On our website, anyone can submit a request for a portfolio review in which we look at the fees the client is paying and how well they are diversified. Most of the requests are from people that have a mutual fund account with a financial advisor at a bank or a mutual fund company. Every month we will feature a review of a portfolio we’ve received, but for privacy reasons the names will be changed.

Over the summer, Peter sent us the account statement from his Investors Group account which had $180,000 in mutual funds. As we expected, the fees on his Investors Group funds were on the high side. Below is a list of the funds Peter had and the annual MER for each.

| Fund Name | Portfolio Weight | Annual MER |

|---|---|---|

| Allegro Moderate Agg Canada Focus Port A | 19% | 2.58% |

| Allegro Moderate Agg Canada Focus Port C | 44% | 2.74% |

| Investors Group Dividend A | 17% | 2.39% |

| Investors Group Canadian Large Cap Value A | 4% | 2.59% |

| Investors Group Canadian Small Cap A | 2% | 2.75% |

| Investors Group Canadian Natural Resource A | 1% | 2.77% |

| IG Mackenzie Emerging Markets Cl A | 6% | 3.00% |

| IG Franklin Bissett Canadian Eq A | 5% | 2.60% |

| Investors Group International Small Cap CL A | 4% | 2.83% |

With all but one of Peter’s funds having an MER of over 2.50%, the weighted average MER for his account was 2.66%. That is above the MER of the typical Canadian mutual fund of around 2.30%, which unfortunately is not unusual for an Investors Group account. We consider anything over 2.25% to be very high.

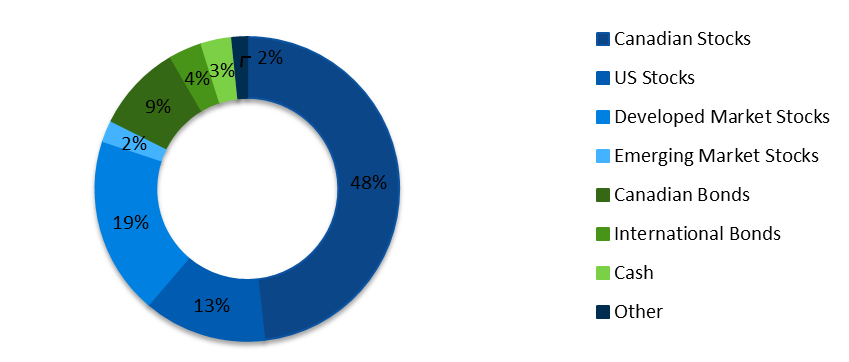

Peter’s Investors Group Portfolio – Asset Allocation

Next we looked at his asset allocation which was as follows:

Peter, who is close to retirement, had a fairly aggressive asset allocation with 82% in stocks, 16% in bonds and cash, and 2% in other. With more than half of his exposure to stocks concentrated in Canada, that is a rather large bet that Canadian stocks will outperform, particularly given our country’s concentration in the resources and financial services sectors.

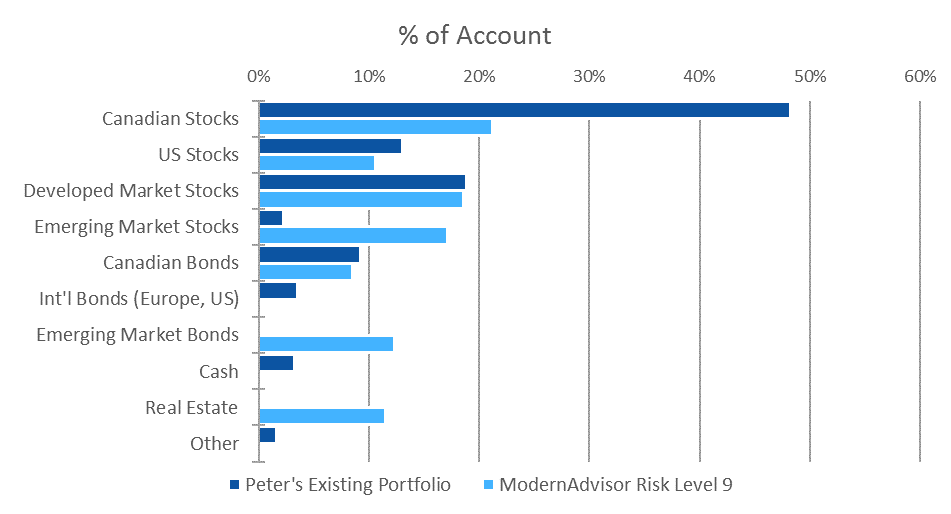

In comparing Peter’s portfolio to a ModernAdvisor portfolio, we selected our Risk Level 9 portfolio since it has a similar exposure to stocks. Below is a comparison of Peter’s asset allocation to ModernAdvisor’s Risk Level 9.

The main difference is that a ModernAdvisor Risk Level 9 portfolio would have only half of the exposure to Canadian stocks as Peter’s existing portfolio. That 27% difference goes mostly to emerging market stocks and real estate investment trusts (REITs) which currently have higher expected future returns.

ModernAdvisor portfolios don’t hold developed country bonds such as US or European bonds and typically hold very little cash. Those allocations from Peter’s account are replaced with emerging market bonds in the ModernAdvisor portfolio.

Fees

Aside from the asset allocation, the major difference between Peter’s Investors Group portfolio and ModernAdvisor Risk Level 9 is fees. With Peter’s Investors Group mutual funds he is paying a weighted average of 2.66% in MER every year! The weighted average of the MERs on the ETFs we use in our Risk Level 9 portfolio is 0.24%, which just happens to be the most expensive of our Core Portfolios.

That means on Peter’s $180,000 portfolio he is paying $4,788 every year in MERs! On a $180,000 in the ModernAdvisor portfolio he would only be paying $432. Add in our management fee of 0.40% (plus GST) and he’s looking at only $720 for the year. Over the long term, those fee savings compound quickly.

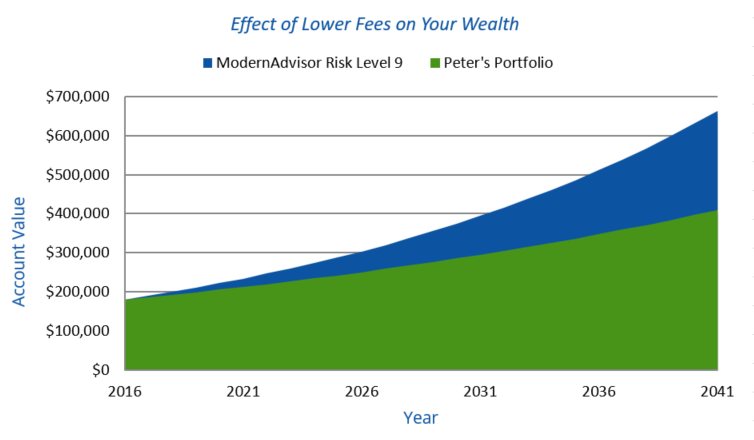

Since we can’t predict the future and for simplicity, we’ve assumed in the above chart that both portfolios earned 6% every year before fees. That fee savings means that Peter could potentially have an additional $254,000 after 25 years just by lowering his fees. Since he’s near retirement, another way of looking at the savings is he has a much lower chance of outliving his savings.

One expense of mutual funds that is rarely discussed is trading expenses. This is measured in the trading expense ratio, or TER. Actively managed mutual funds often have TERs of more than 0.20%. For small funds that trade a lot, a TER of 0.50% would not be unusual.

Fortunately for Peter the weighted average TER of the funds he holds is only 0.11%. That works out to $198 on Peter’s portfolio. Since the point of investing in expensive mutual funds is supposed to be active management, we would have expected the TER to be higher which would indicate more active trading.

The weighted average of the TER on the ETFs in the ModernAdvisor portfolio is 0.00%. It is probably not actually 0.00%; the ETF providers round anything under 0.005% to 0.00%. Even if we assume the TER was actually 0.0049% (which rounds to 0.00%), that would be only be $9 per year on Peter’s portfolio.

To summarize, the fees for both portfolios are:

| MER | MER in $ | Management fee rate | Management fee | TER | TER in $ | Total fees | |

|---|---|---|---|---|---|---|---|

| Peter’s Portfolio | 2.66% | $4,788 | 0% | $0 | 0.11% | $198 | $4,986 |

| ModernAdvisor Risk Level 9 | 0.24% | $432 | 0.42% | $756 | 0.00% | $9 | $1,197 |

| ModernAdvisor Savings | 2.42% | $4,356 | -0.42% | -$756 | 0.11% | $189 | $3,789 |

For much lower cost, Peter can switch to a ModernAdvisor portfolio saving thousands every year, while getting a more diversified portfolio. Since Peter is close to retirement, keeping an additional $3,789 in his pocket every year could mean the difference between struggling to make ends meet and having a comfortable retirement. It also considerably reduces the chance of outliving his savings.