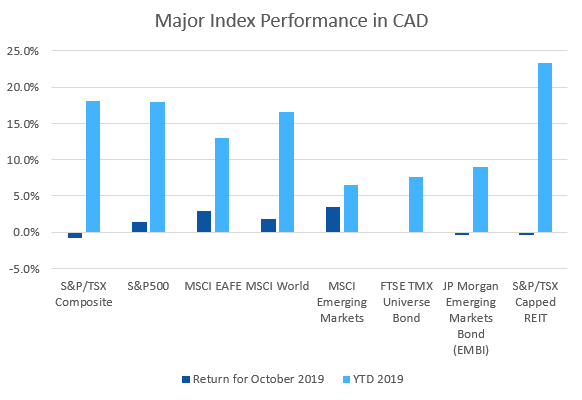

October was another good month for stocks, while one of the best performing asset classes, REITs, took a breather.

October 2019 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for October 2019 | 2019 YTD return |

|---|---|---|---|

| Oil Price (USD) | $54.18 | +0.20% | +19.31% |

| Gold Price (USD) | $1,514.80 | +2.84% | +18.22% |

| US 3 month T-bill | +1.54% | -0.34%* | -0.91%* |

| US 10 year Bond | +1.69% | +0.01%* | -1.00%* |

| USD/CAD FX rate | 1.3160 | -0.63% | -3.53% |

| EUR/CAD FX rate | 1.4671 | +1.61% | -6.03% |

| CBOE Volatility Index (VIX) | 13.22 | -18.60% | -47.99% |

*Absolute change in yield, not the return from holding the security.

October was another good month for equity markets, with a few exceptions. The S&P/TSX Composite was down -0.9% for the month, bringing the year to date return to +18.1%. In the US, the large cap S&P500 was up +2.2% and small cap Russell 2000 was up +2.6%.

EAFE (Europe, Australasia & Far East) stocks were up +1.6%; European stocks specifically were up +0.3%. Emerging market stocks were up +2.9%, and are up +8.5% for 2019.

Canadian bonds were mixed in October, the FTSE/TMX Universe Bond Index declined -0.2% and the FTSE/TMX Short-term Bond Index gained +0.2%. US bonds were also mixed in October, with treasuries and high grade corporates up while lower rated and high yield indexes were down. Emerging market bonds were down -0.4%, REITs were also down -0.4% for the month.

The headline commodities, oil and gold were both up in October. Oil was up +0.2% and gold was up +2.8%. The diversified Bloomberg Commodities Index was also up for the month: +1.9%.

The Canadian Dollar (CAD) gained +0.6% against the US Dollar and +1.6% versus the Euro.

Commentary – by Gordon Ross, CFA

There are four major factors that are generally accepted as the basis for strategies in managing stock portfolios. They are “Value”, “Low Volatility”, “Momentum” and “Quality”. Through the month of October, the U.S. stock market showed strength in the strategies that emphasize “Value”, continuing the strong performance they started in late September. “Value” is defined by comparing trading price to financial fundamentals. Also during October, strategies that emphasize “Low Volatility”, which is defined by how much trading prices jump up and down, were the weakest. These had been the strongest strategies for over a year.

At this point in the U.S., the four major factors have year-to-date performance substantially the same as the broad stock market. In other words, there has been no advantage so far this year for any of these four major factors over the broad market.

Every trade occurs between a buyer and a seller. The market price of a tradeable security is just a price at which one trader is willing to sell and another is willing to buy. It is the outcome of pressure from all the traders in the market: some skilled, some not; some who have done analysis, some who have not done any; some human, some not. The views of the two sides of any trade can differ substantially from each other.

During October one of the most watched new companies, WeWork, was planning to sell shares into public markets. There was enough interest from some people, to value the company at $47 billion U.S. It was one third owned by SoftBank, a huge, high-profile investment firm out of Japan; surely they know how to price a trade. This month problems started to surface at WeWork and they cancelled the sale of shares to the public. Then SoftBank had to put in $10 billion U.S. to bail out the company, and was left with a value of only $8 billion U.S. So you see even experts can be severely challenged to calculate the “value” of a company.

ModernAdvisor takes the safe and stable path, targeting broad market indexes rather than betting your money on someone’s forecast or a “hot” strategy.

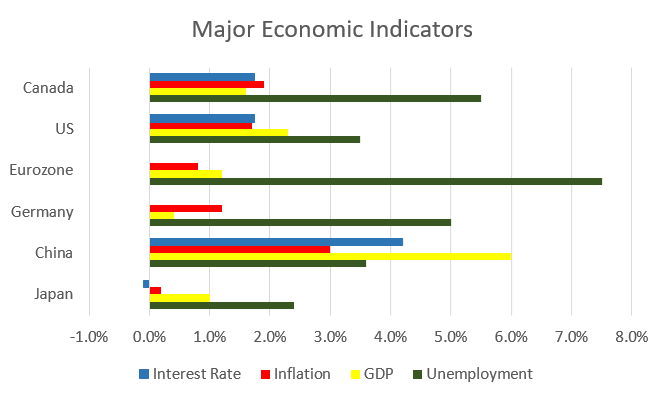

October 2019 Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

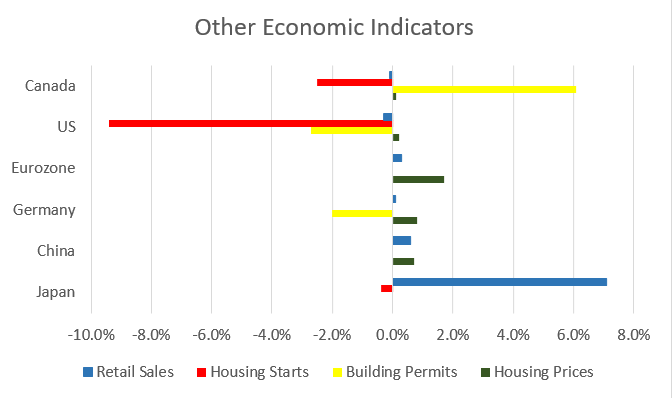

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined to 5.5% in September, as 53,700 jobs were added. 70,000 of those jobs were full time, which were partially offset by the 16,300 part time jobs were lost. Most of the new jobs were created in Ontario (+41,000).

Housing prices across Canada were up +0.1% in September. Meanwhile Vancouver was down -0.5%, its 14th consecutive flat or negative month. 6 of the other 10 metropolitan markets in the index were up, with Montreal (+1.0%), Ottawa (+0.8%), and Winnipeg (+0.6%) the largest gainers.

The level of new housing starts declined -2.5% in September to 221,200 units. Urban housing starts declined -2.4%. The value of building permits issued in August rose +6.1% to $9.0 billion. The value of building permits for condos rose +18.8% to $3.3 billion, over half of that was in BC (primarily Vancouver).

The inflation rate -0.4% for September, and +1.9% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was also +1.9% on an annual basis.

Retail sales declined -0.1% in August; compared to a year ago retail sales were up +1.1%. Sales declined at food & beverage stores, gasoline stations, and building material and garden equipment stores. Sales rose at general merchandise stores. Sales were also up at cannabis stores, which posted their fifth double digit gain in the last 6 months at +18.6%.

Canada’s GDP rose +0.1% in August. Goods producing industries rose +0.2%, led by a +0.5% gain in manufacturing. Gains were also registered in agriculture, forestry, and construction. The services sector rose +0.1%, driven by professional services and finance & insurance.

The Bank of Canada left its benchmark interest rate unchanged at their October 30 meeting. With inflation remaining tame, no changes are anticipated (if at all) until well into 2020.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics