The ETF (Exchange-traded fund) market has skyrocketed from one fund in 1993, to over $70 Billion and more than three hundred funds in 2014. In fact, many experienced investors now refer to ETFs as “the cheaper and better alternative to mutual funds”.

Here is a look at how ETFs differ and how you can benefit from their advantages:

What are ETFs? How do they differ from Mutual Funds?

Exchange traded funds (ETFs), like mutual funds, pool the assets of many investors into a single fund for better efficiency and lower costs. Typically, these funds hold over 100 or even up to 3000 different securities.

Unlike mutual funds, exchange traded funds (as the name implies) are listed on the stock exchange. This means you can buy them in any brokerage account at any time during the day and sell at any time during the day. On the other hand, mutual funds are priced at the end of the day and you buy and sell at that fixed price (also referred to as net asset value or NAV price). Of course, being able to trade an ETF every minute of the day isn’t that important for most investors, but is simply a function of being listed on the exchange.

Two of the biggest differences between ETFs and mutual funds are:

- ETFs have lower operating expenses than actively managed mutual funds

- They have no investment minimums or sales loads.

(Keep reading for more details on what this means for you below!):

Passive Investing vs Active Investing

ETFs are predominately managed using a passive investment strategy (although both mutual funds and ETFs can be managed actively or passively). The rationale for this strategy is based on investing in the same securities, in the same proportions as an index such as the S&P500. For this reason, passive investing is often referred to as indexing. In other words, portfolio managers don’t make decisions about which securities to buy and sell but follow the same methodology for constructing the portfolio as the index uses.

In opposition to this rationale, mutual funds are predominately actively managed. This means that the fund managers are constantly analyzing the market with the intent of outperforming it. They believe that prices in the market react slowly to information which should allow a skillful investor to systematically outperform it.

For decades investors have been trying to beat the market with limited success. The success of some superstar investors might suggest to some people that outperforming, or beating, the market is not that hard. Unfortunately, academic research has shown that outperforming the market over a multi-year time frame is very rare. According to SPIVA Canada, 80% of Canadian equity funds underperformed the S&P/TSX Composite and 95% of U.S. equity funds underperformed the S&P500 over the last 5 years. You can never know for certain when you invest in a fund that you will pick a winner.

If you cannot reliably pick winners, the best thing you can do is to keep your investment fees low, and invest in a basket of diversified passive funds.

The biggest advantage of ETFs – MUCH Lower fees!

ETFs mean investors can enjoy exposure to broad indexes and ease of use through passive investing.

However, the biggest advantage of all is their low fee structure.

Let’s compare a Canadian equity ETF to a Canadian equity mutual fund.

To keep it simple, let’s assume that both of them return 10% before fees, equaling the S&P/TSX Composite’s return for a hypothetical year. The largest Canadian equity ETF in Canada charges 0.17%, the average fee on Canadian equity mutual funds is 2.50%. After fees the ETF would have returned 9.83%, while the mutual fund would have returned 7.50%. To match the ETF’s after fee return, before fees the mutual fund would have had to return 12.33%. Which seems more likely to occur: a 10% return or a 12.33% return?

Now we know why most mutual funds do not outperform the market!

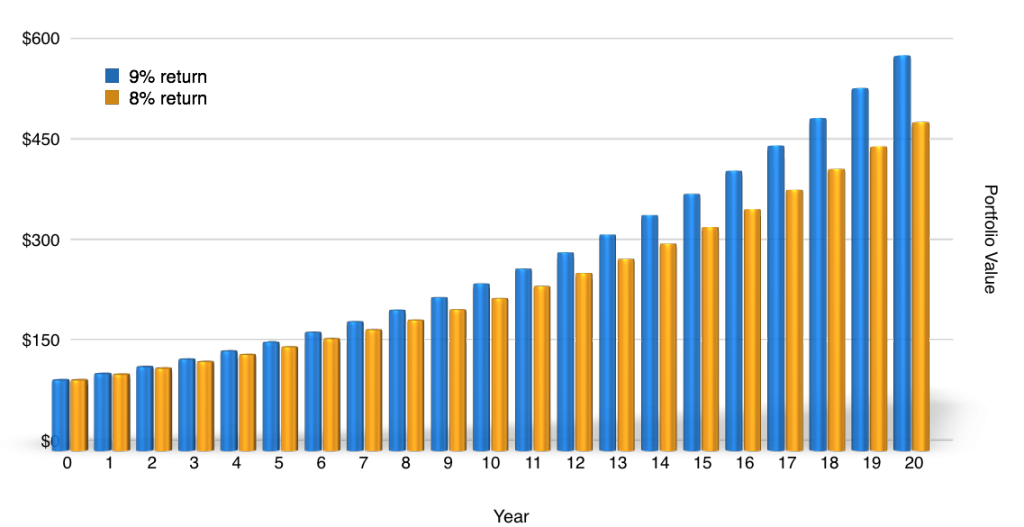

If you think the difference in fees is not significant, let’s take a look at the difference a mere 1% reduction in after-fee returns can make in your investment results over the long haul. Over 20 years the difference in total return between a 9% and an 8% return per year is 94% (460% vs 366%).

Why are mutual fund fees so much higher?

Mutual funds typically trade their portfolios more often than ETFs, so part of the reason for high fees on mutual funds is trading costs. Also, fund managers are highly paid people and are another part of the reason for higher mutual fund costs. But the biggest reason is an open secret in the investment industry: trailing commissions.

When you buy or sell an ETF you pay a trading fee, around $10 at most brokerages, although a few offer free trading on some or all ETFs. You may be thinking; “but when I bought a mutual fund at a bank I didn’t pay anything!” True, if the fund you were sold did not have a front-end load (fee). Mutual funds pay salespeople or advisors a trailing fee for as long as you hold the fund. In Canada, this fee is typically 1% of the funds assets (may be as high as 1.5%) and is paid to the salesperson every year on your behalf by the mutual fund’s manager.

So for example, if you invest $10,000, you would pay $100 in the first year, assuming no growth of your investment. As the investment grows the fee paid to the salesperson also grows. You may have only met them once, but every year that fee is paid regardless. In many cases you will also pay a fee to sell a mutual fund (back-end load), if you sell within the first 5-7 years of ownership.

What does this mean for the average investor?

Because of their lower costs, ease of trading, and broad market exposure, ETFs are more suitable as building blocks for most investors’ portfolios than actively managed mutual funds.

Learn more about ETFs or see how we predict the Canadian investment industry to change in 2015