For most of July investors continued to focus on Greece and turned their attention to China as Chinese stocks continued to correct from what is looking more and more like a bubble. The Bank of Canada cut interest rates by 0.25% for the second time this year, while the US Federal Reserve talked up the possibility of an interest rate increase in September. The latest Canadian GDP figures show that Canada is in recession.

July 2015 Market Performance

All index returns are Total Return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for July |

2015 YTD Return |

| Oil Price (USD) | $47.12 | -20.77% | -11.54% |

| Gold Price (USD) | $1,094.90 | -6.56% | -7.53% |

| US 3 month T-bill | +0.04% | +0.03%* | 0.00%* |

| US 10 year Bond | +2.20% | -0.15%* | +0.03%* |

| USD/CAD FX rate | 1.3080 | +4.72% | +12.75% |

| EUR/CAD FX rate | 1.4365 | +3.15% | +2.33% |

| CBOE Volatility Index (VIX) | 12.12 | -33.52% | -36.88% |

*Absolute change in yield, not the return from holding the security.

Outside of Canada, most equity markets were positive. Canadian small cap stocks were particularly hard hit with the S&P/TSX Small Cap Index down -6.63% and the S&P/TSX Venture down -11.49%. US, European and Asian markets were positive, while emerging markets were negative.

Bond markets were generally positive in Canada and the US as buyers returned following the partial resolution to the situation in Greece. High yield bonds were down in Canada and the US, while emerging market bonds were positive, but only when measured in Canadian Dollars..

Commodities had a rough month, with only a few agricultural commodities posting gains in July. The broad Bloomberg Commodity Index was down more than 10%. Oil and gold, the largest weights in the index were down -20.77% and -6.56%, respectively. Most other metals were also down in July.

The Canadian Dollar continued to weaken, declining more than 3% against the US Dollar and the Euro.

Market Update

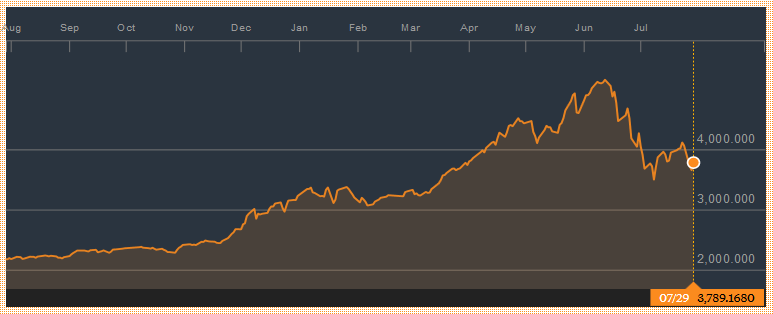

Chinese investors continued to rush for the exit as share prices on the Shanghai stock exchange continued to drop. The Chinese government was caught by surprise and rushed to put in place measures aimed at slowing the decline. The Shanghai Stock Exchange Composite Index peaked on June 12 after climbing 59.7% from December 31, 2014. A chart of the last 12 months is even more dramatic, showing a gain of 134.7% from July 31, 2014 to June 12, 2015.

Why the sudden reversal?

Chinese stocks are owned primarily by individual investors, some estimates put the number as high as 85%. In the US, only 30% of stocks are owned by individuals. The difference is even more dramatic when comparing trading activity; in the US individual investors account for less than 2% of daily trading volume, in China it is estimated that individuals account for nearly all of the trading volume.

The Chinese people have only been able to invest in stocks for less than a generation, while US investors have several generations of experience to look back on. Anecdotal evidence also suggests that many Chinese investors have borrowed money to invest. Inexperience plus leverage is never a good combination.

Meanwhile in Greece, the government caved to pressure from creditors and approved their terms ensuring the country could continue to meet its debt obligations. Banking restrictions were eased somewhat: the daily withdrawal limit of 60 euros remains, however people are now allowed to withdraw their weekly limit once per week, avoiding having to go to the bank everyday.

The problem remains: can Greece ever repay all of that debt? European leaders have been trying to avoid writing down the value of the debt (commonly called a haircut) with past bailouts, but that is looking more and more inevitable as the IMF is shying away from a third(!) bailout. The EU and IMF have been trying so hard to avoid a haircut as Spain, Portugal, and Ireland would want the same.

July Economic Indicator Recap

The Bank of Canada cut its benchmark interest rate by 0.25% in July as economic growth showed that Canada is in a recession. New Zealand also cut interest rates by 0.25% in July, following a cut of 0.25% in June.

Brazil’s central bank raised its benchmark interest rate by 0.50% to 14.25% in July as inflation climbed to an 11 year high of 8.89%. Brazil has raised interest rates by 0.50% in 6 of the last 8 months.

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on the lesser economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate was unchanged in June at 6.8%. 64,800 new full time jobs were created, while 71,200 part time jobs were cut.

The reports on Canada’s housing market in July were mixed. Housing starts in June were ahead of forecasts at 202,800 but building permit activity in May was down -14.5% compared to April. New house prices were less robust, up only 0.2% for May and 1.2% over the last 12 months.

Inflation remains tame. In June the Consumer Price Index (CPI) rose +0.2%, +1.0% over the last year. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest rose 2.3%. Retail sales in May rose 1.0%, and were up 2.7% over the part 12 months.

GDP in May was down -0.2%, the fifth negative month for GDP. Unlike the government and the Bank of Canada, I’m not going to mince words, Canada is in a mild recession. Given that oil doesn’t appear likely to recover any time soon, I doubt that we are going to see much pick-up in economic growth.

As the US economy appears to be growing, it seems more likely that the US Federal Reserve will raise interest rates in September. If that does indeed happen, expect the Canadian Dollar to drop further vs the US Dollar, this would be exacerbated if the Bank of Canada has to cut interest rates again. None of the banks are forecasting the Canadian Dollar to drop under 0.74.

Of the Big 5 Banks, only Scotiabank had forecast the BoC rate in their March update; they aren’t forecasting another. However as in March, and unlike the other banks, they are not forecasting any rate increases through their forecasting horizon (end of 2016).

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics