With the recent volatility on the world’s stock markets after an extended period of relative calm, many investors are looking for something to soothe their nerves. While you might be tempted to reduce the size of your investments in the stock market, over the long term stocks outperform most other investments.

Instead of reducing your exposure to stocks, a better option is to invest only in low volatility stocks. There are now many ETFs available that select stocks based on their volatility as the primary criteria.

Volatility Measures

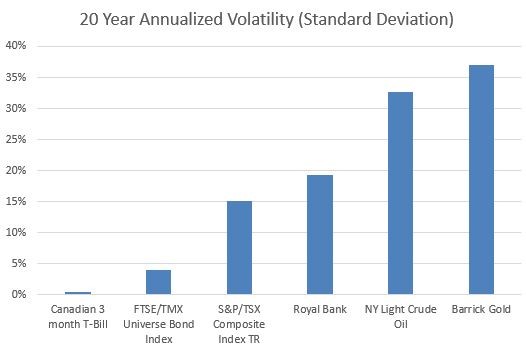

The main measure of risk of any investment is its volatility, usually represented by standard deviation. For those that slept through Statistics 101, standard deviation is basically a measure of how spread out the values in a series of numbers are. A series of returns that shows low standard deviation would be considered low risk (bonds), while something else with high standard deviation like individual stocks would be considered high risk.

By choosing investments that are lower in volatility, you can avoid some of the largest negative returns, but give up some of the largest positive returns. This can be very beneficial as your compounded returns are improved.

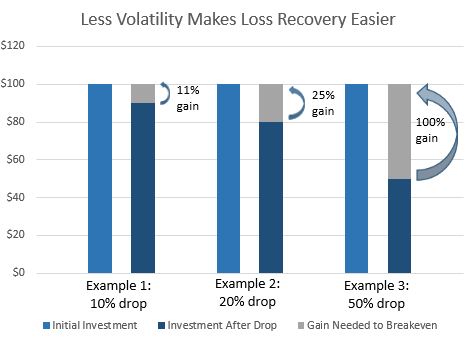

If you invested $100 in a stock and it drops 10% to $90, to get back to $100 you would need a gain of 11%. If instead your $100 had declined by 20% to $80, to get back to $100 you would need a gain of 25%. As declines get bigger, you need exponentially larger gains to get back to even. A 50% decline requires a 100% gain to get back to even.

Beta

Another way to measure the risk of a stock is to look at its Beta to a stock market index. Beta is calculated from the stock’s volatility, the stock’s correlation to the stock index and the stock index’s volatility.

A beta less than 1 generally indicates that the stock (or ETF) is less risky than the index and a beta greater than 1 indicates that the stock (or ETF) is more risky than the index, the implication being that if the market drops 10%, the stock (or ETF) would drop more than that.

Does Low Volatility Investing Work?

In a word, YES. Basically, you are winning by not losing; your gains compound faster because you are not constantly having to recover from big losses.

Early work in the 1970s by Dr. Robert A. Haugen showed that contrary to financial theory, over the long-term, low volatility stocks delivered better returns than high volatility stocks. Research since then has confirmed this “low volatility anomaly” in stock markets around the world. But it wasn’t until the financial crisis in 2008 that the investment community took notice.

So if it works, why doesn’t everyone do it?

The high risk, high return mentality is so ingrained in investors and investment advisors that most just don’t consider the promise of low volatility investing.

Another possibility is that many investors are attracted to the headline grabbing stocks and the “flavour of the month”. Most of the sectors that feature prominently in low volatility investing aren’t sexy tech companies, but old school companies that have been in business for decades. These aren’t “get rich quick” companies, but get rich slowly companies that compound significantly over the long term – companies that Warren Buffet would be interested in.

Research Affiliates’ research showed that from July 1991 to February 2012, a US Low Volatility strategy outperformed the S&P500 by 1.5%, with 3.7% lower volatility. The performance improvement was even stronger in non-US developed markets at 4.8%.

High Return, Low Risk sounds great! How can I take advantage?

Unless you are comfortable with or interested in investing in individual stocks, an ETF is likely your best choice. There are many ETFs to choose from in Canada that take a low volatility approach to investing.

BMO Low Volatility Canadian Equity ETF (ZLB)

BMO’s Low Volatility Canadian Equity ETF is the largest ETF of its kind in Canada at $591 million. This ETF utilizes a rules based methodology to select the least volatile stocks. It invests in the 40 lowest beta stocks out of the 100 largest and most liquid stocks in Canada. The ETF’s portfolio is rebalanced in June and the stocks are reselected in December. Given ZLB’s low beta1 of 0.66, you would expect it to look much different than the typical TSX-tracking ETF, and it does. While financials are still the largest sector at 22%, that is much lower than the typical 36%. The next largest sectors, consumer staples and consumer discretionary, together are nearly triple their usual weights.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.40% | 0.01% | 0.08% | 0.49% |

iShares MSCI Canada Minimum Volatility Index ETF (XMV)

The iShares MSCI Canada Minimum Volatility Index ETF seeks to replicate the performance of an index with the same name, net of expenses. The top 85% of stocks by market cap in the MSCI Canada Index are eligible to be included in the MSCI Canada Minimum Volatility Index. MSCI then follows a rules-based methodology to determine optimal weights for the stocks in order to minimize volatility. XMV is well diversified, with no individual stock more than 4% of assets. The beta of this ETF is 0.60.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.32% | 0.01% | 0.08% | 0.41% |

First Asset MSCI Canada Low Risk Weighted ETF (RWC)

RWC was been designed to replicate the performance of the MSCI Canada Risk Weighted Index, net of expenses. This index is based on the MSCI Canada Index, but the stock weightings are changed so that stocks with lower risk are given higher index weights. The MSCI Canada Risk Weighted Index seeks to emphasize stocks with lower historical return volatility and tends to have a bias towards smaller and less risky risk stocks. RWC is well diversified with no holding more than 4% of assets. It does however have a high weight in financials, and the highest beta of the low volatility ETFs at 0.78.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.67% | 0.16% | 0.20% | 1.03% |

PowerShares S&P/TSX Composite Low Volatility Index ETF (TLV)

The PowerShares S&P/TSX Composite Low Volatility Index ETF seeks to replicate the performance of an index with the same name. The index is designed to measure the performance of the 50 stocks from the S&P/TSX Composite Index with the lowest volatility over the past year, where volatility is the standard deviation of the stock’s daily price returns. This ETF is well diversified, with no individual holding over 3% of assets. While nearly 60% of the holdings are in financial services, more than half of that is REITs. Beta is fairly low at 0.55.

| MER | TER | Bid/Ask Spread | Total Cost |

| 0.33% | 0.04% | 0.21% | 0.58% |

Which one to choose?

While XMV is the least expensive choice, with a total cost of 0.41%, it is not that much less volatile than the Canadian market.

ZLB comes a close second on total cost at 0.49%, however it’s composition is very different from the market, which explains its low beta. Being different from the market has allowed ZLB to be the top performer out of the low volatility Canadian ETFs so far in 2015. While the outperformance is great, the low cost and diversification make ZLB our pick of the low volatility Canadian stock ETFs.

RWC is too expensive and very thinly traded and TLV’s large concentration in financials and REITs is a concern.

Notes:

- We calculated betas over a 1 year period using daily data, except for RWC which was obtained from TMX.