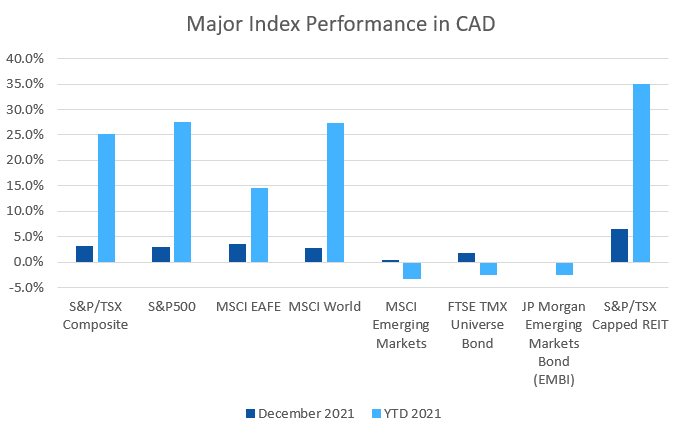

December was a good month for most equity markets around the world, capping off what was a great year for many equity markets.

December 2021 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for December 2021 | 2021 YTD Return |

|---|---|---|---|

| Oil Price (USD) | $75.21 | +13.64% | +55.01% |

| Gold Price (USD) | $1,828.60 | +2.93% | -3.51% |

| US 3 month T-bill | +0.06% | +0.01%* | -0.03%* |

| US 10 year Bond | +1.52% | +0.09%* | +0.59%* |

| USD/CAD FX rate | 1.2678 | -0.89% | -0.42% |

| EUR/CAD FX rate | 1.4391 | -0.68% | -7.80% |

| CBOE Volatility Index (VIX) | 17.22 | -36.67% | -24.31% |

*Absolute change in yield, not the return from holding the security.

The S&P/TSX Composite gained +3.1% in December, and finished its best year in over a decade at +25.1%. The S&P/TSX Small Cap was also positive at +1.0% for December and +18.2% for 2021. In the US, the large cap S&P500 gained +4.5% (in USD) and finished the year up the +28.7%, its second year of the last three where the gain was more than +25%. Given the extremely high valuations in the US relative to all other equity markets and the political instability, one wonders when (or if?) US stocks will comeback to earth. The index of US small cap stocks, the Russell 2000, gained +2.1% in December and +13.7% for 2021. The tech focused Nasdaq was again one of the indexes with more muted performance, gaining +0.7% in December and +21.4% for 2021.

The broad index of EAFE (Europe, Australasia & Far East) stocks gained +4.2% in December and +16.1% for 2021; a good year (especially as 2020 was negative), but not a standout in its recent past. Out of the EAFE regions, European stocks were strong, gaining +5.1% in December and +19.9% for 2021. Japanese stocks were also positive, gaining +3.5% in December, but only +4.9% for 2021 as a whole. Emerging market stocks were up +1.2% in December, but finished 2021 down -2.3%. EM stocks are a reminder that cheap stocks can get cheaper still; hopefully 2022 will look more like 2019 and 2020 than 2021 for EM stocks.

After what has been a difficult year for bonds, most markets were able to perform well in December. The major Canadian bond index, the FTSE/TMX Universe Bond Index, had its best month of the year gaining +1.7%, but finished the year down -2.5%. The FTSE/TMX Short-term Bond Index gained +0.4% for December, but was down -0.9% for 2021. Conversely, US investment grade bonds were down in December; the ICE BoA AAA index lost -0.4%, and finished 2021 down -2.4%. The BBB index was down -0.1% and finished 2021 down -0.2%. High yield bonds had a positive month, gaining +1.9% in December for the HY Master II Index, and +1.7% for the CCC and lower (the real junky stuff) Index. For 2021, those indexes were +5.4% and +10.4%, respectively. Emerging market bonds were down -0.1% for December, and down -2.6% for 2021, their first negative year since 2007(!).

REITs were up more than +6% for the second month in 2021, this time gaining +6.6%. That brought 2021’s return up to +35.1% their strongest year since 2009.

Oil bounced back in December, gaining +13.6%, and finished the year up more than 50%. Gold gained +2.9% in December, but finished the year down -3.5%; surprising given that it is often touted as a store of value, especially in the face of strong inflation. The diversified Bloomberg Commodities Index gained +3.5% in December and +27.1% in 2021.

