After equity markets finished December strongly, they took a breather in January. Bond markets didn’t do much better.

January 2021 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for January 2021 | 2021 YTD return |

|---|---|---|---|

| Oil Price (USD) | $51.98 | +7.13% | +7.13% |

| Gold Price (USD) | $1,850.30 | -2.36% | -2.36% |

| US 3 month T-bill | +0.06% | -0.03%* | -0.03%* |

| US 10 year Bond | +1.11% | +0.18%* | +0.18%* |

| USD/CAD FX rate | 1.2780 | +0.38% | +0.38% |

| EUR/CAD FX rate | 1.5513 | -0.61% | -0.61% |

| CBOE Volatility Index (VIX) | 33.09 | +45.45% | +45.45% |

*Absolute change in yield, not the return from holding the security.

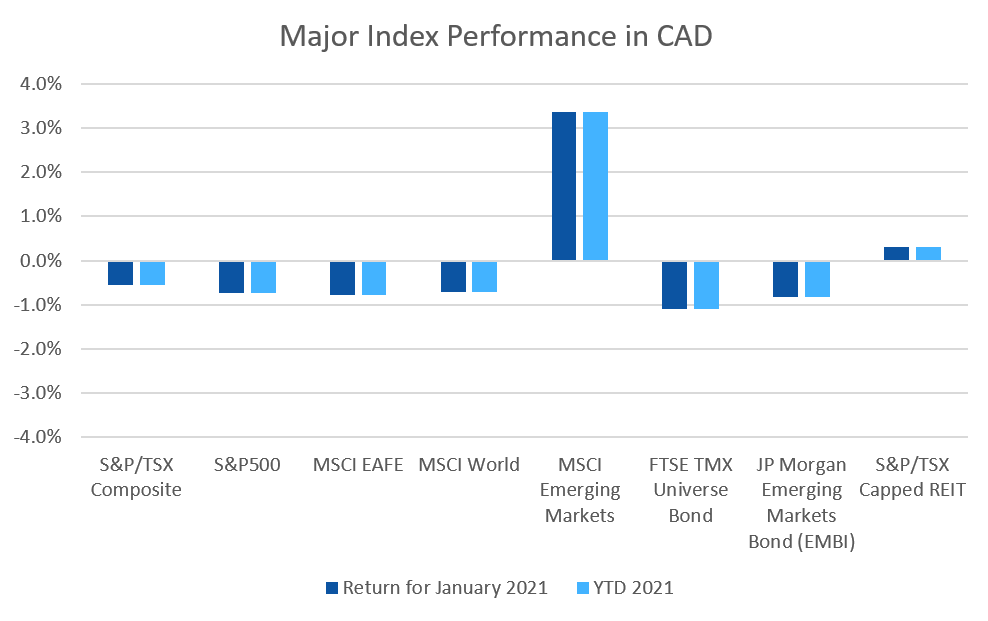

The S&P/TSX Composite was down -0.5% to kick off the year, while the small cap and micro cap TSX indexes were up +0.4% and +5.3% respectively. In the US, the large cap S&P500 was down -1.0%, while the small cap Russell 2000 index was up +5.0% for January.

The broad index of EAFE (Europe, Australasia & Far East) stocks were down -0.4%, as were European (-1.0%) and British stocks (-0.8%). Japanese stocks were up +0.8% for January, but the bright spot in January was emerging market stocks which returned +3.7%.

Bonds didn’t perform much better than equities in January. The major Canadian bond index, the FTSE/TMX Universe Bond Index, was down -1.1% and the FTSE/TMX Short-term Bond Index was up +0.1%. US investment grade bonds in the US fared worse: the ICE BoA AAA and BBB indexes were down -2.3% and -1.0% respectively. High yield did better at +0.4% for HY Master II and +2.4% for the CCC and lower (the real junky stuff). The yield on the CCC index is lower than we’ve seen in decades, which could be the sign of a pending turn in the high yield markets. Emerging market bonds were down -0.8%, and REITs were up +0.3%.

Oil was up +7.1% in January, breaking above $50/barrel for the first time since February 2020. Gold was down -2.4%, and the diversified Bloomberg Commodities Index was up +2.6% for the month.

The Canadian Dollar (CAD) lost -0.4% against the US Dollar in January, and the Euro gained +0.6% against CAD.

January 2021 Economic Indicator Recap

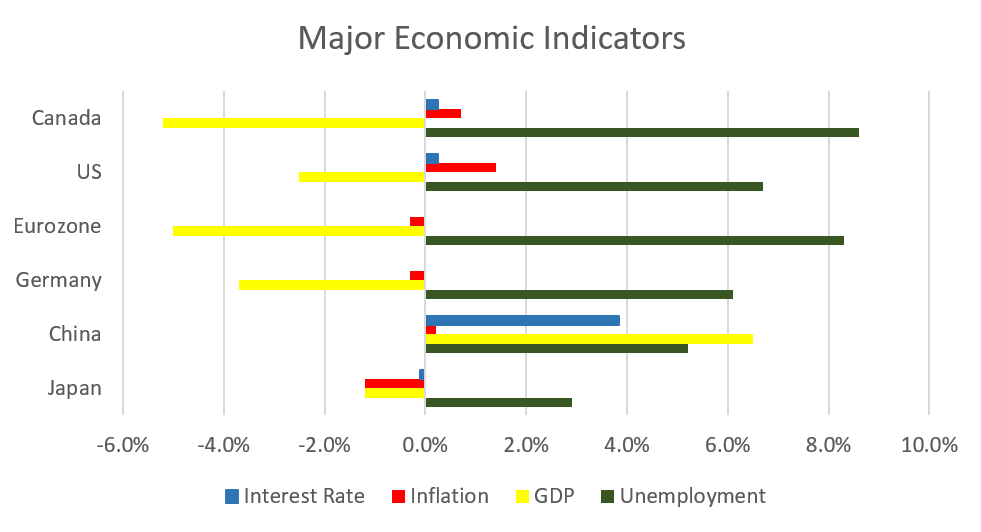

Below are the readings received in December for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

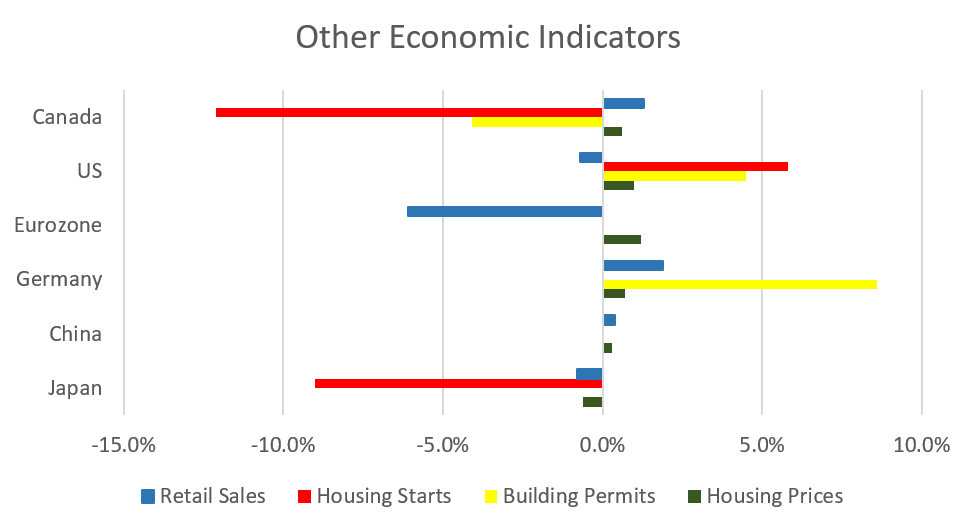

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate rose slightly to 8.6% in December. The economy lost 62,600 jobs during the month, 99,000 of which part time job losses, while full time employment rose 36,400.

Housing prices across Canada were up +0.6% in December, the strongest gain for the month of December since 2009. Victoria was the top performer at +1.3%, followed by Halifax (+1.2%), Ottawa (+1.2%), and Montreal (+1.0%).

The level of new housing starts declined -12.2% in December to 228,300 units. Urban construction fell -12.8%, as multifamily construction declined -15.1%. Building permits fell -4.1% in December to $9.1 billion, as all construction segments declined.

The inflation rate for December was -0.2%, and +0.7% on an annual basis, largely due to a decline in demand. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.5%. The cost of food and shelter rose.

Retail sales were up +1.3% in November, the seventh month of positive growth. Sales rose at grocery stores and e-commerce sites. Sales declined at car and parts dealers for the first time since April. Compared to a year ago retail sales were up +7.5%.

Canada’s GDP was up +0.7% in November, the seventh consecutive monthly gain since the biggest contraction on record in March and April. Both goods and services sectors were positive; 14 of 20 industrial sectors posted gains.

As expected, the Bank of Canada left its benchmark interest rate at 0.25% at the January 20 meeting. The benchmark interest rate is expected to remain at its current low level until into 2023. The BoC has maintained its quantitative easing program of purchasing at least $4 billion of bonds.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics