Q2 2021 Performance Update

The second quarter of 2021 was another good one for ModernAdvisor’s portfolios; all of the Core and SRI portfolios were positive for the quarter, and all are now positive for 2021. Equity markets in Canada and abroad performed well as did real estate investment trusts, all of which contributed positively to our portfolios’ performance. Fixed income was a drag in the first quarter, and while flat, fixed income at least didn’t negatively impact performance in the second quarter.

Emerging market stocks were again one of the laggards, performing the least well out of the equity market exposures in the second quarter, while Canadian stocks were the top performer.

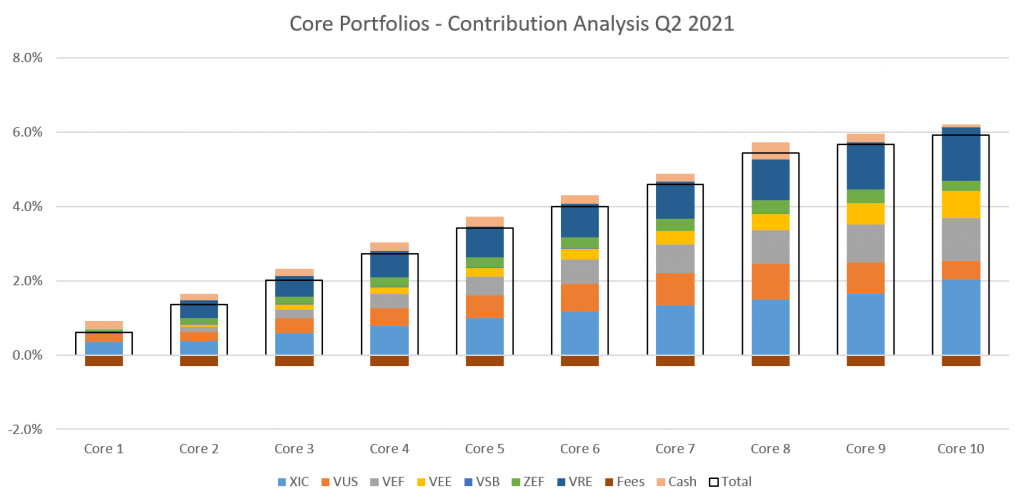

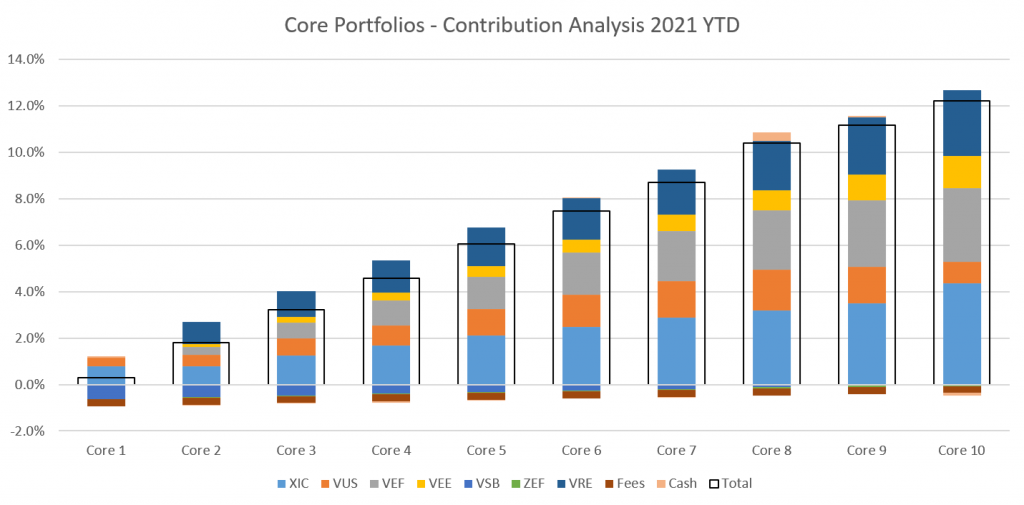

Core Portfolios:

The largest positive contributors to performance for the quarter were Canadian stocks (XIC), and real estate investment trusts (VRE) despite REITs being one of the smaller components of the portfolios. Together, XIC and VRE accounted for a little more than half of the portfolios’ performance. International developed market stocks (VEF) and US stocks (VUS) were the next largest positive contributors to performance. Emerging market stocks (VEE) and bonds (ZEF) also contributed positively. No part of the portfolio contributed negatively to performance, Canadian fixed income (VSB) was flat.

For the first half of 2021, Canadian stocks (XIC) and international developed market stocks (VEF) were the top contributors to the positive performance. Real estate investment trusts (VRE) was the next largest contributor, followed by US stocks (VUS) and emerging market stocks (VEE). Canadian fixed income (VSB) hurt performance of the lower risk levels and the impact to the higher risk levels was negligible. Emerging market bonds (ZEF) had a negligible impact on performance.

