are used to move petroleum products from production sites to refineries and various refined product distributors. These types of companies are not typically impacted by movements in crude oil or natural gas prices, hence they are less volatile than producers of oil and natural gas. Companies in those sectors are known for being reliable dividend payers; the current yield on HOG is 3.33%.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.62% | 0.02% | 0.58% | 1.22% |

iShares S&P/TSX Capped Energy Index ETF (XEG)

This oil ETF invests in the broad oil industry in Canada and includes companies in the drilling, oil field services, integrated companies, and exploration and production sectors. XEG owns familiar companies like: Canadian Natural Resources, Imperial Oil, Encana, Suncor and Cenovus.

Like HXE, this ETF seeks to replicate the performance of the S&P/TSX Capped Energy Index, but this ETF owns shares of the companies in that index directly, helping to keep costs low.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.61% | 0.01% | 0.26% | 0.88% |

iShares Oil Sands Index ETF (CLO)

iShares is terminating this ETF effective September 4 and it will be delisted from the TSX on August 27. Any remaining shareholders as of August 28 will receive a final payment sometime after September 4.

So those are your options. Which should you buy?

If you want to invest directly in oil, you have two options: Horizons NYMEX Crude Oil ETF (HUC) and United States Oil Fund, LP (USO). USO is roughly half the cost of HUC, but you would need to hold it for a minimum of 5 years for the currency conversion costs to outweigh the cost savings. Even if you have some US dollars available to invest in USO, the tax implications of investing in a US LP may not be worth it. While HUC is fairly expensive for an ETF at 1.56%, it is less expensive and is more suitable as a long-term investment than HOU.

If you want to go really cheap, then you need a passive indexing strategy offered by either BMO S&P/TSX Equal Weight Oil & Gas ETF (ZEO) or Horizons S&P/TSX Capped Energy Index ETF (HXE).

BMO’s ETF is easier to understand since it holds oil stocks directly and does not use any derivatives to get access to the index. Plus, ZEO pays a high distribution of 3.65% while you wait for oil prices to rise.

The Horizons ETF choice is cheapest at 0.66% despite using costly derivatives. The total return swap (TRS) it uses is offered by National Bank, so the risk of the ETF not being able to collect on the TRS is very low. If you’re not looking for dividends, HXE is more tax efficient and less expensive than ZEO.

Both are strong choices for getting exposure to oil stocks.

Whether you prefer to invest in oil stocks or crude oil itself, ETFs are a great way to get exposure to oil should prices rebound in the future.