January was a wake up call for growth investors with many high-flying tech companies missing earnings expectations, which roiled equity markets. Meanwhile, fixed income didn’t offer much protection as the prospect of rising interest rates spooked investors, sending bond indexes lower.

January 2022 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for January 2022 | 2022 YTD Return |

|---|---|---|---|

| Oil Price (USD) | $88.15 | +17.21% | +17.21% |

| Gold Price (USD) | $1,795.00 | -1.84% | -1.84% |

| US 3 month T-bill | +0.10% | +0.16%* | +0.16%* |

| US 10 year Bond | +1.79% | +0.27%* | +0.27%* |

| USD/CAD FX rate | 1.2719 | +0.32% | +0.32% |

| EUR/CAD FX rate | 1.4260 | -0.91% | -0.91% |

| CBOE Volatility Index (VIX) | 24.83 | +44.19% | +44.19% |

*Absolute change in yield, not the return from holding the security.

January was a wake up call for growth investors with many high-flying tech companies missing earnings expectations, which roiled equity markets. Meanwhile, fixed income didn’t offer much protection as the prospect of rising interest rates spooked investors, sending bond indexes lower.

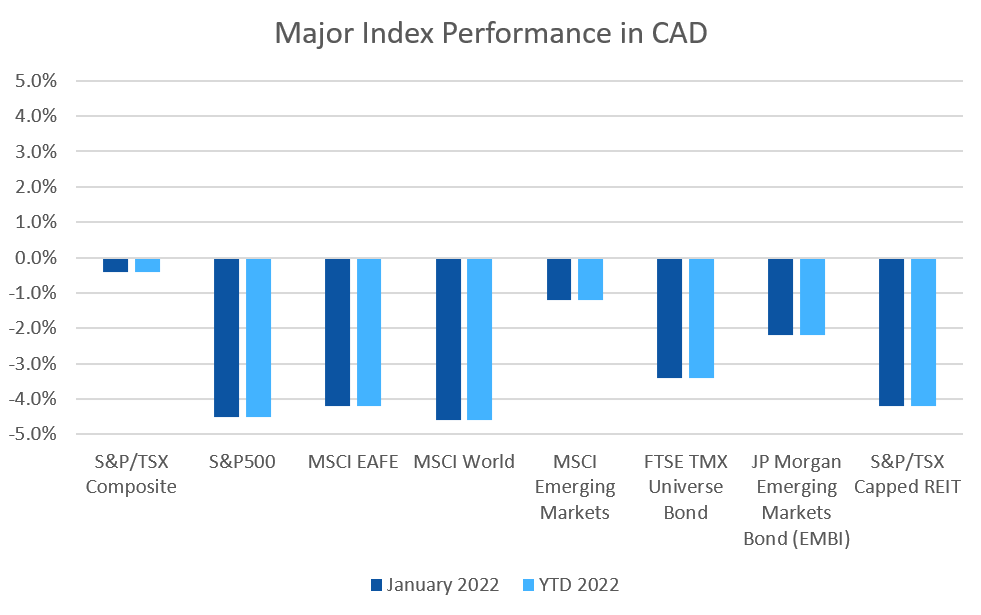

The S&P/TSX Composite declined -0.4% in January, recovering almost all of the losses sustained earlier in the month. The S&P/TSX Small Cap declined -1.2% for the month. US markets were hit much harder; the large cap S&P500 lost -5.2% (in USD), recovering about half of its losses from earlier in the month. The index of US small cap stocks, the Russell 2000, lost -9.7% and the tech focused Nasdaq lost -9.0% (it was down almost -15% at one point during the month).

The broad index of EAFE (Europe, Australasia & Far East) stocks lost -3.7% in January. Out of the EAFE regions, European stocks were a little stronger at -3.2%, meanwhile British stocks were actually positive at +1.1%. Japanese stocks were weaker at -6.2%. Emerging market stocks were one of the better performers at -1.8%.

Bond markets are beginning to anticipate interest rate increases from the central banks in Canada, the US, UK and Europe, which sent bonds tumbling. If you have significant exposure in long-term bonds, now would be a good time to start shifting exposure to short-term bonds (under 3 years). Fortunately, the ModernAdvisor Core and SRI portfolios have been in short-term Canadian bonds for some time.

The major Canadian bond index, the FTSE/TMX Universe Bond Index lost -3.4% in January, its worst month since March 1994(!) when it declined -5.0%. The FTSE/TMX Short-term Bond Index lost ‘only’ -0.9% in January – not a notable amount looking back through its history. In the US, investors sold the higher grade bonds heavily, while high yield was spared the worst of the losses. US investment grade bonds, like US stocks, were among the worst performers in the fixed income world. The ICE BoA AAA index lost -4.4% for January, their worst month since the 2008 financial crisis. The BBB index performed a little better at -3.2%. High yield bonds lost -2.7% in January for the HY Master II Index, and -1.9% for the CCC and lower (the real junky stuff) Index. Emerging market bonds were down -2.2% for January, not terrible in the larger fixed income universe and far from their worst showing for a month.

