Question. I’ve noticed a lot of news about the US stock market recently, and how last year was a great year for investors. I have mostly Canadian investments in my portfolio, as I feel that it’s safer. But I’m wondering if 2020 will be the same, and if I should buy US investments instead? Do you think that now is a good time?

Answer. Indeed, stock market performance in some regions has been spectacular in recent years. This is particularly true in the U.S. As 2019 drew to a close, we saw countless headlines like this:

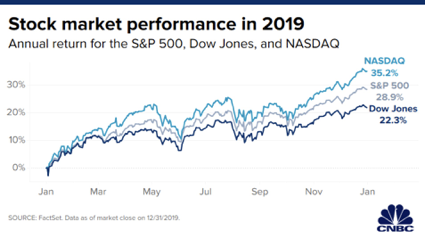

“Stocks post best annual gain in 6 years with the S&P 500 surging more than 28%”

That was the headline on the CNBC website at the end of last year, on December 31, 2019. Last year was a stellar year in general for US markets, with the three primary indexes showing massive gains: The S&P 500 was up 28.9%; the Nasdaq 100 was up 35.2%, and the Dow Jones Industrial Average (“Dow Jones”) 22.3%.

Taking Stock – Canada vs. U.S.

Let’s expand our view, and look at how markets have performed in both Canada and the US, over the last 3 calendar years – 2017, 2018, and 2019. Note that for both markets, we measure the total return – this is the actual rate of return of the stock market experienced over the given evaluation period, including both capital gains and dividends.

As our metric for measuring performance of the Canadian market, we use the S&P/TSX Composite Index, which currently includes the largest 250 companies on the Toronto Stock Exchange. Although the TSX has over 1,500 companies listed, the S&P/TSX Composite Index represents about 70% of the value of all the companies listed on the exchange, and is the most widely used measure of Canadian market performance.

Now let’s take a look at our neighbours to the south. For measuring market performance in the US, we use the S&P 500 Index. Although the Nasdaq and the Dow Jones are also used to measure US market performance, the S&P 500 measures the stock performance of 500 largest publicly traded companies in the US – It is generally considered to be one of the best, if not the best, representation of the overall U.S. market.

From January 3rd, 2017, the first trading day of that year, to December 31st, 2019, the last trading day of that year, the markets performance is illustrated below.

Total Return:

- US: 53.2%

- Canada: 22.1%

Cost of Home Bias

The unfortunate reality of the outstanding performance in US markets is that many Canadian investors simply didn’t benefit from it. Why not?

Home bias refers to the tendency of investors to overweight their portfolios with investments of their country of residence. As investors, we are often prone to this behaviour because investing in familiar companies feels safer. However, a home bias for Canadian investors can be both very risky, and very costly.

It’s risky because, in the context of global markets, the Canadian market is actually quite tiny. In fact, Canada comprises less than 4% of the global equity market. But it’s more than just that. It’s also important to note that the Canadian stock market is very heavily weighted in a few industry sectors, and very deficient in others. Financials account for over 35% of the entire Canadian stock market, and energy accounts for over 23%. So those two sectors comprise over half the entire Canadian market. It’s no surprise that, if you were invested heavily in Canada, not only would you be missing the vast majority of opportunities available global equity markets, but you’d also likely be over-concentrated in energy and financials.

Investors who have avoided US markets over recent years because they felt it’s too risky, and who have sought refuge in Canadian markets instead, because they felt it’s much safer, have done themselves a massive disservice. As shown in the previous section, the cost of home bias are evident in the numbers above. Over the last 3 years, the performance of US stock market is about quadruple that of the Canadian market – that is, the US has outperformed Canada by a factor of 4 to 1. To the extent that your portfolio is overweight Canada, and underweight US, this translates to a very real difference in the value of your portfolio due to substandard returns.

So, should you liquidate all of your Canadian stocks and buy US instead? No! Because past performance is no guarantee of future performance, and going forward, the situation may be reversed, with Canada outperforming the US over the next 3 years.

To be clear, we not advocating for the US over Canada, or advocating for Canada over the US, either. What we are advocating for, however, is a disciplined and balanced approach to investment diversification.

Bottom Line – Why you need to be diversified

Harry Markowitz once famously said that diversification is “the only free lunch in finance.” The point Markowitz was making was that, by being properly diversified, you can increase the returns in your portfolio without increasing risk. Indeed, Markowitz’ work on that topic won him a Nobel Prize, and laid the foundations for what would eventually become known as Modern Portfolio Theory.

At ModernAdvisor, diversification is one of the core principles of our investment philosophy. We ensure that our portfolios are properly diversified across many different variables, such as industry sector and geography. When you invest with us, you can be assured that your portfolio will not only be properly diversified, but will also be regularly rebalanced, to make sure you maintain adequate diversification at all times.

If you’re interested in learning more, or would like to have a discussion with a Portfolio Manager or Certified Financial Planner, just contact us.