Nearly all major equity markets continued their recovery from the difficult first quarter of 2020.

August 2020 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for August 2020 | 2020 YTD return |

|---|---|---|---|

| Oil Price (USD) | $42.61 | +5.81% | -30.22% |

| Gold Price (USD) | $1,978.60 | +0.80% | +29.91% |

| US 3 month T-bill | +0.11% | +0.02%* | -1.44%* |

| US 10 year Bond | +0.72% | +0.17%* | -1.20%* |

| USD/CAD FX rate | 1.3042 | -2.70% | +0.42% |

| EUR/CAD FX rate | 1.5573 | -1.63% | +6.79% |

| CBOE Volatility Index (VIX) | 26.41 | +7.97% | +91.65% |

*Absolute change in yield, not the return from holding the security.

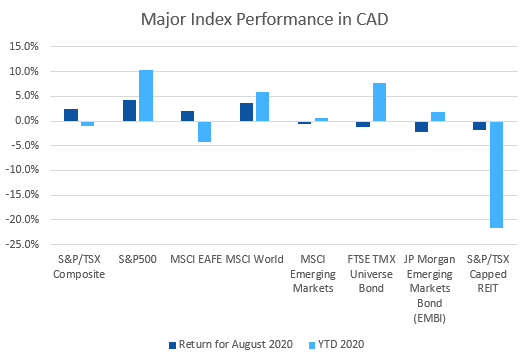

Nearly all major equity markets continued their recovery from the difficult first quarter of 2020.

The S&P/TSX Composite was up +2.3% for August, and is now almost flat for 2020. The S&P/TSX Small Cap Index was up +3.9% and the speculative S&P/TSX Venture Index was up +4.1%. In the US, the large cap S&P500 was up +7.0% and is now up +8.3% for 2020. The US’ main small cap index, the Russell 2000, was up +5.5% but remains down -6.4% for the year.

EAFE (Europe, Australasia & Far East) stocks were up +3.9% in August, but remain down -10.1% for 2020. European and British stocks were up +2.5% and +1.1% for August, respectively. For 2020 British stocks are still down -20.9%! Japanese stocks were up +6.6% for August, cutting the YTD loss to -2.2%. Emerging market stocks were up +2.1% for August and +2.7% for 2020.

Bonds were mixed in August. The major Canadian bond index was down in August; the FTSE/TMX Universe Bond Index was down -1.1% and the FTSE/TMX Short-term Bond Index was up +0.1%. Those indices are up +7.7% and +4.6% for 2020. Emerging market bonds were down -2.2% in August.

Oil was up +5.8% in August, but remains down -30.2% for 2020. Gold, has seen a resurgence in interest, gaining +0.8% in August and is now up +29.9% for 2020. The diversified Bloomberg Commodities Index was up +6.8% for the month but remains down -9.4% for the year.

The Canadian Dollar (CAD) has recovered much of the ground lost during the worst of the pandemic as oil prices have recovered. In August CAD gained +2.7% against the US Dollar and +1.6% against the Euro.

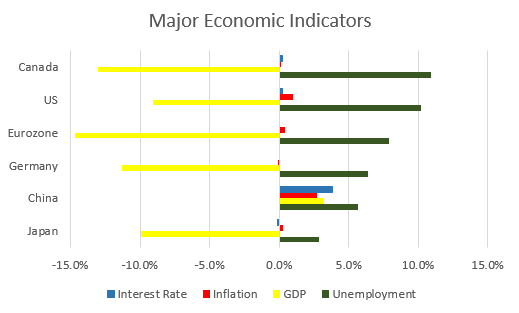

August 2020 Economic Indicator Recap

Below are the readings received in July for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

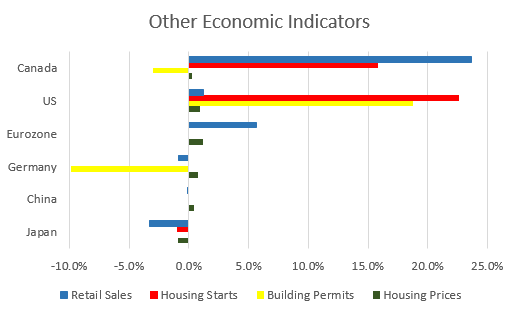

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined to 10.9% in July after the economy started reopening from the COVID related closures. The economy added 418,500 jobs during the month, mostly from part-time positions (345,300).

Housing prices across Canada were up +0.3% in July. Quebec City was the top performer at +1.4%, followed by Ottawa and Winnipeg at +1.2% and +1.1%, respectively. Vancouver was flat and Victoria declined -0.3%.

The level of new housing starts rose +15.8% in July to 245,600 units, the highest reading since November 2017. The majority of the growth came from multifamily urban construction. The value of building permits issued in July declined -3.0% to $7.8 billion. BC, Quebec and Newfoundland posted large double digit declines

The inflation rate for July was -0.1%, and +0.1% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +0.7%. Prices for food, shelter, transport, and recreation all declined.

Retail sales were up +23.7% in June, the largest increase since the data series began, as regions moved ahead with plans to reopen. Compared to a year ago retail sales were up +3.8%. Higher sales were reported in nearly all sectors, with the largest gains at motor vehicle & parts dealers (+53.4%), clothing stores (+142.3%), gasoline stations (+26.3%).

Canada’s GDP was up +6.5% in June, the strongest monthly increase since the inception of the data series in 1961. 19 of 20 industrial sectors posted gains for the month, with accommodation & food services, retail trade, and manufacturing being the largest gainers.

As expected, the Bank of Canada left its benchmark interest rate at 0.25% at the July 15 meeting. The BoC continues to purchase at least 5 billion in Federal government securities per week.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics