RRSP contributions can increase your income tax refund

Get those sweet, sweet tax savings.

Time is running out to contribute to your RRSP for the 2015 2016 tax year. Why should you care? Read on.

But first – do you:

- Have any outstanding high-interest debt, like credit cards? Unless you have a contribution-matching program through your employer (hello, free money!), the gains you would earn on your investments, even with the tax savings, probably won’t be enough to offset the interest you’re paying on those credit cards. Pay that debt off first, and then get cracking on your RRSPs.

- Make less than $50,000? If so, you won’t get the full benefit of tax-deferred awesomeness, and you may be better of investing in a Tax Free Savings Account (TFSA). You can and should absolutely still invest, but the RRSP deadline isn’t as important.

- Already make RRSP contributions throughout the year? It’s smart to top up your contributions, but you’ll want to check your limit to make sure you don’t go over (and incur penalties). There are other tools available, like TFSAs, if your RRSPs are maxed out.

Paying taxes is great, right? I mean who doesn’t like having roads and schools and universal healthcare? But there’s no reason you should pay more tax than you have to, and there aren’t a lot of legal ways to pay less tax. RRSPs offer a way to minimize the tax you pay, and smooth it out over your lifetime.

Frequently asked questions about RRSPs

How much can I contribute for the 2015 2016 tax year?

18% of your income or $25,370, whichever is less

PLUS

Any amount left over from previous tax years

Here is a handy table with examples:

| 2016 Income |

18% | Max Contribution |

Notes |

|---|---|---|---|

| $50,000 or less | Consider Investing in a TFSA instead | ||

| $75,000 | $13,500 | $13,500 | 18% is less than the maximum |

| $100,000 | $18,000 | $18,000 | 18% is less than the maximum |

| $140,944 | $25,370 | $25,370 | 18% is equal to the maximum |

| $150,000 | $27,000 | $25,370 | 18% is greater than the maximum |

| $200,000 | $36,000 | $25,370 | 18% is greater than the maximum |

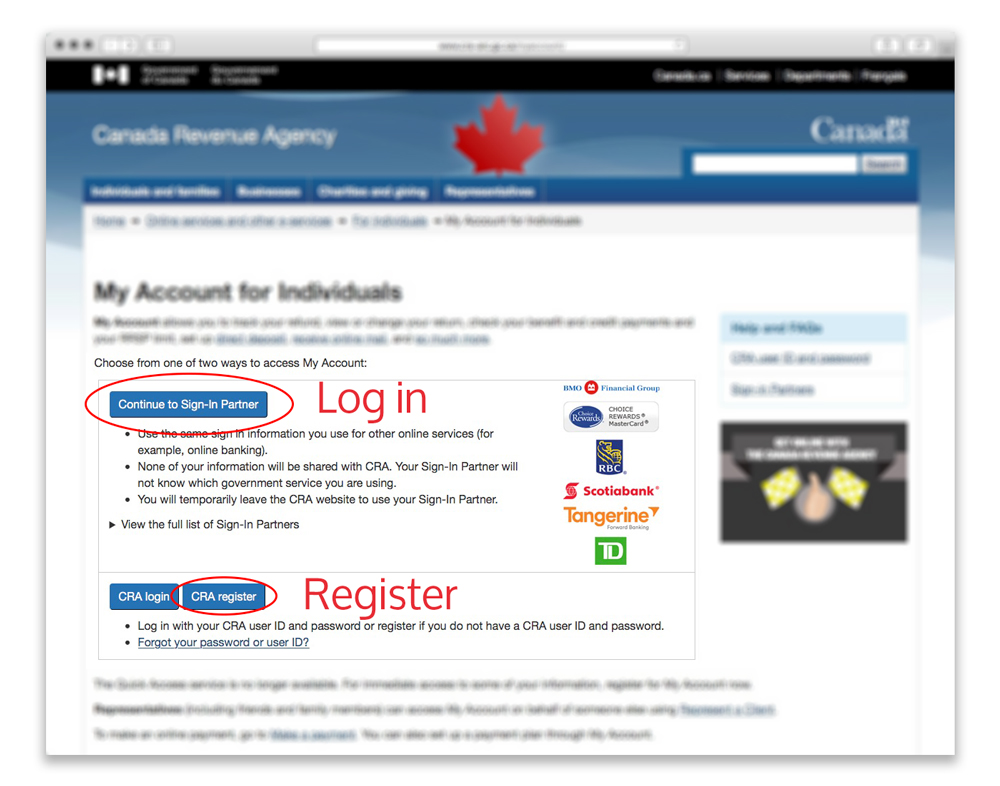

You may have room left over from previous years. Don’t know your RRSP/PRPP limit? There are three ways to find out, including CRA’s online service where you can check your personal contribution limit, including leftover amounts you have from previous years:

You may have room left over from previous years. Don’t know your RRSP/PRPP limit? There are three ways to find out, including CRA’s online service where you can check your personal contribution limit, including leftover amounts you have from previous years:

- Check your last year’s Notice of Assessment

- Find it online using CRA’s online service, My Account For Individuals

- Call Tax Information Phone Service (T.I.P.S.) at 1- 800-267-6999.

*Side note: personally, I love TurboTax for all of my tax filing needs. Also, Mint.com for general money and budget tracking. Love me some Mint.

I have some debt – should I pay that off first, before I start investing?

The short answer is: it depends. If you have any high-interest debt like credit cards, it usually makes sense to pay that off first, before focusing on growing your investments.

Lower-interest debt like government issued student loans are usually fine to pay off over longer time periods, while simultaneously saving and investing.

What should I do with my tax refund?

Expect to get a tax refund this year? Getting a refund isn’t usually a good thing – it basically means you’ve been lending the government money – money you could have been investing elsewhere. If you know you will be decreasing your tax bill throughout the year, say by making regular RRSP contributions, you can ask your employer to reduce the amount of tax they automatically deduct from your paycheck. If you do get a refund, it’s a really good idea to invest it and get it working for you. While you’re at it, why not set up automatic RRSP contributions for 2016? It’s as easy as setting up a recurring bill payment through your online banking.

What the heck does ‘tax-deferred’ mean?

RRSPs are magical, but they don’t eliminate tax so much as defer and minimize it. When you contribute to an RRSP, the government allows you to knock off the contribution amount from your taxable income. So you’re taxed as though you earned less money, which means you pay less tax. And as long as your money stays in the account, the growth isn’t taxed either. Once you retire, you’ll be earning less income and paying tax at a lower rate. So even though you’ll pay tax on withdrawal, it’ll be less than you would have paid during your highest-income-earning years.

So, my money is trapped in there until I retire?

Not exactly. While you can withdraw your money at any time, you will be dinged with a tax bill. The idea is that you will start pulling money out when you have less taxable income, and therefore have less tax to pay.

So you don’t want to use your RRSP as an emergency fund or treat it like a chequing account. But there are a few situations where the government will allow you to withdraw funds without the tax penalty (with the caveat that you need to recontribute it later). Specifically:

- Paying for school

- Buying your first house

You can find more information about the Lifelong Learning Plan and the Home Buyers Plan here.

I don’t have an RRSP account set up yet. How do I get started?

If you already do your banking online, managing your investments online is easy. ModernAdvisor offers both registered and non-registered investment accounts.

Disclaimer

This guide is intended to be informational only. Your individual financial situation is unique and investing is just one part of your overall financial well-being. We recommend talking to a financial planner that you trust.