In December the Canadian Dollar (CAD) gained +0.9%, finishing the year within -0.4% of where it started. Against the Euro, CAD gained +0.7% in December and +7.8% for 2021

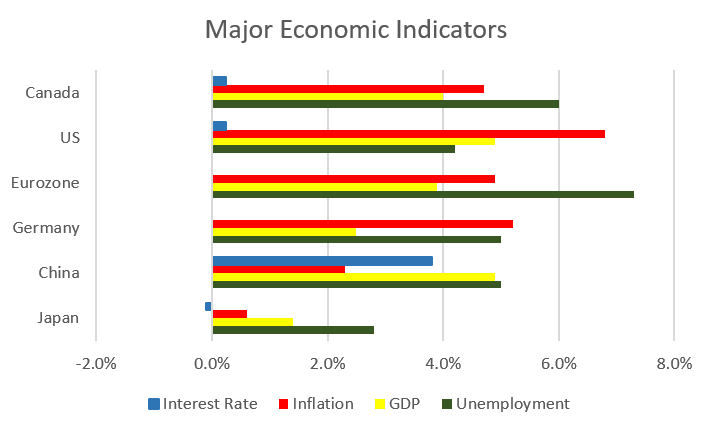

December 2021 Economic Indicator Recap

Below are the readings received in December for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

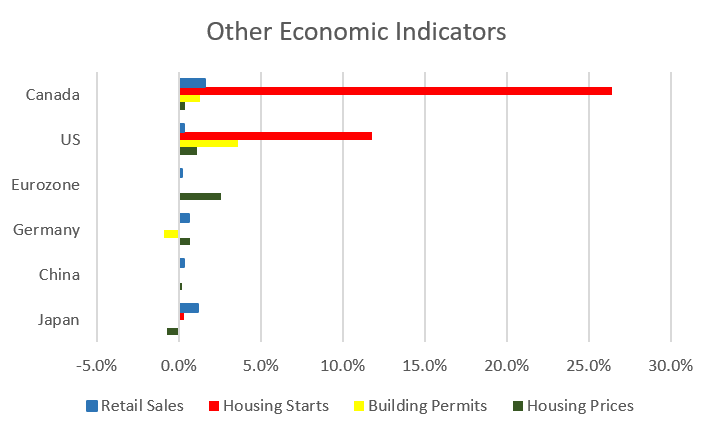

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined for the sixth consecutive month, dropping to 6.0% in November, the lowest rate since the COVID-19 pandemic began in early 2020, as most provinces implemented vaccine mandates allowing more non-essential venues to reopen. The economy gained 153,700 jobs, three times the forecasted amount. 79,900 full time jobs were created, along with 73,800 part time jobs. Gains were concentrated in the private sector (+107,000), and healthcare (+44,000).

Housing prices across Canada were up +0.4% in November. Like October, seven of eleven markets were positive in November. The top gainers were Halifax (+1.2%), Victoria (+1.0%), and Toronto (+0.6%). Ottawa was again the worst performer, losing -1.1%, followed by Edmonton at -0.3%. The annual national price gain for the 12 months ended November 30 was +15.2%; Halifax was almost double that at +29.8%. Surprisingly, Vancouver was below average at +13.9%.

The level of new housing starts jumped +26.4% in November to 301,300 units following five months of declines. Urban housing starts climbed +29%, driven by multifamily (condo and townhouse) construction. The value of building permits issued rose +1.3% in October to $10.3 billion. This was driven by non-residential construction’s +4.2% rise, while residential construction was flat.

The inflation rate for November was +0.2%, and +4.7% on an annual basis – the highest annual inflation rate since February 2003. Part of the reason for the higher level of inflation is the comparison to lower price levels seen in the midst of the worst of the pandemic last year, as well as ongoing supply chain issues. Prices again rose in all eight components of the index. The largest increases were seen in transportation (+10.0%) and household maintenance (+4.8%). Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +3.6%.

Retail sales were up +1.6% in October, with 7 of 11 sectors posting gains. Gains were seen at motor vehicle and parts dealers, as well as new car dealers. Compared to a year ago retail sales were up +5.3%.

Canada’s GDP was up +0.8% in October. 17 of 20 economic sectors saw growth, led by accommodation, construction and arts & entertainment. Mining and oil & gas extraction offset some of the gains.

As expected, the Bank of Canada left its benchmark interest rate at +0.25% at the December 8th meeting. The benchmark interest rate is expected to remain at its current low level until into second half of 2022. The BoC expects inflation to remain elevated for the first half of 2022, after which they expect inflation to ease.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics