Good performance in March capped off a strong first quarter, completing the recovery from the decline in the fourth quarter of 2018.

March 2019 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for March 2019 | 2019 YTD return |

|---|---|---|---|

| Oil Price (USD) | $60.14 | +5.10% | +32.44% |

| Gold Price (USD) | $1,293.00 | -1.76% | +0.91% |

| US 3 month T-bill | +2.40% | -0.05%* | -0.05%* |

| US 10 year Bond | +2.41% | -0.32%* | -0.28%* |

| USD/CAD FX rate | 1.3363 | -1.47% | -2.05% |

| EUR/CAD FX rate | 1.5002 | +0.08% | -3.91% |

| CBOE Volatility Index (VIX) | 13.71 | -7.24% | -46.07% |

*Absolute change in yield, not the return from holding the security.

The S&P/TSX Composite was up +1.0% in March, its 3rd positive month in a row, and is up +13.3% for 2019. With the best quarterly return since the second quarter of 2009, the TSX has fully recovered from the losses posted in Q4 2018.

US markets were mixed with the large cap S&P500 up +1.9%, while the Russell 2000 small cap index was down -2.3% and the S&P600 small cap index was down -3.5%. All are up more than +10% for 2019 though.

EAFE (Europe, Australasia & Far East) stocks were up +0.8% in March, and are up +9.6% for 2019. European stocks specifically were up +1.5%, while British stocks were up +2.9% for March.

Emerging market stocks were up +1.2% in March and are up +9.5% for 2019.

Canadian bonds are also off to a strong start in 2019. The FTSE/TMX Universe Bond Index gained +2.4% in March and +3.9% for the year to date; the best quarterly return since Q1 2015. The FTSE/TMX Short-term Bond index was up +0.9% in March and is up +1.7% for 2019.

Emerging market bonds were also up strongly in March at +2.9%, their 5th positive month in a row. The JPM EMBI is now up +4.6% for 2019 in Canadian Dollars. REITs have performed strongly for the first three months of 2019; +3.8% for March and +15.8% for the year to date, one of the best performances out of any of the indexes we track.

Commodities, were one of the few losers in March with the Bloomberg Commodities Index down -0.4%, but it is up +5.7% for 2019. Oil performed more strongly at +5.1% for March and +32.4% for 2019, while gold was down -1.8% in March and is up +0.9% for 2019.

The Canadian Dollar (CAD) was down -1.5% against the US Dollar in March and flat versus the Euro. For 2019 the CAD has gained +2.0% against the US Dollar and +3.9% against the Euro.

