Stock markets had another bad month in January. The Bank of Canada left interest rates unchanged despite analyst predictions and the Bank of Japan joined the negative interest rate club.

January 2016 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for January |

Return for 2016 |

| Oil Price (USD) | $33.62 | -11.76% | -11.76% |

| Gold Price (USD) | $1,116.40 | +5.30% | +5.30% |

| US 3 month T-bill | +0.33% | +0.17%* | +0.17%* |

| US 10 year Bond | +1.94% | -0.33%* | -0.33%* |

| USD/CAD FX rate | 1.4006 | +1.20% | +1.20% |

| EUR/CAD FX rate | 1.5173 | +0.96% | +0.96% |

| CBOE Volatility Index (VIX) | 20.20 | +10.93% | +10.93% |

*Absolute change in yield, not the return from holding the security.

Stock markets had another poor month in January. The S&P/TSX Composite actually performed well compared to most stock markets around the world, and was only down -1.44% for January. All of the major stock market indexes we track were negative when measured in their home currency and when measured in Canadian Dollars The worst performing index for the month was the Russell 2000 (a measure of US small cap stocks) which was down -8.85%. The German DAX was a close second at -8.80%. Japanese stocks were close behind at -7.96%. Volatility rose in both Canada and the US. The S&P 500 had 5 days in January that were bigger than +/-2%, the most since August 2015.

Canadian bonds performed well, particularly the safer government issues. The broad FTSE/TMX Universe Bond Index was up +0.39% for the month, while the Federal Bond Index was up +0.91%. Investment grade bonds in the US performed even better; the Merrill Lynch US Corporates AAA was up +1.13%. But outside of that, the performance was decidedly negative. The most speculative grade bonds as measured by the Merrill Lynch US High Yield CCC and Lower index was down -3.89%. Canadian high yield was also negative for the month.

Commodities continued to fare poorly. Oil continued to slide and was down -11.76%, finishing the month at US$33.62. Gold was one of the bright spots (pun not intended) at +5.30% for the year. The broad Bloomberg Commodity Index was down -1.70% in January.

The Canadian Dollar weakened against the US dollar, but was well off its lows of 1.4559, finishing the month at 1.4006. Against the Euro, the Canadian Dollar also weakened and closed the month at 1.5173.

Market Commentary

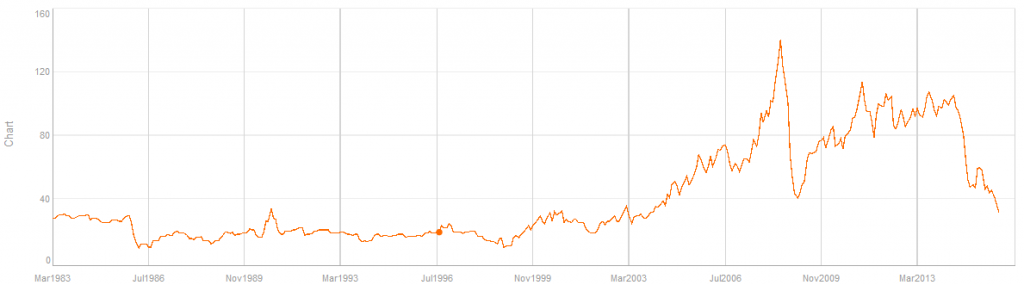

January saw oil prices drop to levels not seen in over 10 years as WTI Crude briefly dropped under $30. With the Canadian Dollar closely tracking the price of oil, it also hit levels not seen in over 10 years.

Analysts are not expecting oil prices to recover any time soon. Usually when the price of a commodity hits lows, suppliers reduce supply in order to better balance it with demand: translation, they reduce supply to push prices back up. With oil that does not seem to be happening. OPEC countries have not reduced supply as they are trying to gain back market share from high cost North American supplies like the US shale oil and Canadian oil sands. With the lifting of sanctions on Iran, expect supply to remain high.

That means the Canadian Dollar will likely remain low for some time to come. If the US Federal Reserve raises interest rates further and the Bank of Canada leaves rates the same or cuts them, then the Canadian Dollar would likely drop further.

The low Canadian Dollar doesn’t have many upsides for Canadians. Much of the produce in grocery stores this time of year comes from the US, so prices have been going up. Expect prices of anything imported to rise over the next few months. Apple has raised prices in the AppStore, and La-Z-Boy told me earlier this month that prices are going up on February 1 because of the low dollar.

If you work in the tourism industry, expect to be busier this year as more American tourists are expected to choose Canada. With Whistler and other ski resorts in BC having their best snow conditions in several years it should help draw more tourists. Real estate in Canada looks more attractive with the low Canadian Dollar, which is good if you’re looking to sell, but not good if you’re looking to buy in Vancouver and Toronto.

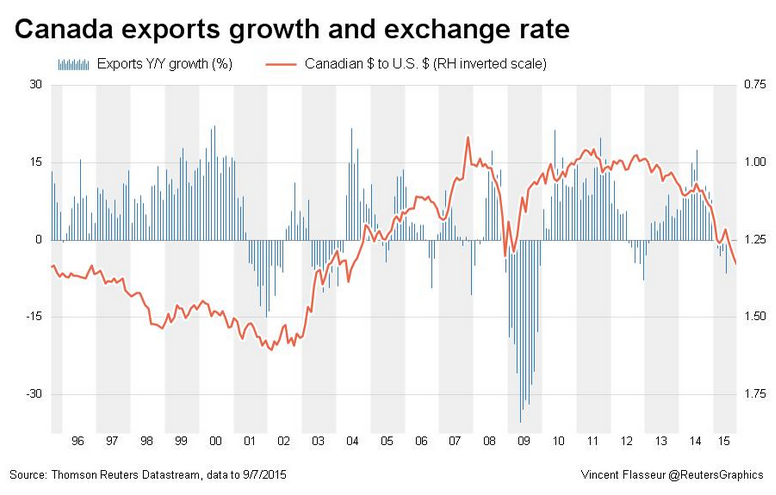

Economic theory suggests that a declining currency helps a country’s exports. Unfortunately, our chief exports like oil are not in great demand right now. Our manufacturing industries have shrunk over the last few decades as more and more companies began manufacturing their products overseas. So the benefit of a low Canadian Dollar is less pronounced now than it was in the 1980s. In fact, exports continued to grow even while the Canadian Dollar was near par.

January Economic Indicator Recap

Japan joined Switzerland, Sweden and Denmark in the negative interest rate club, after the bank of Japan lowered its benchmark interest rate to -0.1%.

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate was unchanged in December at 7.1%. 6,400 full time jobs were lost in December and 29,200 part time jobs were added. The labour force participation rate remains below 66%, the lowest since 2001.

Building permit activity, which was reported for November, was down -19.6%. So it’s no surprise that new housing starts dropped -18.4% in December to 173,000, below the 200,000 forecast. Housing prices rose 0.2% for the month of November and were up 1.6% over the last year.

Inflation for December was -0.5%, or +1.6% over the last year. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.9%. Retail sales in November rose +1.7%, and were up 3.2% over the past 12 months.

After 2 months of flat or negative reports, the November GDP report for Canada was positive at +0.3%. With the continuing decline in oil and the Canadian Dollar, many analysts were expecting the Bank of Canada to cut interest rates by 0.25% to +0.25%. The Bank of Canada confounded the analysts and left interest rates unchanged at +0.5%. Inflation remains within the BoC’s target range and the economy continues to adjust to low oil prices.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics