Since ModernAdvisor launched to the public in January 2016, we haven’t made any changes to the weights of the asset classes in our model portfolios or changed the investments we use in our model portfolios. Effective July 1, we will be adjusting the weight of the ETF we use to represent non-North American developed market stocks.

Why?

In late December 2015, Vanguard announced that they were going to be changing the index that the Vanguard Developed All Cap ex North America Index ETF (VEF) tracked. The reason was the US ETF that VEF invests in (VEA) would be changing the index that it tracked. That new index would now include investments in Canadian stocks, something that clients invested in our low-cost portfolios already have in the iShares Core S&P/TSX Capped Composite Index ETF (XIC).

The exposure to Canadian stocks in VEF started around 1% and has slowly been creeping up, reaching 8.1% at the end of May 2016. For our highest risk portfolios, that means that they have an additional 1.5% exposure to Canadian stocks as of the end of May. Our rebalancing threshold is 5%; so while extra exposure to Canadian stocks from an international ETF isn’t ideal, if the exposure to XIC in a client’s portfolio was 11.5% instead of the 10.0% target, we would not rebalance until it reached 15.0%.

To avoid the duplication, we considered using Vanguard’s new ETF (VI) that the does what the ‘old’ VEF did, but since it is new, it was too small in size to be a suitable replacement. We also looked at switching to another ETF provider’s product for our non-North America developed market exposure. The next best choice was a little bit more expensive and it introduced some new issues. The index provider that Vanguard uses (FTSE) has a different definition of emerging markets than MSCI. We would also have needed to replace the ETF we use for emerging market stocks to avoid missing out on some of our Asian markets exposure.

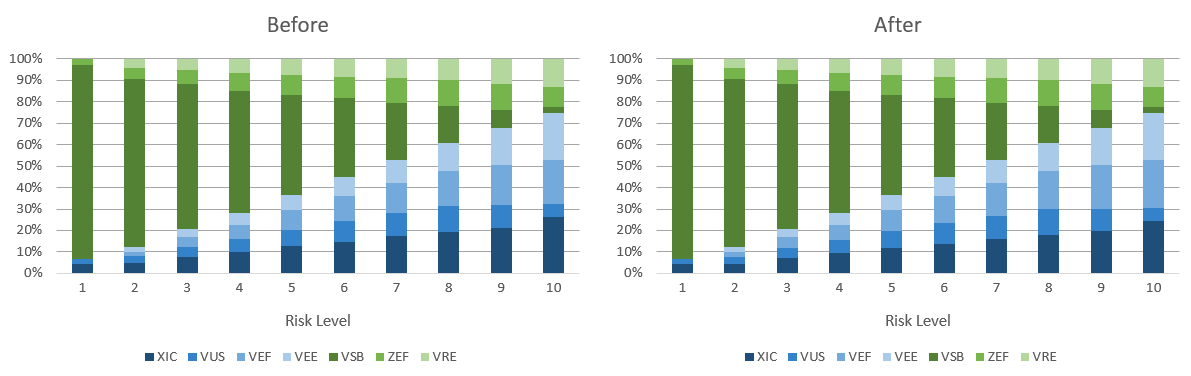

In the end, the simplest thing to do was to adjust the weight of XIC down to account for the extra exposure to Canadian stocks in VEF, and since VEF has less exposure to international stocks we adjusted the weight in VEF up. Below is a chart of our low-cost portfolio asset allocations before and after the weights of XIC and VEF were adjusted.

The change in weights of XIC and VEF are small, so the effect on most accounts will be small, and in most cases we will not need to rebalance your account. For those of you with a taxable account (an account that is not an RRSP, RRIF, TFSA or RESP) that does need rebalancing, there may be small capital gains or losses triggered when your account is rebalanced.