Investors around the world were rattled by the continuing saga in Greece, sending stock and bond markets lower around the world. Yields on short-term bonds dropped below zero briefly in the US as investors rushed to safety. Earlier in the month investors focused on economic data which was largely positive.

June 2015 Market Performance

All index returns are Total Return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for June |

2015 YTD Return |

| Oil Price (USD) | $59.47 | -1.21% | +11.64% |

| Gold Price (USD) | $1171.80 | -1.48% | -1.04% |

| US 3 month T-bill | +0.01% | 0.00%* | -0.03%* |

| US 10 year Bond | +2.35% | +0.23%* | +0.18%* |

| USD/CAD FX rate | 1.2490 | +0.43% | +7.66% |

| EUR/CAD FX rate | 1.3926 | +1.95% | -0.80% |

| CBOE Volatility Index (VIX) | 18.23 | +31.72% | -5.05% |

*Absolute change in yield, not the return from holding the security.

Market Update

June began positively for most markets but as it became increasingly clear that Greece was not going to meet its debt repayment obligations, the markets began to falter, and finished the month negatively.

All of the major equity markets we track were negative in June, with Europe being the hardest hit. While Greece is economically a very small part of Europe, the concern is that the other countries still on life support such as Spain, may experience renewed problems due to Greece’s bankruptcy. Greece became the first developed country to default on an International Monetary Fund (IMF) loan after it missed an interest payment on June 30.

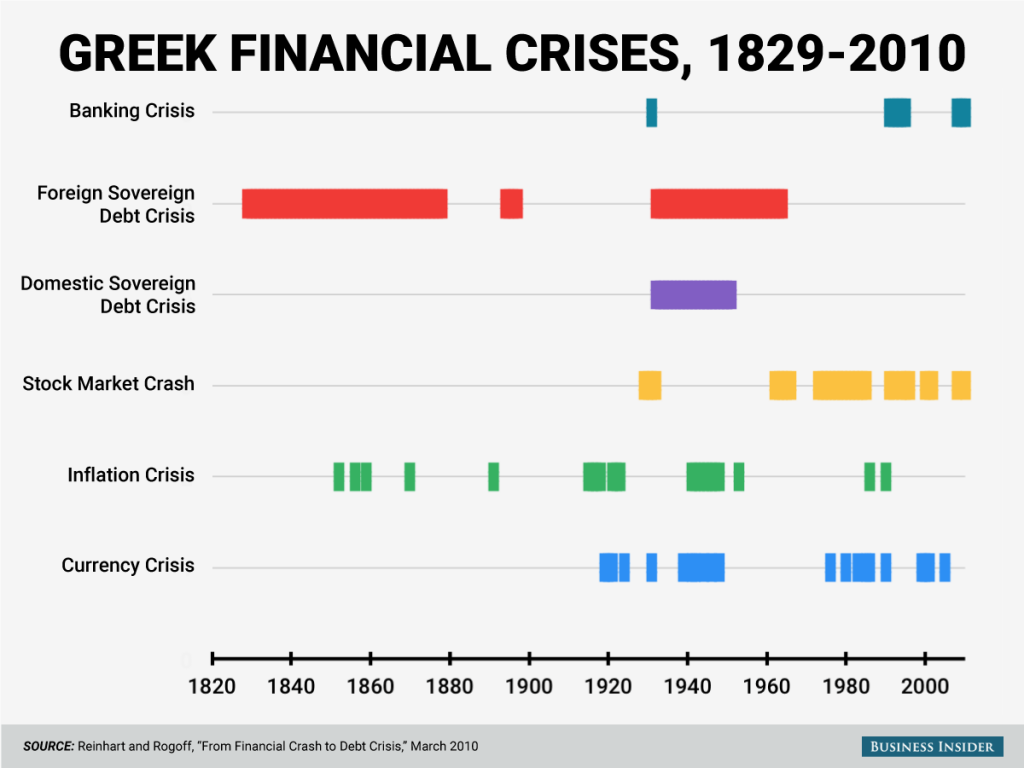

The loan from the IMF was a bailout; essentially Greece has defaulted on its first bailout, so why does anyone think next time will be different? Greece has serious structural economic and social problems that will not be solved by another bailout. Its not like Greece hasn’t been here before:

Given the turmoil in Europe, volatility in equity markets rose sharply, as Canadian and US stocks had their first negative day of more than 2% since early January.

Bond markets didn’t provide a safe place in June, as investors sold all but the shortest dated bonds. Canadian and US investment grade and high yield, and emerging market bonds were all down for the month.

Commodities, other than the headline oil and gold, generally performed well in June. The broad Bloomberg Commodity Index was up 1.7%, as gains on agricultural commodities and natural gas outweighed losses on oil and gold, the largest weights in the index. The most widely reported commodities, oil and gold, were -1.2% and -1.5%, respectively.

As in May, the Canadian Dollar weakened against the US Dollar and the Euro as economic data was relatively weaker in Canada than in those areas.

June Economic Indicator Recap

A number of central banks cut interest rates in June in an effort to boost economic growth or defend their currency. China, Norway, India, South Korea and New Zealand all cut interest rates by 0.25% in June. Sweden followed suit on July 2 and cut it’s rate 0.1% to -0.35%.

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on the lesser economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate was unchanged in May at 6.8%. While 58,900 new jobs were created, 30,900 of which were full-time, but since more people were looking for work the unemployment rate was unchanged.

The housing market in Canada remains strong as housing starts in May were well ahead of expectations at 201,700 and building permits were up 11.6% in April. New house prices were less robust, only up 0.1% for April and 1.1% over the last 12 months.

Inflation remains tame. In May the Consumer Price Index (CPI) rose +0.6%, +0.9% over the last year. Both were ahead of forecasts. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest rose 2.2%. Retail sales numbers were released with inflation data. Retail sales in April declined -0.1% during the month, but rose 1.7% over the past 12 months.

GDP in May was down -0.1%, the fourth consecutive negative month for GDP. Unless June’s GDP report is positive by at least +0.3%, Canada will have two negative quarters in a row, which would constitute a recession. Recessions are usually preceeded by an inverted bond yield curve, something we are starting to see in Canada. The yield curve was already very flat, but now the medium term bonds have dropped in yield, creating a slight inversion. The yield on 3 month treasury bills is 0.58%, while the yield on the 2 and 3 year bonds are 0.49% and 0.47%, respectively.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics