November was a strong month for stock and bond markets following announcements of positive test results for COVID-19 vaccines.

November 2020 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for November 2020 | 2020 YTD return |

|---|---|---|---|

| Oil Price (USD) | $45.34 | +26.68% | -25.75% |

| Gold Price (USD) | $1,780.90 | -5.27% | +16.93% |

| US 3 month T-bill | +0.08% | -0.01%* | -1.47%* |

| US 10 year Bond | +0.84% | -0.04%* | -1.08%* |

| USD/CAD FX rate | 1.2965 | -2.65% | -0.18% |

| EUR/CAD FX rate | 1.5509 | -0.15% | +6.35% |

| CBOE Volatility Index (VIX) | 20.57 | -45.90% | +158.59% |

*Absolute change in yield, not the return from holding the security.

November was a strong month for stock and bond markets following announcements of positive test results for COVID-19 vaccines.

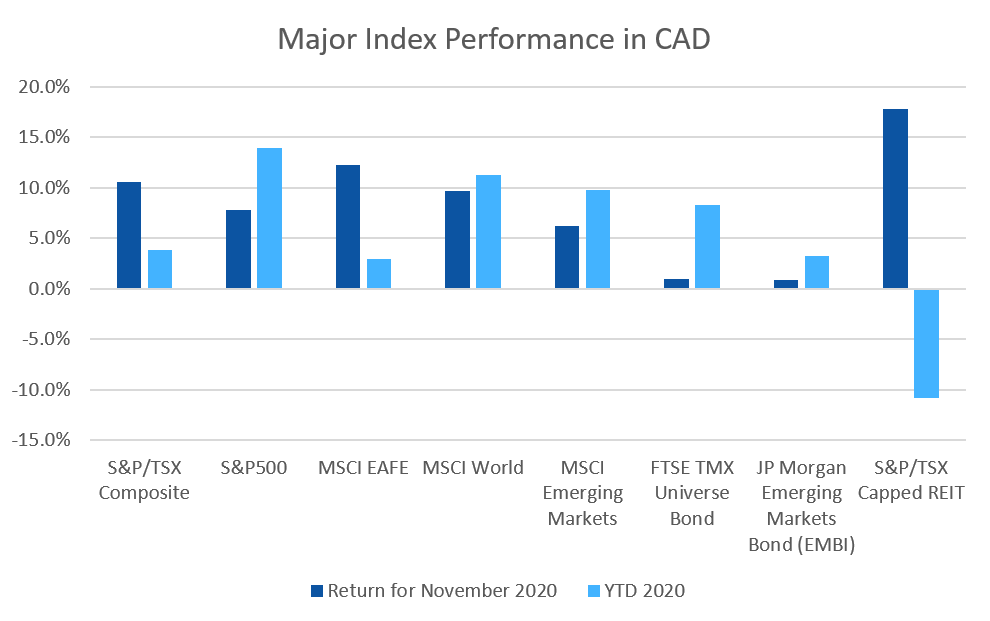

The S&P/TSX Composite was up +10.6% and the S&P/TSX Small Cap Index was up +17.4%, both are now positive for 2020: +3.8% and +4.2% respectively. In the US, the large cap S&P500 was up +10.9%, and the small cap Russell 2000 index was up +18.3% turning it positive for 2020 (+9.1%).

EAFE (Europe, Australasia & Far East) stocks were up +13.0%, the best month in over 26 years! (our data goes back to January 1994) but it’s still down -3.7% for 2020. European and British stocks were up +13.8% and +12.4% for the month, respectively. Both are still down for 2020. Japanese stocks were up +15.0%. Emerging market stocks were up +7.7% for the month, and are up +10.2% for 2020.

REITs were hard hit this year, and hadn’t seen much of a recovery until November. The S&P/TSX Capped REIT Index gained +17.8%, its best month since May 2009. Despite that, the Index is still down -10.8% for 2020.

Bonds were broadly positive in November. The major Canadian bond index, the FTSE/TMX Universe Bond Index, was up +1.0% and the FTSE/TMX Short-term Bond Index was up +0.2%. Those indices are up +8.3% and +5.1% for 2020. US investment grade bonds were up in November, as were high yield and distressed bonds. Emerging market bonds were up +0.9% for the month.

Oil was up +26.7% in November, but remains down -25.7% for 2020. Gold was down -5.3% for the month but remains up +16.9% for 2020. The diversified Bloomberg Commodities Index was up +3.5% for November and remains down -8.1% for the year.

The Canadian Dollar (CAD) gained +2.7% against the US Dollar in November and +0.2% against the Euro.

November 2020 Economic Indicator Recap

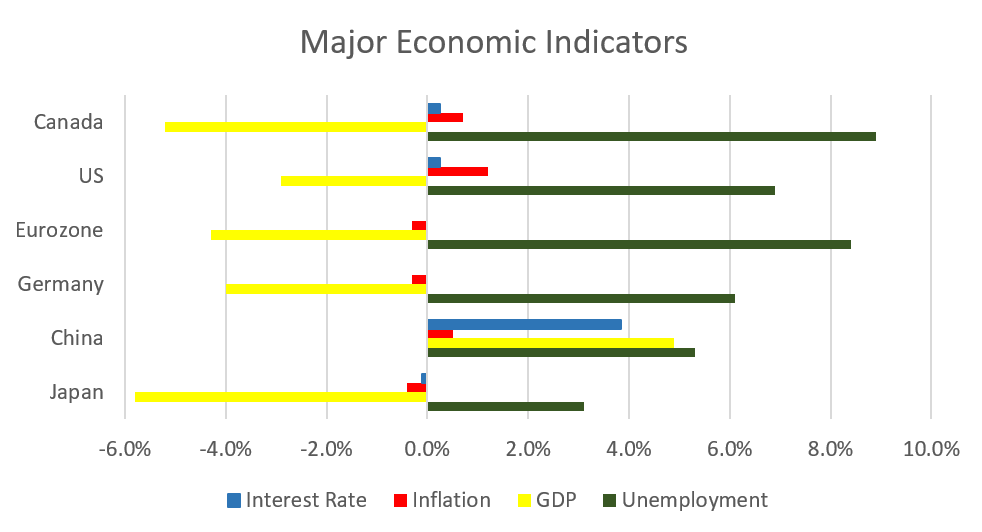

Below are the readings received in November for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

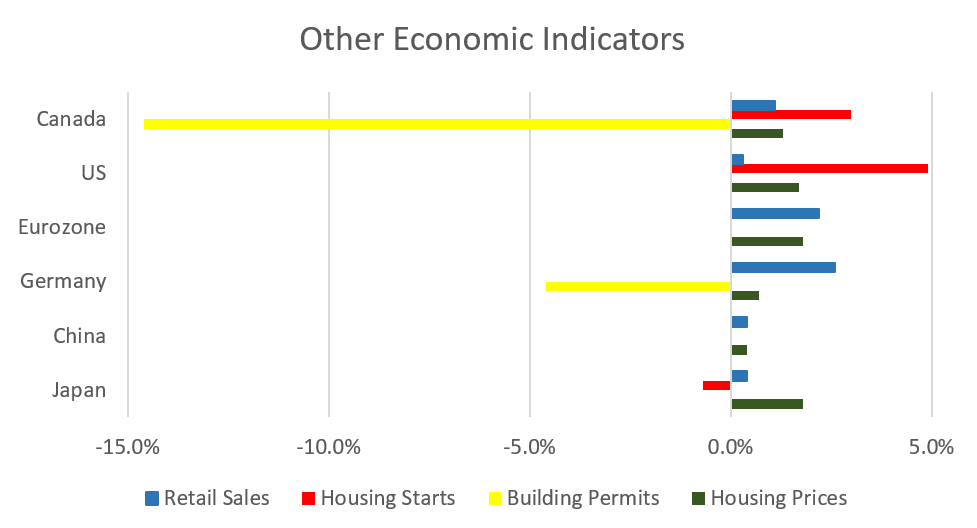

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined slightly to 8.9% in October. The economy added 83,600 jobs during the month, 69,100 of which were full time jobs and 14,500 were part time jobs. Self-employment increased for the first time since the onset of the COVID-19 pandemic.

Housing prices across Canada were up +1.3% in October, the strongest gain for the month of October in the 22 years of the index. Ottawa was again the top performer with a gain of +2.7%, followed by Hamilton, Montreal, and Victoria at +2.1%, +1.8% and +1.7%, respectively. None of the major Canadian housing markets were down for the month.

The level of new housing starts rose +3.0% in October to 214,900 units. Urban construction rose +3.5%, led by single detached urban starts at +14.3% and multifamily construction was flat. The value of building permits fell -14.6% in October to $8.2 billion, led by Newfoundland (-55.2%), PEI (-27.2%), and Ontario (-23.9%).

The inflation rate for October was +0.4%, and +0.7% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.0%. The cost of food, shelter, and health & personal care rose, while prices of recreation, clothing & footwear, and reading & education declined.

Retail sales were up +1.1% in September, the fifth month of positive growth. Sales rose at general merchandise stores, grocery stores, furniture stores, and car dealers. Compared to a year ago retail sales were up +4.6%.

Canada’s GDP was up +0.8% in September, the fifth consecutive monthly gain, but economic activity remains 5% below pre-pandemic levels. Both goods and services sectors were positive; 16 of 20 industrial sectors posted gains.

As expected, the Bank of Canada left its benchmark interest rate at 0.25% at the October 28 meeting. The BoC has adjusted its quantitative easing program towards purchasing longer-term bonds and that total purchases will be gradually reduced to 4 billion per week.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics