October was a down month for nearly all equity market indices we track, with emerging markets being one of the few positives.

October 2020 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for October 2020 | 2020 YTD return |

|---|---|---|---|

| Oil Price (USD) | $35.79 | -11.01% | -41.39% |

| Gold Price (USD) | $1,879.90 | -0.82% | +23.43% |

| US 3 month T-bill | +0.09% | -0.01%* | -1.46%* |

| US 10 year Bond | +0.88% | +0.19%* | -1.04%* |

| USD/CAD FX rate | 1.3318 | -0.16% | +2.54% |

| EUR/CAD FX rate | 1.5533 | -0.63% | +6.51% |

| CBOE Volatility Index (VIX) | 38.02 | +44.18% | +175.91% |

*Absolute change in yield, not the return from holding the security.

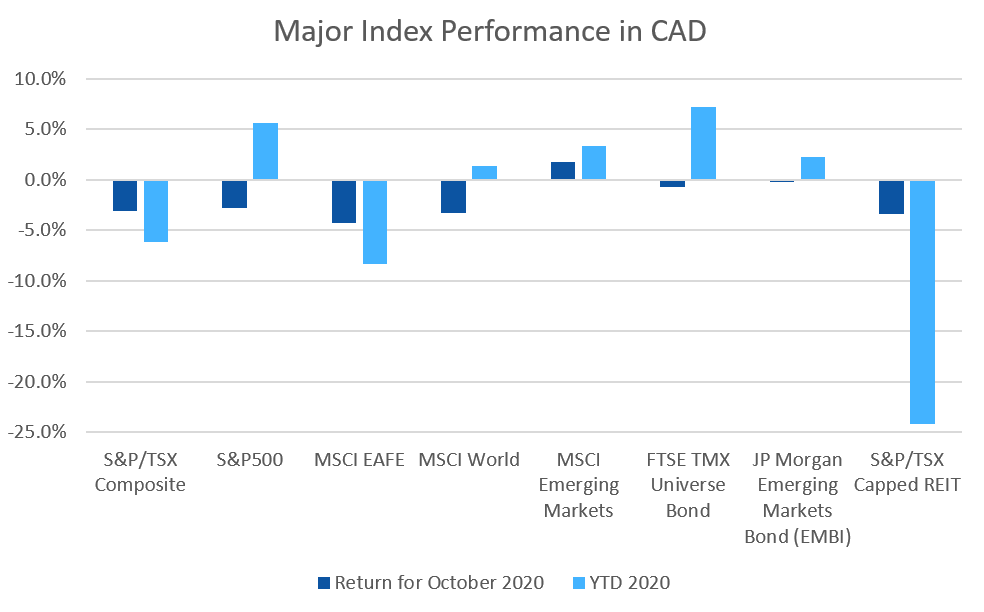

October was a down month for nearly all equity market indexes we track, with emerging markets being one of the few positives.

The S&P/TSX Composite was down -3.1% in October and the S&P/TSX Small Cap Index was down -0.9%. In the US, the large cap S&P500 was down -2.6% and remains up +2.8% for 2020. The US’ main small cap index, the Russell 2000, was up +2.0% for the month but is still down -7.8% for 2020.

EAFE (Europe, Australasia & Far East) stocks were down -4.0% in October, and remain down -14.8% for 2020. European and British stocks were down -5.4% and -4.9% for the month, respectively. For 2020 British stocks are still down -26.1%! Japanese stocks were down -0.9%. Emerging market stocks were up +1.4% for the month, and are up +2.3% for 2020.

Bonds were mixed in October. The major Canadian bond index, the FTSE/TMX Universe Bond Index, was down -0.8% and the FTSE/TMX Short-term Bond Index was flat. Those indices are up +7.2% and +4.8% for 2020. US investment grade bonds were down in October, while high yield and distressed were up. Emerging market bonds were down -0.2% for the month.

Oil was down -11.0% in October, but remains down -41.4% for 2020. Gold was down -0.8% for the month but remains up +23.4% for 2020. The diversified Bloomberg Commodities Index was up +1.4% for the month and remains down -11.2% for the year.

The Canadian Dollar (CAD) gained +0.2% against the US Dollar in October and 0.6% against the Euro.

October 2020 Economic Indicator Recap

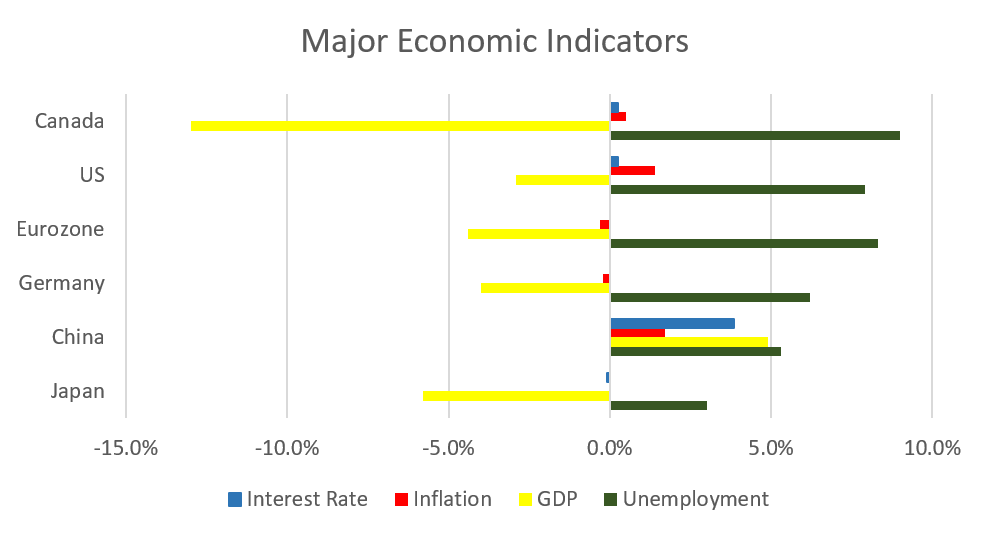

Below are the readings received in July for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

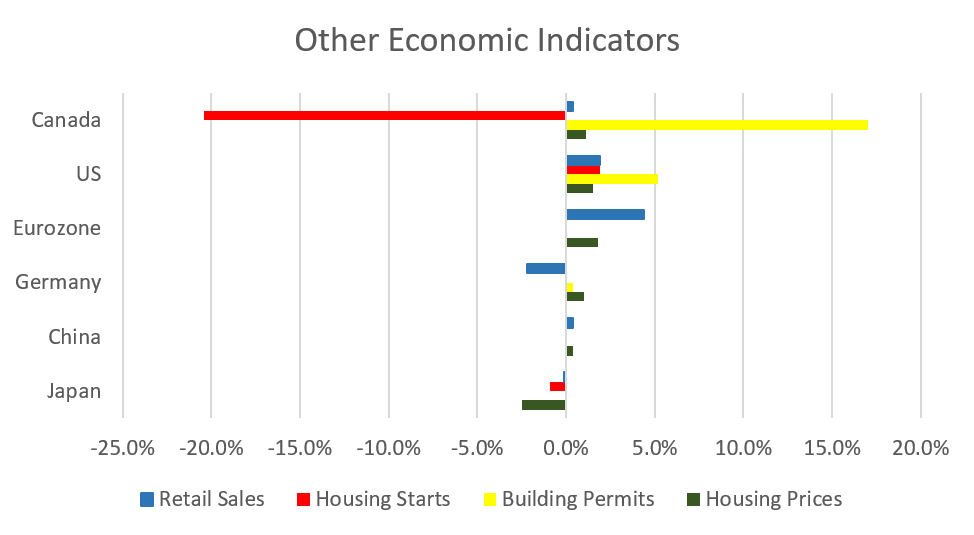

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined to 9% in September, the first month since March that it has been under 10%. The economy added 378,200 jobs during the month, 334,200 of which were full time jobs and 44,000 were part time jobs.

Housing prices across Canada were up +1.1% in September. Ottawa was the top performer at +2.3%, followed by Quebec City, Montreal, and Hamilton at +2.2%, +1.9% and +1.9%, respectively. None of the major Canadian housing markets were down for the month.

The level of new housing starts declined -20.4% in September to 209,000 units. Urban multifamily construction declined -27%. The value of building permits in September rose +17.0% to $9.4 billion, the largest gain in over 11 years. The value of nonresidential construction rose +40.6%.

The inflation rate for September was -0.1%, and +0.5% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.0%. The cost of recreation, clothing & footwear, and reading & education declined, while housing, and health & personal care rose.

Retail sales were up +0.4% in August; sales rose at gasoline stations, building materials stores, and grocery stores, while sales declined at car dealers. Compared to a year ago retail sales were up +3.5%.

Canada’s GDP was up +1.2% in August, the third consecutive monthly gain, but economic activity remains 5% below pre-pandemic levels. Both goods and services sectors were positive; 15 of 20 industrial sectors posted gains.

As expected, the Bank of Canada left its benchmark interest rate at 0.25% at the October 28 meeting. The BoC has adjusted its quantitative easing program towards purchasing longer-term bonds and that total purchases will be gradually reduced to 4 billion per week.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics