According to renowned investment consultant, Charles Ellis, investors innocently describe mutual fund fees with one four-letter word and one number – both word and number are wrong.

The word is “only,” and the number is often “1%.” So, when referring to mutual fund fees, we end up with statements like “It’s only 1%.”

That may be true in the United States, but in Canada, our mutual fund fees are much higher.

Welcome to Canada: Highest Mutual Fund Fees in the World

Morningstar, an investment research company, regularly evaluates the mutual fund industry in 25 countries in the developed world. While Canada sits in the middle of the pack, ranking an unexceptional C+ overall, our mutual fund fees leave much to be desired. Placing behind China, Hong Kong, Japan, and Taiwan, Canada ranks dead last when it comes to mutual fund fees. The highest in the developed world.

Investor Economics states that the average mutual fund fee in Canada is 2.35%. Sorry, what I meant to state was that the average mutual fund fee in Canada is “only” 2.35%. Still, this sounds like a rather small and irrelevant number. Really, 1%, 2%, or 3%… What’s the big deal?

Well, as it turns out, fees are a big deal. Really big. And the big deal stems from the fact that investment growth is exponential. That is, it’s compound growth. Remember, Einstein famously said “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

Hi-Fee Harry and Lo-Fee Larry

Let’s dig into an example, shall we? We want to know about the real impact of fees over time, and numbers like 2.35% are meaningless to most investors. So let’s paint a scenario around this and see how it unfolds.

Assume we have two investors, Hi-Fee Harry and Lo-Fee Larry. Both Harry and Larry hold a similar underlying basket of investments that have an annualized return of 8% gross of fees (that is, before fees).

Harry owns a typical mutual fund portfolio with a fee of 2.35%. On the other hand, Larry owns a ModernAdvisor portfolio with a fee of only 0.65%. In this case, although both investors have a return of 8% before fees, after accounting for fees, Harry ends up with a net annualized return of 5.65%, whereas Larry ends up with 7.35%.

The difference is 1.7%. Again, what’s the big deal? It sure doesn’t sound like much. Truthfully, the difference may not be huge after the first year, or even first couple of years. But over a lifetime of investing, that difference is massive.