REITs were also down in January, losing -4.2%, again far from their worst showing.

Oil posted another double digit positive month, gaining +17.2% in January, coming close to US$90 per barrel. With equity and bond markets not performing well, gold bugs would have hoped that gold would provide some protection, but it too was down in January, losing -1.8%. The diversified Bloomberg Commodities Index gained +8.8% in January, largely on the strength in oil.

In January the Canadian Dollar (CAD) lost -0.3% against the US Dollar. Against the Euro, CAD gained +0.9% for the month.

January 2022 Economic Indicator Recap

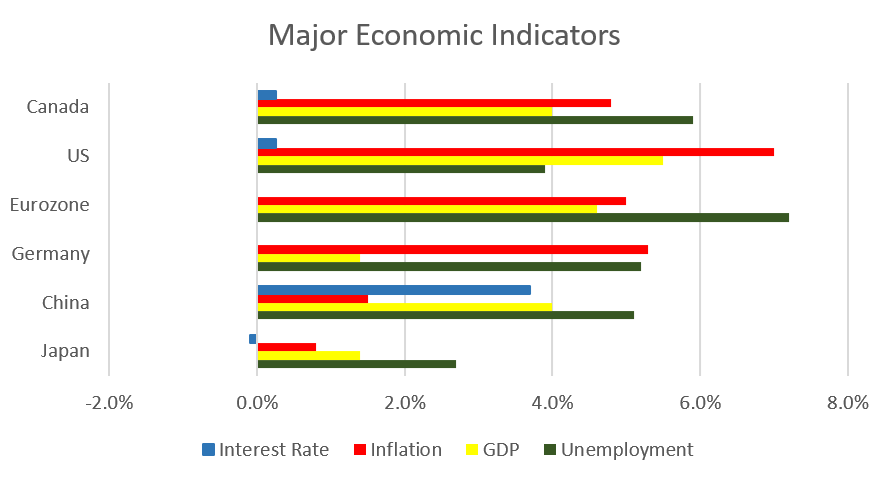

Below are the readings received in January for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

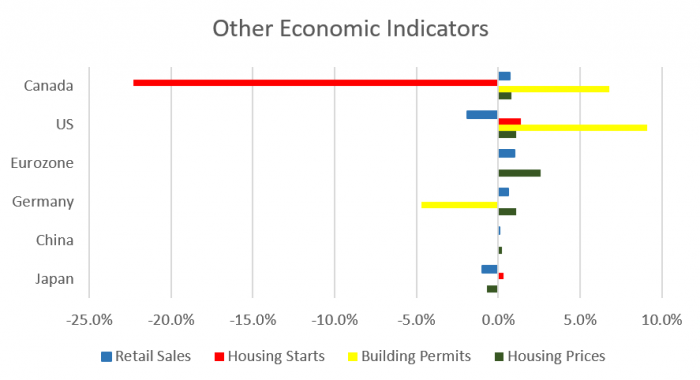

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined for the seventh consecutive month, dropping to 5.9% in December, the lowest rate since the COVID-19 pandemic began in early 2020, despite the surge in Omicron cases. The economy gained 54,800 jobs, double the forecasted amount. 122,500 full time jobs were created, while 67,700 part time jobs were lost.

Housing prices across Canada were up +0.8% in December. The top gainers were Victoria (+2.1%), Halifax (+1.9%), and Hamilton (+1.2%). Ottawa and Edmonton were again the worst performers, losing -0.3% and -0.4% respectively. The annual national price gain for the 12 months ended December 31 was +15.5%; Halifax was almost double that at +30.7%.

The level of new housing starts dropped -22.3% to 236,100 units in December, making November’s strong showing an aberration. Urban housing starts dropped -24%, driven by multifamily (condo and townhouse) construction. The value of building permits issued rose +6.8% in November to $11.2 billion, the highest amount on record. This was driven by a 12% rise in residential construction.

The inflation rate for December was -0.1%, and +4.7% on an annual basis – the highest annual inflation rate since February 2003. Part of the reason for the higher level of inflation is the comparison to lower price levels seen in the midst of the worst of the pandemic last year, as well as ongoing supply chain issues. Prices again rose in all eight components of the index. The largest increases were seen in transportation (+8.9%), passenger vehicles (+7.2%) and housing (+5.4%). Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +4.0%.

Retail sales were up +0.7% in November, with 6 of 11 sectors posting gains. Gains were seen at gas stations, building material and garden stores, and grocery stores. Compared to a year ago retail sales were up +4.4%.

Canada’s GDP was up +0.6% in November, the sixth consecutive positive month. 17 of 20 economic sectors saw growth, led by manufacturing, agriculture, forestry & fishing, and accommodation & food services. Mining and oil & gas extraction offset some of the gains.

As expected, the Bank of Canada left its benchmark interest rate at +0.25% at the January 26. The benchmark interest rate is expected to remain at its current low level until into second half of 2022. The BoC expects inflation to remain elevated for the first half of 2022, after which they expect inflation to ease.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics