October was a good month for equity markets, but a mixed one for fixed income as central banks continue to raise interest rates.

October 2022 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for October 2022 | 2022 YTD Return |

|---|---|---|---|

| Oil Price (USD) | $86.53 | +8.86% | +15.05% |

| Gold Price (USD) | $1,640.70 | -1.87% | -10.28% |

| US 3 month T-bill | +4.22% | +0.89%* | +4.16%* |

| US 10 year Bond | +4.10% | +0.27%* | +2.58%* |

| USD/CAD FX rate | 1.3649 | +1.99% | +7.66% |

| EUR/CAD FX rate | 1.3502 | -1.50% | -6.18% |

| CBOE Volatility Index (VIX) | 25.88 | -18.15% | +50.29% |

*Absolute change in yield, not the return from holding the security.

October was a good month for equity markets, but a mixed one for fixed income as central banks continue to raise interest rates.

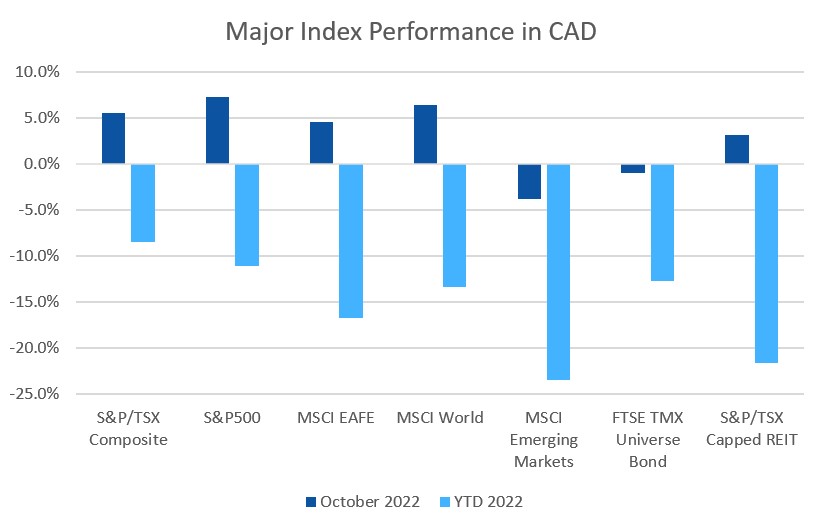

The main index of Canadian stocks, the S&P/TSX Composite, had a good month, rising +5.6%. The S&P/TSX Small Cap was up +3.6%. US markets were also strong: the large cap S&P500 gained +8.1% (in USD), but it’s still down -17.7% for 2022. The index of US small cap stocks, the Russell 2000 gained +10.9%, and the tech focused Nasdaq gained +3.9%. The Nasdaq is still down -30% for 2022.

The broad index of EAFE stocks (Europe, Australasia & Far East) gained +5.3% in October, bringing the YTD to -12.2%. Out of the EAFE regions, European stocks performed a little better at +6.0% for the month. Despite all of the turmoil in the UK following Brexit and turnover in the prime minster’s office, British stocks have weathered 2022 very well, gaining +2.9% in October and losing only -3.9% so far in 2022. Japanese stocks gained +6.4% in October, while emerging market stocks were one of the few markets that lost in October, losing -2.7%.

Bonds were mixed in October with investment grade bonds falling and high yield performing well.

The major Canadian bond index, the FTSE/TMX Universe Bond Index lost -1.0% in October, pushing the YTD loss to -12.7%. The FTSE/TMX Short-term Bond Index was essentially flat (-0.1%), and is down -4.7% for 2022. In the US, investment grade and high yield bonds were both down. The investment grade ICE BoA AAA index lost -1.8% in October, bringing the YTD loss to -22.3%. The BBB index lost -0.9% for the month. High yield bonds gained +2.8% in October for the HY Master II Index, while the CCC and lower (the real junky stuff) Index gained +1.7%.

Canadian REITs gained +3.2% in October, and are down -21.6% for 2022.

Oil reversed its slide, gaining +8.9% in October. Gold lost another -1.9% for the month and is now down more than -10% for 2022. The diversified Bloomberg Commodities Index gained +1.7%, its still the only index we track that is up more than +5% in 2022, gaining +14.3% so far this year.

The Canadian Dollar (CAD) lost ground against the US Dollar, declining -2.0% in October, but gained +1.5% against the Euro.

October 2022 Economic Indicator Recap

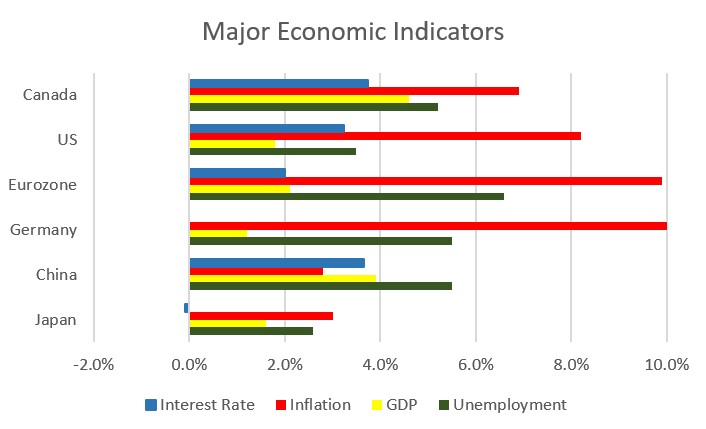

Below are the readings released in October for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

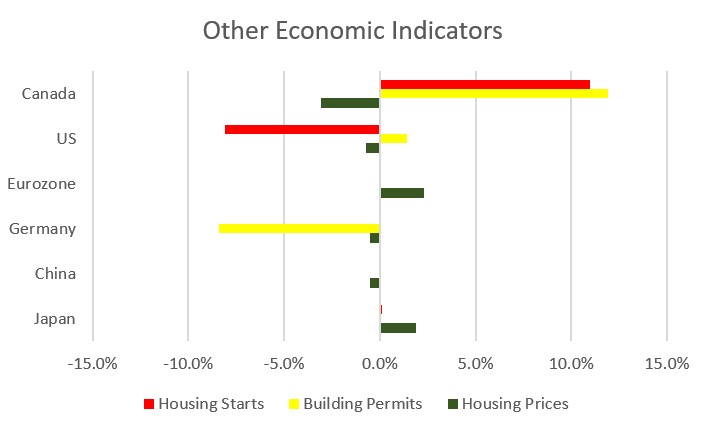

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

The Canadian labour market remains tight with many businesses seeing difficulty attracting interest in their open positions. Canada’s unemployment rate declined slightly to 5.2% in September. The economy gained 21,100 jobs, as 15,400 part time jobs and 5,700 full time jobs were added. Gains were seen in education and social assistance fields, offsetting losses in manufacturing, recreation and culture, and transportation sectors.

Higher interest rates are having an effect on housing prices across Canada; the Teranet index set a new record for the largest monthly decline (following the previous month’s record decline) since the Teranet index began in 1999, declining -3.1% in September and the fifth monthly decline in a row. 8 of 11 major markets posted declines, with the largest declines in Victoria (-5.9%), Vancouver (-3.5%) and Hamilton (-2.1%). Outside of the major cities, Peterborough (Ontario) was the largest decliner at -11.8% (!). The only gainers were Calgary (+1.2%), Halifax (+1.1%) and Edmonton (+0.2%). The annual national price gain for the 12 months ended September 30 was +6.0%, a far cry from +35% gains we were seeing 6 months ago!

The level of new housing starts rose +11% in September to just under 300,000 homes, the highest level in almost a year. Urban multifamily housing (condos and townhouses) accounted for most of that (216,000). The value of building permits issued rose +11.9% in August $12.5 billion, this was way above market expectations of a -0.5% decline. Both the residential and non-residential sectors posted strong gains (+12.0% and +11.8%, respectively) with Ontario providing much of the increase.

The inflation rate for September was +0.1%, and +6.9% on an annual basis; inflation could decline by 2% and still be higher than inflation at any point in the last 25 years. A decline in gasoline prices helped transportation costs ease; inflation also eased in the recreation and education sectors. Meanwhile, food prices increased to a level not seen since 1981, exceeding +10%. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +6.0%. While the Bank of Canada has raised interest rates 6 times so far in 2022, it generally takes at least 12 months for interest rate increases to affect the economy – so don’t expect any major relief in inflation until well into 2023.

Canada’s GDP was up +0.1% in August (the same slight growth for 4 months in a row), with 14 of 20 industrial sectors posting gains. Growth in services sectors (+0.3%), outweighed a -0.3% decline in the goods producing sectors. Retail and grocery stores (not surprising given the continued high food inflation) performed well, while construction declined for the fifth month in a row.

The Bank of Canada raised interest rates +0.50% to 3.75% at the October 26 meeting, at level not seen since 2008. The governors indicated that interest rates will need to rise further to curb inflation as core inflation hasn’t shown much change. The BoC also noted that the policy of quantitative tightening (bond market purchases to affect longer term interest rates) will continue. This activity shows up in fixed rate mortgages, with interest rates climbing for fixed rate mortgages.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics