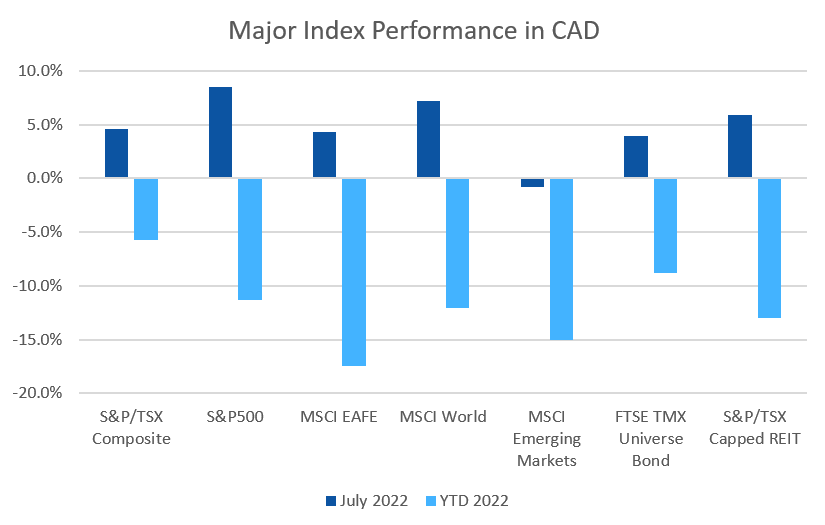

July was strong month for both equity and fixed income investors alike.

July 2022 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for July 2022 | 2022 YTD Return |

|---|---|---|---|

| Oil Price (USD) | $97.94 | -7.39% | +30.22% |

| Gold Price (USD) | $1,778.75 | -1.58% | -2.73% |

| US 3 month T-bill | +2.41% | +0.69%* | +2.35%* |

| US 10 year Bond | +2.67% | -0.31%* | +1.15%* |

| USD/CAD FX rate | 1.2824 | -0.48% | +1.15% |

| EUR/CAD FX rate | 1.3072 | -2.93% | -9.17% |

| CBOE Volatility Index (VIX) | 21.33 | -25.71% | +23.87% |

*Absolute change in yield, not the return from holding the security.

July was strong month for both equity and fixed income investors alike.

The main index of Canadian stocks, the S&P/TSX Composite, had a good month, gaining +4.7%. The S&P/TSX Small Cap was up +7.6%, bringing the YTD to -8.6% for 2022. US markets, one of the laggards in 2022, performed a little better than Canadian markets in July. The large cap S&P500 gained +9.2% (in USD), shaving the YTD loss to -12.6%. The index of US small cap stocks, the Russell 2000, gained +10.4% in July and the tech focused Nasdaq gained +12.3% putting it at -20.8% for 2022.

The broad index of EAFE stocks (Europe, Australasia & Far East) gained +5.1% in July, trimming the YTD loss to -8.3%. Out of the EAFE regions, European stocks performed a little better, gaining +6.0% for the month. Meanwhile British stocks’ gained +3.5%, and Japanese stocks gained +7.1%. Emerging market stocks were one of the few negative markets in July, losing -0.3%.

Bond markets saw their strongest month in several years, halting their decline.

The major Canadian bond index, the FTSE/TMX Universe Bond Index gained +3.9% in July, reducing the YTD loss to -8.8%. The FTSE/TMX Short-term Bond Index gained +1.2% for the month, and is down -3.2% for 2022. Fortunately, ModernAdvisor has only used short term bonds in the Core and SRI portfolios, helping to mitigate the losses on the bond side of our clients’ accounts. In the US, investment grade bonds and high yield bonds were both positive. The ICE BoA AAA index gained +3.6% for July, bringing the YTD loss to -12.2%. The BBB index gained +3.0% for the month. High yield bonds gained +4.1% in July for the HY Master II Index, while the CCC and lower (the real junky stuff) Index gained +6.0%.

Canadian REITs gained +5.9% in July, cutting the YTD loss to -13.0%.

Oil retreated again in July, losing -7.4%, dropping below US$100 per barrel. Gold lost -1.6% in July, and -2.7% for 2022 so far. The diversified Bloomberg Commodities Index gained +4.1% in July, bringing its year to date performance to +22.9%.

In July the Canadian Dollar (CAD) gained +0.5% against the US Dollar, and +9.2% against the Euro. Against the Euro, CAD has gained +9.2% this year, bringing it to a level not seen in almost 10 years (1.30 CAD to a Euro).

Core and SRI Portfolio Updates

For the last few years, our Core and Socially Responsible (SRI) portfolios have had a relatively conservative posture, with our highest risk portfolio (Risk Level 10) having an almost 10% allocation to bonds. This conservative posture was driven by our view that risky assets (i.e. stocks) were trading at a higher-than-average valuation over the past few years.

We have been monitoring the markets for an opportunity to increase the equity portion of ModernAdvisor’s Core and SRI portfolios in line with a neutral strategic asset mix. In Q1 and Q2 of this year, we bought into the stock market weakness, increasing our equity exposure in these portfolios. The highest increase was in our Risk Level 10, which is now 100% equities, compared to approximately 90% equities previously. As a rule of thumb, you can add a zero to the risk level number to determine its strategic equity weight; Risk Level 7 is 70% equity, Risk Level 8 is 80% equity, etc.

