Just like your car, your investment portfolio needs routine maintenance.

While having an asset allocation for your investment portfolio is a great start, unfortunately it doesn’t mean you can set it and forget it. In any diversified portfolio, some of your investments will do a lot better than others.

Rebalancing is the process of selling some asset classes that have done really well and reallocating to those that haven’t done quite as well.

For example, stocks (green) generally have higher returns than bonds, so at some point you will likely need to sell some of your riskier stock allocation in order to buy some less risky bonds (blue).

Why You Should Rebalance

In two words: risk control.

The idea behind creating an asset allocation is to maximize the return for a level of risk that you are comfortable with.

When your portfolio deviates from your target asset allocation, you may be taking too much or too little risk, making it difficult to achieve your investment goals.

While it may be difficult to consider selling a stock, bond or fund that has done really well, how would you feel if it suddenly dropped 10% or 20%?

By rebalancing regularly, you’re reducing the chance that one of these unpredictable events will take a bite out of your hard won gains. Controlling risk is even more important as you near retirement.

As an example, consider a portfolio that is 50% Canadian Stocks and 50% Canadian Bonds. If you invested $25,000 in this simple portfolio 10 years ago you would have $47,443 today if you did not rebalance even once. If you had rebalanced regularly using a +/-5% absolute rebalancing threshold as described below you would instead have $49,122. Equally important, the volatility of the rebalanced portfolio was lower at 7.3%, compared to 7.7% for the portfolio that was not rebalanced.

Rebalancing Strategies

Rebalancing can be done in 1 of 3 ways: on a time basis, by using percentage thresholds or by using cash flows.

Time-Based Strategy

If you are the type of investor who prefers not to look at your investments too frequently, then this strategy is for you. Once a quarter or once a year you review your investments and rebalance your asset classes back to their target weights.

To do this, you would sell some of the asset class(es) that are above their target allocation and buy some of the asset class(es) below their target allocation. This will bring your investments back to their target allocation weights.

Percentage Threshold Strategy

If you are the type of investor who keeps a closer eye on your portfolio, you might prefer to use the percentage threshold method.

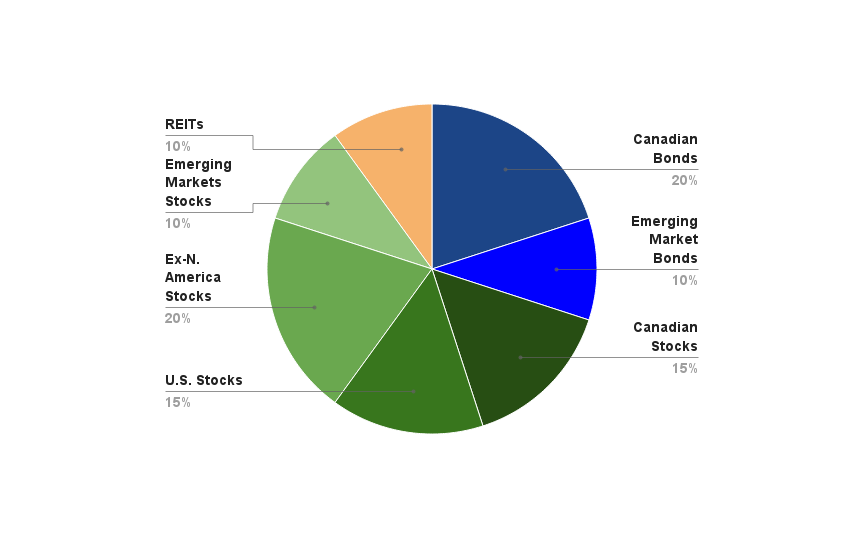

For this example, let’s revisit the 7 asset class portfolio (as described in the post “The Importance of Asset Allocation”) and look at how we would apply the percentage threshold method to it.

The percentage threshold method can be applied in one of two ways:

1. Rebalance every time an asset class exceeds a relative percentage

In this example, there is a 20% target allocation to Canadian Bonds. The remaining allocations are outlined in the table below.

If you were using this asset allocation, you might use a relative +/- 10% band as your rebalancing threshold. In practice, you would add to the Canadian Bond position if it declined to less than 18% of the portfolio and sell some if it rose above 22% of the portfolio, to get back to the 20% target.

| Lower Threshold | Target Allocation | Upper Threshold | |

| Canadian Bonds | 18.0% | 20.0% | 22.0% |

| Emerging Market Bonds | 9.0% | 10.0% | 11.0% |

| REITs | 9.0% | 10.0% | 11.0% |

| Canadian Stocks | 13.5% | 15.0% | 16.5% |

| U.S. Stocks | 13.5% | 15.0% | 16.5% |

| Ex-N. American Stocks | 18.0% | 20.0% | 22.0% |

| Emerging Market Stocks | 9.0% | 10.0% | 11.0% |

| Total | 100.0% |

2. Rebalance every time an asset class exceeds an absolute percentage

If you were using an absolute percentage, a +/-5% band would result in a range of 15% to 25% for Canadian Bonds.

| Lower Threshold | Target Allocation | Upper Threshold | |

| Canadian Bonds | 15.0% | 20.0% | 25.0% |

| Emerging Market Bonds | 5.0% | 10.0% | 15.0% |

| REITs | 5.0% | 10.0% | 15.0% |

| Canadian Stocks | 10.0% | 15.0% | 20.0% |

| U.S. Stocks | 10.0% | 15.0% | 20.0% |

| Ex-N. American Stocks | 15.0% | 20.0% | 25.0% |

| Emerging Market Stocks | 5.0% | 10.0% | 15.0% |

| Total | 100.0% |

How often should you use the percentage threshold strategy?

In theory, you could use this method every day but in practice, you are better off using a combination of both the time-based and the percentage threshold strategies.

You can set rebalancing thresholds and a policy of reviewing your portfolio on a quarterly or annual basis.

Regardless of which method you choose, the aim when rebalancing is usually to return the asset class proportions back to their target weights.

Rebalancing With Cash Flows

For the active contributor or withdrawer, rebalancing can be simple.

If you are actively contributing or actively withdrawing from your account, you can add to the asset class(es) that are below their target weight or sell some that are above their target weight when you need cash from your account.

These contributions or withdrawals may be enough to effectively rebalance your portfolio, but if they are not, then you would need to make additional buys and sells to rebalance the asset class(es) that differ from their targets.

Which method works best?

There are no hard and fast rules when it comes to rebalancing. What works for someone else may not work for you.

Setting the rebalancing thresholds when using the percentage threshold method is a cost/benefit trade-off – the narrower the bands, the more often you need to rebalance, which in turn will increase your trading costs. Alternatively, setting the bands too wide may mean being off target for a longer period of time than is optimal.

The most important thing to remember:

Set a policy and stick to it. Don’t make your policy any more complicated than it needs to be or you won’t follow through!