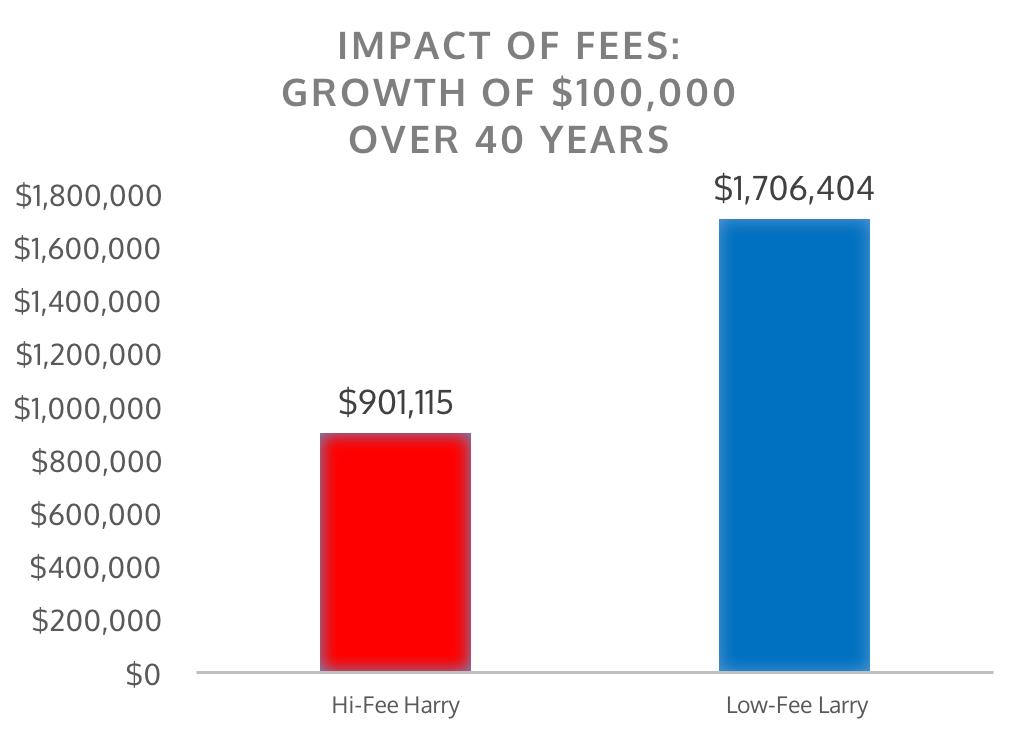

So let’s assume that both Harry and Larry started off with $100,000 in each of their respective portfolios, and neither makes any subsequent contributions or withdrawals. Where would they be 40 years later?

Hi-Fee Harry would have grown his nest egg to $901,115. Not too shabby. Until you consider that Low-Fee Larry would now have $1,706,404. That’s a whopping $805,289 more than Harry! And the entirety of that difference is attributable solely to a 1.7% difference in fees.

Would someone ever say, “It’s only $800,000”? I don’t think so. But statements like “It’s only 1.7%” are commonplace. Now we can see how truly misleading those statements really are. And as benign as a number like 1.7% may sound on the surface, over a lifetime of investing, we can see it’s anything but.

Disclaimer: The example above is intended solely to demonstrate the impact of fees. Although the fees are an accurate description of reality, the returns are purely hypothetical. This example should not be interpreted as investment advice, or as any type of guarantee or expectation of investment performance.

Fees: The #1 Predictor of (Under)Performance

When selecting investments, we often rely on a fund’s historical performance (despite warnings to the contrary), the manager’s track record, various ratings and rankings, etc. But there’s a better way to predict which investments will perform: Fees.

A few years ago, Morningstar conducted a study to determine the best way to predict mutual fund returns. Morningstar’s own 5-star rating system performed quite well, with the highest-rated mutual funds outperforming the lowest rated funds 84% percent of the time.

But despite all the variables included in the 5-star rating system, fees proved to be an even stronger predictor. Amazingly, fees were an accurate predictor 100% of the time. “A fund’s annual fee is the most proven predictor of future fund returns,” said Morningstar’s Russel Kinnel.

The data is indisputable here. In every single instance, and across every single asset class, the least expensive funds outperformed the most expensive funds.

Unlike many other areas of our lives, where paying a lot for something means getting a lot in return, with investing, it’s just the opposite: You get what you don’t pay for. After all, there’s only one source of money in the whole equation – yours. Quite simply, the more that’s siphoned off in fees, the less that’s left in your account.

So, How Much Are You Paying?

If you’re like most investors, you probably have no idea how much you’re paying in fees. It’s not your fault – the industry goes to great lengths to obscure this information. At best, some investors have a ballpark idea, typically a fuzzy number “around 2 or 3%” or something similar. Again, framing it in percentage terms is totally misleading. What does that translate to, in actual dollars?

You can find out here! Our Portfolio Checkup tool analyzes mutual fund fees and gives investors a great overview of the fees they’re currently paying.

Of course, at ModernAdvisor, we also charge a fee for our investment management service. However, our fees are significantly lower than those charged by retail mutual funds. In fact, our analysis demonstrates that most mutual fund investors pay fees that are 3 to 4 times higher than they would pay for a comparable portfolio at ModernAdvisor.

From our low management fees to low-cost ETFs, the net result is that, at ModernAdvisor, our clients enjoy ultra-low cost professional investment management. Indeed, our fees are amongst the lowest in Canada.

Bottom Line

As we’ve just demonstrated, seemingly small differences in fees can amount to massive differences in personal net worth over a lifetime of investing.

From stock market ups and downs, to interest rate fluctuations, the world of investing is full of unknowns. As somewhat of an investing rarity, fees present us with a unique opportunity for control. While you can’t control the markets, you sure can control the amount you pay in fees.

Why pay high fees when you simply don’t have to? If you haven’t done so already, request a complimentary portfolio review to find out how you can lower your investment fees and grow your wealth faster with an investment portfolio from ModernAdvisor.