Continued from 10 Common Misconceptions About Robo Advisors (Part 1)

Misconception #6 – Humans are inherently better investors (and advisors) than robo advisors

Intuitively, it seems like humans would have the advantage over technology, that an algorithm could never perform as well as a human advisor. There’s a hesitation in handing over the reins to an unfeeling algorithm, even when we consciously want to.

For example, how comfortable are you with the idea of Google’s self-driving cars? It’s a little scary, right? The thought of causing an accident ourselves is somehow less frightening than the idea of trusting a machine to keep us safe, even when statistics show that self-driving cars dramatically reduce accidents. At the end of the day, having control is not the same as having security.

My personal opinion is that future generations will look back in wonder that at one point, people were allowed to manually operate vehicles at all. After all, we’ve accepted that technology can be trusted to help pilots fly airplanes, surgeons perform operations, and manufacturing employees assemble cars.

In all the situations, it’s important to remember that humans create the philosophy, and the method. Technology just carries out the operations more efficiently. Unlike a human, technology doesn’t call in sick, doesn’t have a “bad day”, and won’t forget that all-important decimal point in the calculation.

Humans still map the route. Technology just makes sure we stay on course.

Misconception #7 – Robo-advisors use a ‘black box’ investment philosophy

Another concern is the idea that only a select few people really understand the technology. While it’s true that all robo advisors have their own ‘secret sauce’, a proprietary method of choosing your optimal portfolio allocation, the basis of that secret sauce is the same fundamental investing principles used by human advisors.

In reality, traditional mutual funds are incredibly opaque. If you’ve looked at a typical mutual fund statement lately, you may have noticed a stunning lack of information. Sure, you can see the value of your account(s), but what does that mean? Are you ahead of where you were before? Do you understand how the returns shown on your statement were calculated? If returns aren’t what you were hoping for, can you tell whether that’s because of the fund performance or because of the fees?

At the end of the day, is your financial ship pointed in the right direction?

Misconception #8 – My money is safer with a big, well-known company

Okay, so even if you feel alright with a robot handling your money, it can’t just be any robot. To be safe, it’s gotta be the biggest robot out there, like one of the name-brand banks. After all, Canada’s banks have been around for decades, and weathered the most recent financial crisis better than many Western countries.

You feel comfortable doing your banking online and handing over your credit card details to Amazon. But when it comes to your life savings, is it wise to put your trust into a new startup?

Here’s the thing: Just because you’re a hip new startup doesn’t mean you’re exempt from securities laws and other financial regulations. In order to operate in Canada, robo-advisors must be registered with provincial securities commissions and use a custodian*. If you bank with a credit union, there’s a good chance your deposits are already held at the same custodian used by that hip, new startup robo-advisor.

For example, ModernAdvisor is registered as a portfolio manager, which means we must adhere to some of the strictest regulations and standards of care in the industry.

Your deposits with a robo-advisors are also protected under the Canadian Investor Protection Fund (CIPF) for up to $1,000,000. Important note: this is not the same as protecting against market losses – your portfolio with a robo can lose value from normal market fluctuations, just like any other investment. But in the event that something catastrophic happened to the robo-advisor itself, your money would remain safely stowed with the custodian, and insured up to $1,000,000 through CIPF.

*A custodian is a third party, arm’s length financial institution that specializes in safeguarding financial assets.

Misconception #9 – Robo Advisors are Difficult to Use

Just like the so-called ‘black box’ of investing methodology, many people think of technology as this big inscrutable mess of complicated information. If you’ve ever wanted to drop-kick your laptop or smash your desktop printer like this scene from Office Space (one of my favourites), then you know what I mean.

Just because robo-advisor technology is sophisticated, doesn’t mean the average investor has to be tech-savvy to use it. If you can manage online banking or posting cat pictures on Facebook, working with a robo-advisor is a snap.

In our dashboard, for example, you see a live feed of ALL activity of your account, including every time a dividend is paid or a fee is charged. You always know exactly which funds you’re invested in, and the performance of your account in easy to understand terms.

More importantly, you’ll clearly see where you started – how much you’ve contributed – and where you are now. You’ll be able to determine, with a quick click and scan, whether or not your money is moving in the right direction.

Robo advisors make investing, and understanding your investments, simple.

Misconception #10 – I’m better off just doing it myself

DIY investing is great. And pioneers like Dan Bortolotti have done the general public a great service by popularizing the very well-known ‘Canadian Couch Potato’ method (a take on index or passive investing) which has since spawned several variations like the ‘Hot Potato’.

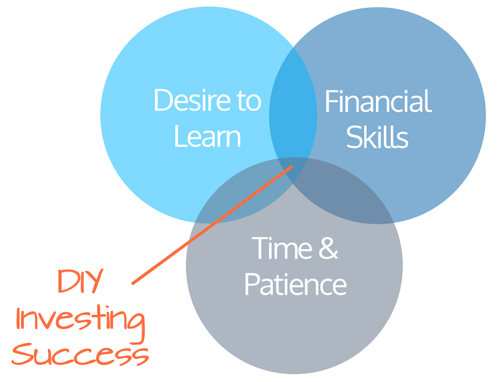

We think that it is great for people to take it upon themselves to become educated about how investments work. But in order to be a successful DIY investor, you need to have:

- The interest in learning how investments work

- The skill and ability to manage them effectively, and

- The time, patience, and discipline to actually do it.

How much free time do you really have at the end of the day to monitor your investments, research new investments, rebalance, read market updates and other reports to know what is going on in the economy and financial markets? Most people just don’t have the time or the inclination to properly manage their own investments.

Robo advisors’ accounts are automatically updated with great investments, rebalanced, and managed professionally. The information is available at your fingertips, on your phone or on your computer, and with a quick click you can chat with us – and even our CEO, Navid – at your convenience.