Studies* have shown that 80 to 90% of investors’ return comes from asset allocation, so it is much more important than most investors realize.

The main idea behind asset allocation is to reduce risk. By including asset classes with investment returns that move in different directions you can protect your portfolio from significant losses. If you have too much of your portfolio invested in one asset class you may be taking more risk than is healthy for your portfolio.

Asset allocation is an easy way to ensure that your portfolio has proper diversification.

What are asset classes?

An asset class is a group of securities that all share similar financial characteristics, behaviours and are subject to the same laws and regulations.

The main asset classes are:

- Stocks (aka equities)

- Bonds (aka fixed income)

- Real Estate

- Cash Equivalents (cash and money market securities).

Those 4 main asset classes can be further divided into categories such as Canadian Stocks, US Stocks, Canadian Bonds, etc.

Basic Asset Allocations

You may be familiar with the traditional 60/40 portfolio: a portfolio that holds 60% of its assets in stocks and 40% in bonds.

As you age, you are supposed to reduce your exposure to stocks leading up to retirement in order to reduce or avoid losses that happen in the stock market from time to time. A rule of thumb that is often used is to have no more than 100 less your age in equities at any time: as you age your exposure to stocks declines in favour of less volatile bonds.

These rules of thumb are just basic asset allocations that any one could quickly and easily implement in their portfolio.

What goes into an Asset Allocation

Asset allocation is generally determined by 4 basic factors (among others):

- Your risk tolerance and appetite

- The size of your account

- Whether or not you have a pension

- Your time horizon

Smaller accounts most often have fewer asset classes in them, perhaps just broad exposures to stocks, bonds and cash.

Large accounts often have exposure to Canadian, US, and Global stocks (both developed and emerging markets), bonds (Canadian, US, emerging markets), real estate, commodities and other alternative assets.

Accounts that are being managed more aggressively due to high risk tolerance and appetite often have greater exposure to stocks and other more volatile asset classes than bonds and cash.

Sample Asset Allocations

Here are some sample asset allocations for two young professionals that have a high risk tolerance and appetite; one that has just started saving for retirement and another that has been saving for a few years.

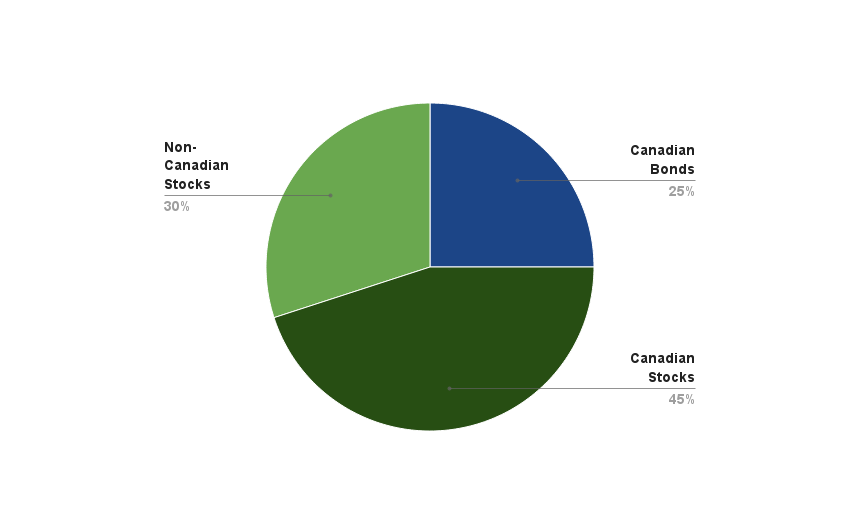

For the young professional just starting out with a small account we would suggest starting with three broad asset classes: Canadian Bonds, Canadian Stocks and Non-Canadian Stocks.

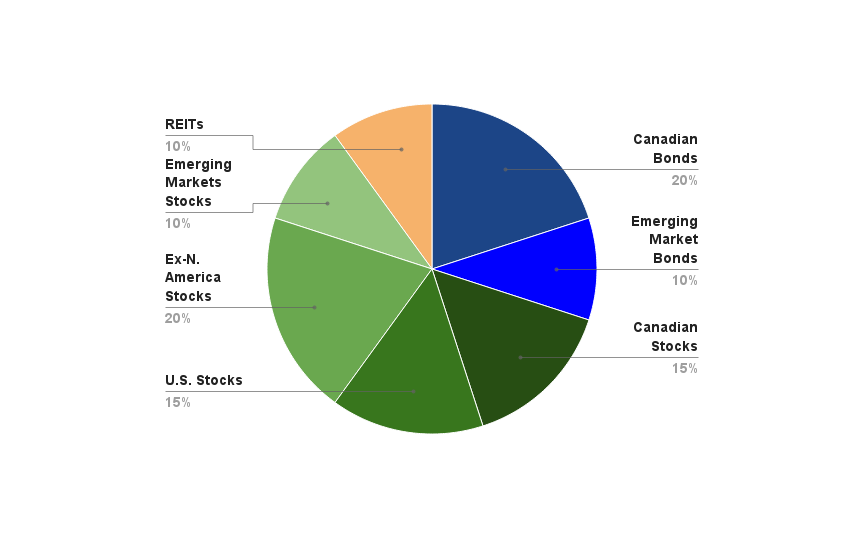

For a young professional with $20,000 or more to invest we might suggest using seven asset classes: Canadian Bonds, Emerging Market Bonds, Canadian Stocks, U.S. Stocks, Ex-North American Stocks, Emerging Market Stocks and Real Estate Investment Trusts (REITs).

Once you have selected an asset allocation for your portfolio, you need to decide what investments to hold to represent the different asset classes. For large accounts you could select individual stocks, bonds and REITs to fill the asset classes, but a cheaper and easier solution is ETFs. ETFs are also the best choice for small accounts.

ETFs that we would suggest for the young professional just starting out are:

| Asset Class | ETF | Symbol |

| Canadian Bonds | Vanguard Canadian Aggregate Bond Index ETF | VAB |

| Canadian Stocks | iShares Core S&P/TSX Capped Composite Index ETF | XIC |

| Non-Canadian Stocks | Vanguard FTSE All-World ex Canada Index ETF | VXC |

ETFs that we would suggest for the young professional with the $20,000 portfolio are:

| Asset Class | ETF | Symbol |

| Canadian Bonds | Vanguard Canadian Aggregate Bond Index ETF | VAB |

| Emerging Market Bonds | BMO Emerging Markets Bond Hedged ETF | ZEF |

| Canadian Stocks | iShares Core S&P/TSX Capped Composite Index ETF | XIC |

| U.S. Stocks | Vanguard U.S. Total Market Index Hedged ETF | VUS |

| Ex-N. America Stocks | BMO MSCI EAFE Hedged to CAD Index ETF | ZDM |

| Emerging Markets Stocks | BMO MSCI Emerging Markets Index ETF | ZEM |

| REITs | iShares S&P/TSX Capped REIT Index ETF | XRE |

How many asset classes do I need?

If you start from the three asset class portfolio of Canadian Bonds, Canadian Stocks and Non-Canadian Stocks, each additional asset class that you add provides significant diversification benefits to your portfolio. However, the size of the improvements decline with each asset class added.

Once you reach 7-8 asset classes, the diversification benefits have largely been realized, unless you can add a low or negatively correlated asset class such as hedge funds, managed futures or commodities.

Discover why ETFs beat mutual funds or if you should choose an RRSP over a TFSA

*Source: Vanguard, The Global Case for Strategic Asset Allocation (Wallick et al., 2012).