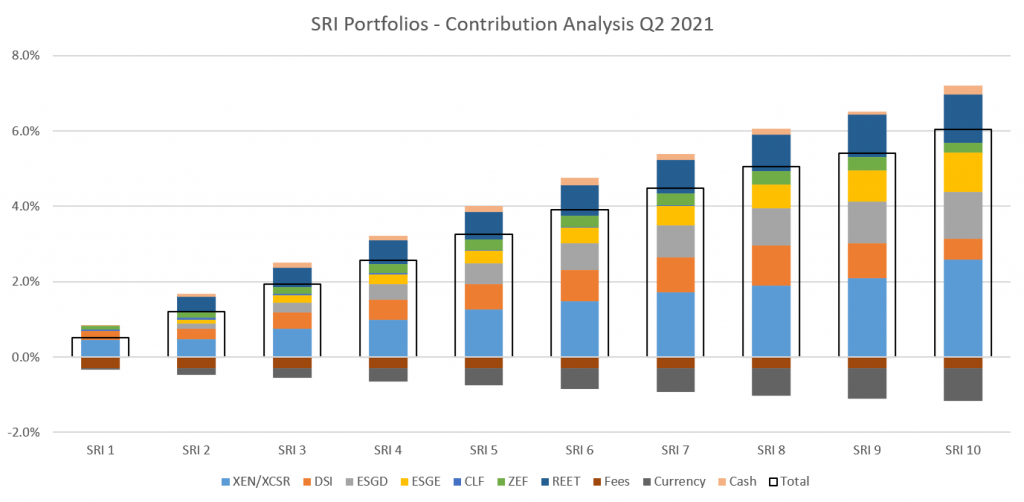

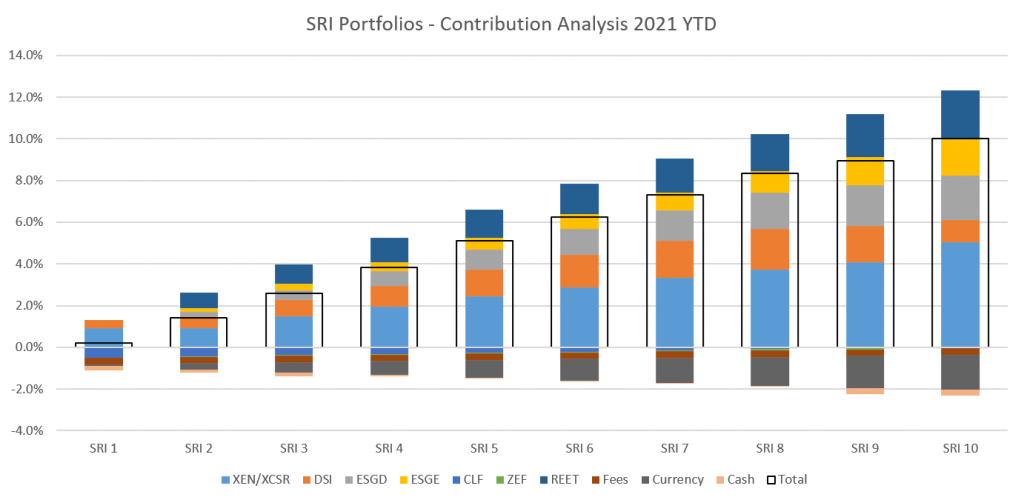

Socially Responsible Portfolios:

The largest positive contributor to the SRI portfolios’ performance for the quarter were Canadian stocks (XEN up until June 8, and XCSR after that), accounting for almost half of the performance for most of the risk levels, or almost all of it in the cash of Risk Level 1. International (ESGD) and US stocks (DSI) were the next largest positive contributors followed closely by real estate investment trusts (REET). Emerging market stocks (ESGE) and bonds (ZEF) also contributed positively to performance for the quarter.

The contribution to performance of CLF, our Canadian fixed income ETF, was negligible.

The only major negative contributor to performance was the US dollar. DSI, ESGD, ESGE, and REET are all priced in US dollars; with the Canadian dollar gaining +1.4% against the US dollar in the second quarter, the currency effect had a negative impact on performance.

For the first half of 2021, the largest positive contributor to performance for the quarter were Canadian stocks (XEN up until June 8, and XCSR after that), accounting for almost half of the performance for most of the risk levels, and almost all of it in the cash of Risk Level 1. International stocks (ESGD) and real estate investment trusts (REET) were the next largest positive contributors. US stocks (DSI) and emerging market stocks (ESGE) also contributed positively.

The contribution to performance of CLF, our Canadian fixed income ETF, was negative for the lower risk levels and negligible for the higher risk levels. Emerging market bonds (ZEF) had no impact on performance in the first half of 2021.

With the Canadian dollar hitting multiyear highs during the first half of 2021, the currency effect of holds the US ETFs, DSI, ESGD, ESGE, and REET negatively impacted performance.