Commentary – Q1 2019 Performance Review

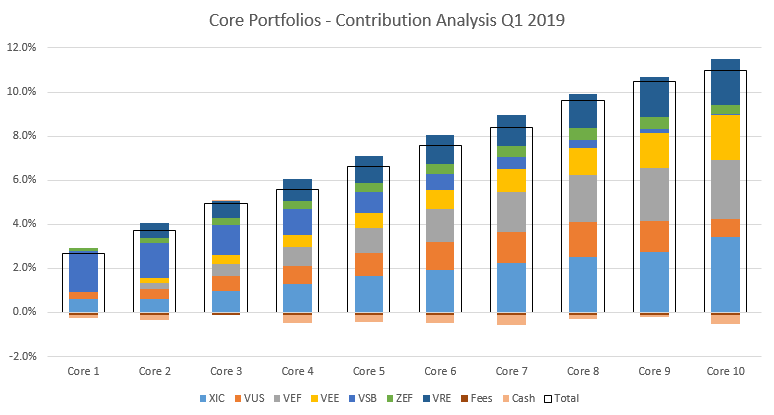

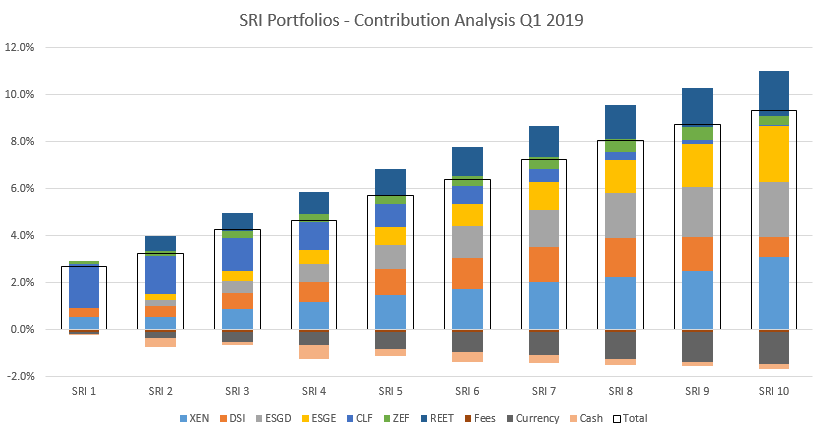

The first quarter of 2019 was a strong one for the ModernAdvisor portfolios, both for Core and SRI. All portfolios were positive for all three months of the quarter; the last time we saw that was in the first quarter of 2017. The Core portfolios performed slightly better than the SRI portfolios, mostly due to the use of currency hedged ETFs where available.

In the Core portfolios all asset classes contributed positively to performance in Q1. Canadian short-term bonds (VSB) was the largest contributor to the performance of the low risk portfolios. Canadian stocks (XIC) and international developed market stocks (VEF) were the largest positive contributors for the higher risk portfolios, followed by emerging market stocks (VEE) and real estate investment trusts (VRE). US stocks (VUS) and emerging market bonds (ZEF) also contributed positively. Cash was a slight drag on performance, as would be expected in during a period of strong performance for equities and bonds.

In the SRI portfolios all asset classes contributed positively to performance in Q1. Canadian short-term bonds (CLF) was the largest contributor to the performance of the low risk portfolios. Canadian stocks (XEN) and international developed market stocks (ESGD) were the largest positive contributors for the higher risk portfolios, followed by emerging market stocks (ESGE) and real estate investment trusts (REET). US stocks (DSI) and emerging market bonds (ZEF) also contributed positively. The strength in the Canadian Dollar was a drag on performance for the higher risk SRI portfolios. DSI, ESGD, ESGE, and REET are priced in US Dollars, so a strengthening Canadian Dollar hurts performance when their values are converted to Canadian Dollars. Cash was a slight drag on performance, as would be expected in during a period of strong performance for equities and bonds.

March 2019 Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate remained steady at 5.8% in February with a net 55,900 new jobs added; 67,400 full time jobs were added and 11,600 part time jobs were lost.

Housing prices across Canada were down -0.4% in February, the fifth consecutive month without a gain. 9 of 11 metropolitan markets were down with Victoria (-2.0%), Hamilton (-1.4%), and Quebec City (-1.2%) the worst decliners. Montreal and Halifax were the only gainers, with gains of +0.4% and +0.3%, respectively.

The level of new housing starts declined -16.3% in February to 173,153 units, the lowest reading since December 2015. The value of building permits declined -5.5% in January to $8.4 billion, the largest decline since November 2017.

The inflation rate for February was +0.7%, and +1.5% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was also +1.5%.

Retail sales declined -0.3% in January, the third consecutive monthly decline. Compared to a year ago retail sales were up +1.1%. Sales declined at new and used car dealers, general merchandise stores, and gas stations. Building material and garden stores, and health and personal care stores saw growth.

Canada’s GDP rose +0.3% in January, slightly ahead of forecasts. 18 of 20 industrial sectors posted gains; manufacturing was the largest gainer at +1.5%. Following seven months of losses the construction sector gained +1.9%, its largest gain since July 2013. Conversely, mining, quarrying, and oil & gas extraction contracted -3.1%, the sector’s 5th consecutive monthly decline.

As expected the Bank of Canada left its benchmark interest unchanged at 1.75% at its March 6th meeting. Many analysts had previously predicted that the Bank of Canada would raise interest rates twice in 2019 (0.25% each time), but many are now calling for no change to the benchmark rate in 2019 and some are even calling for a 0.25% cut.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics