You have probably seen many articles about how to save money every month. The typical lists of fee saving ideas usually include:

- Cut your cable and internet costs

- Choose a cheaper cell phone plan

- Clip coupons

- Buy non-perishables in bulk

- Make your own cleaning products

- Earn more money by getting a part time job!

The weirdest one I have come across advocated finding your own food. This was actually on Oprah’s website!

I don’t know about you, but I’ve already cut my phone, internet and cable costs pretty low. And I’m not going to go foraging for weeds in a meadow!

Most ways to save money take ongoing effort. There is an easier way!

Most of those money saving ideas require an ongoing effort. Clipping coupons, watching for deals, and making cleaning products yourself requires a lot of ongoing effort. There is an easier way to save money and it only requires a one time effort with minimal annual maintenance.

Cut Investment Fees

Cutting the fees on your investments can save you a lot of money. And since you are charged fees on a regular basis, even a small reduction in fees can quickly compound into big numbers. The average mutual fund fee in Canada is 2.10% per year. Morningstar gives Canadian mutual funds a D- on fees and expenses, the lowest grade in the world. That’s a failing grade, but up from the F received in the 2013 report!

If you are comfortable managing your own investments, you can quickly and easily switch to an ETF portfolio that costs only 0.25% per year.

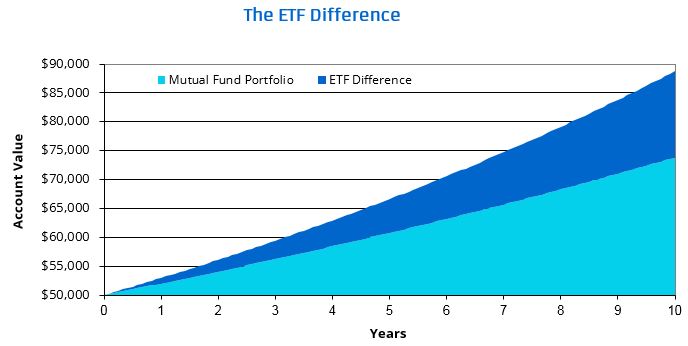

If you switch your investments from expensive mutual funds to much cheaper ETFs, on a $50,000 account you could save $77 per month in the first year. Thanks to the magic of compounding, your fee savings will continue to grow over time.

After 5 years, instead of saving just $77 per month, your monthly savings would be the equivalent of $123. After 10 years, your monthly savings would be $155. The difference between 2.10% and 0.25% doesn’t seem that big, but assuming both portfolios earn a 6% return every year before fees, the difference in the value of your investments after 10 years could be huge.

The mutual fund manager is effectively taking 35% of your annual return! By comparison, the ETFs only take 4% of your annual return.

What if I don’t want to manage my investments myself?

Part of the reason you chose mutual funds in the first place was to have someone manage your investments for you. If you’re not comfortable managing your investments yourself, there is an alternative: an online investment advisor like ModernAdvisor.

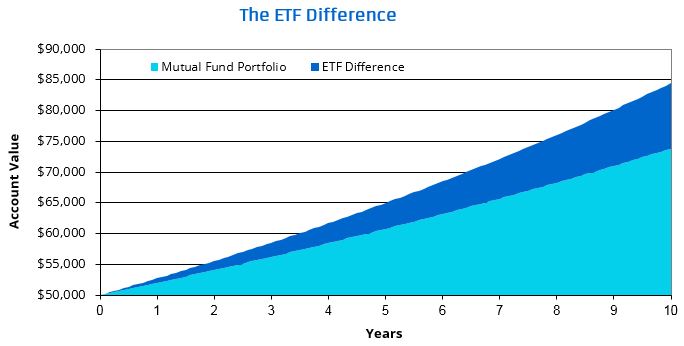

Depending on the size of your account, online investment advisors like us charge as little as 0.35% per year for large accounts. For a $50,000 account, you would most likely pay 0.50% per year. Add that to the cost of the ETFs and you have a total fee of 0.75%. While the higher fee means your monthly savings is lower, saving $56 in fees per month over mutual funds is still great. And your monthly fee savings grow over time.

After 10 years you are still a lot better off than with mutual funds and your portfolio is managed by an investment professional, rather than a salesperson.

Whether you do it yourself, or hire an online advisor to manage your ETFs for you, switching from mutual funds can save you hundreds every year, and as your account grows this savings quickly turns into thousands. And all it took was a simple change in your investments.

Whether you do it yourself, or hire an online advisor to manage your ETFs for you, switching from mutual funds can save you hundreds every year, and as your account grows this savings quickly turns into thousands. And all it took was a simple change in your investments.

To see how much you could save by switching from mutual funds, request your complementary fee report today!