Going forward, you can expect our Core and SRI portfolios to be relatively static. We review the strategic asset mix and the underlying funds in these portfolios on an annual basis, but unless there have been significant changes in the underlying funds, competing funds that have become more attractive, and/or the macro-economic outlook, we are likely to keep the asset allocation in these portfolios unchanged.

In addition to the changes described above, we have continued to monitor the vast majority of client accounts on a daily basis, and have rebalanced them as needed. This rebalancing approach ensures we trim overweight positions, and add to underweight positions systematically. This rebalancing approach adds value to client accounts, especially in choppy markets as we have experienced so far in 2022.

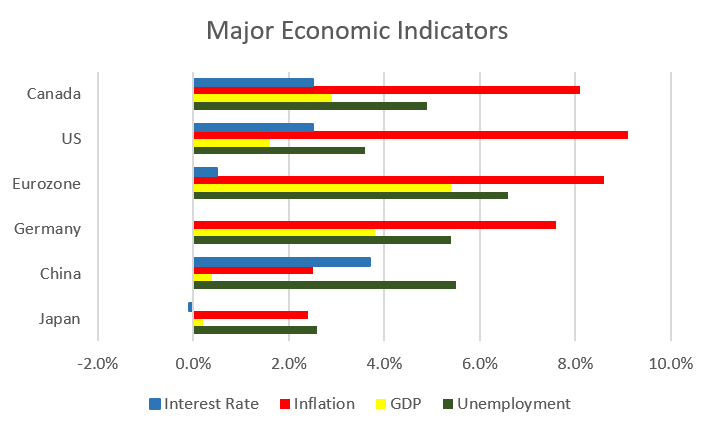

July 2022 Economic Indicator Recap

Below are the readings released in July for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

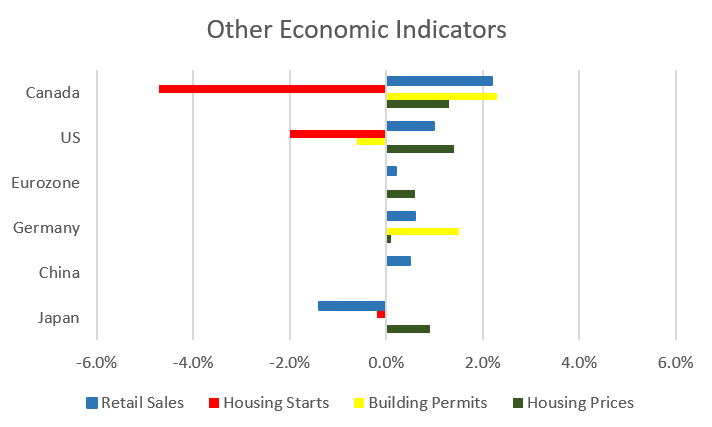

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate dropped to 4.9% in June, a new lowest rate on record since comparable data became available in 1976. BC, New Brunswick, PEI and Newfoundland also had unemployment rates at or near record lows. The economy actually lost 43,100 jobs (39,100 part time and 4,000 full time), but as 100,000 people voluntarily exited the workforce, the unemployment rate declined. This indicates that the economy is near full maximum employment.

Housing prices across Canada were up +1.3% in June, with 9 of 11 major markets again posting gains; Edmonton and Victoria were the exceptions, losing -0.5% and -0.4%, respectively. The top gainers were Montreal (+3.2%) and Calgary (1.8%). The annual national price gain for the 12 months ended June 30 was +16.7%. Halifax was almost double that at +30.9%. Nice to not see Vancouver near the top at ‘only’ 14.4%!

The level of new housing starts declined -4.7% to 273,800 units in June. Urban housing starts declined -3% to 257,400 as multifamily (condo and townhouse) construction declined -2%, and single family construction declined -4%. The value of building permits issued rose +2.3% in May to $12.1 billion, led by a +7.0% increase in non-residential construction. The residential sector posted a slight decline of-0.1% to $7.38 billion.

The inflation rate for June was +0.7%, and +8.1% on an annual basis – the highest annual inflation rate since January 1983! Transportation, food, and shelter (aka life!) were the primary drivers of inflation. Transportation costs surged +16.8% (driven by a 55% rise in gasoline prices). Food inflation was again +8.8%, and shelter rose +7.1%. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +6.2%.

Retail sales were up +2.2% in May, with 8 of 11 sectors posting increases, led by higher sales at gas stations. Car sales were up +3.3%, rebounding from 3 months of declines. Compared to a year ago, retail sales were up +14.1%.

Canada’s GDP was flat in May; 14 of 20 sectors posted gains. The services sectors grew +0.4%, which was offset by a -1% decline in the goods producing sectors. Gains in transportation and food services offset declines in construction and manufacturing.

The Bank of Canada increased their benchmark interest rate by a full 1% to 2.5%, the largest increase since 1998, and many analysts were expecting a 0.75% increase. The BoC slashed economic growth forecasts for 2022 and 2023.

In Europe, the ECB raised interest rates to 0.5%, it had been zero percent for over 6 years.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics