Most people know the biggest advantage of using an RRSP is the tax savings. But do you know how to maximize that refund? Or choose when a TFSA might be better?

We break it down so you can make those decisions in minutes.

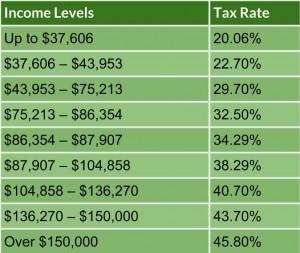

Since ModernAdvisor is based in B.C., all references to tax rates will be to combined federal and provincial tax rates in B.C. For the tax rates applicable in your province a great source is taxtips.ca/tax_rates.htm.

Firstly, locate which tax bracket you are in based on your annual income (use your T4 or use 2013’s tax return if you are unsure about 2014). For example, if you earned $75,000 in 2014, the top tax rate you will pay is 29.70%. *Note that this rate only applies to the income you earned from $43,953 to $75,000, not the full $75,000.

Consider two situations:

The Graduate

Say you’ve graduated from university, landed your first job, and your starting salary is $45,000. In that case, the two most important numbers for you for 2014 are $43,953 and 29.7% – that is, the 29.7% tax bracket kicks in at $43,953, so every dollar that you earn over that number, 29.7 cents is taken by the federal and provincial governments.

The Executive

If you’re a more established executive and earned $100,000 in 2014, your important numbers would be $87,907 and 38.29%; the combined take of the federal and provincial governments is 38.29 cents of every dollar you earned over $87,907.

Let’s compare:

The new grad earns $45K. Contributes $1K to an RRSP. Tax refund: $297.00.

The executive earns $100K. Contributes $1K to an RRSP. Tax refund: $382.90

The executive gets an additional savings of $85.90! What we learn from this exercise is that the higher your income, the bigger bang for your buck. In either case, if you decide to contribute to an RRSP and have enough cash to eliminate any income in your highest tax bracket, do it.

Now, consider: Do you expect your income to increase in the future?

If so, it makes sense to save your RRSP room until your income is higher so that you can save even more tax! If you don’t expect that your income will increase in the future, it likely makes the most sense for you to use your RRSP contribution room now. But keep in mind that an RRSP is really just deferring tax until the future when you withdraw the funds.

Might a TFSA be better?

There is a possibility that contributing to an RRSP could cause you to pay more tax in the long run. Pension income (including CPP and OAS) when combined with large RRSP withdrawals in retirement could push you into a higher tax bracket than when you were working. This is mostly a concern for those who contributed to an RRSP while in lower tax brackets. If you think this may apply to you, consider saving for retirement in a TFSA before an RRSP.

General rules of thumb to conclude:

- If you are in a lower income tax bracket and expect your income to rise in the future, then choose a TFSA for now. You can withdraw the funds from your TFSA in the future and put it into an RRSP when it is most advantageous for you from a tax perspective. And you get the TFSA contribution room back, unlike an RRSP where the contribution room is gone (except in very limited circumstances) if you need to make an early withdrawal.

- If you are an investor with a high income tax bracket, you should always choose RRSP before TFSA.