Like most investors, Canadians prefer to stick close to home. That is, most Canadians think of investing in their own stock and bond markets first, before venturing beyond our borders. That would be fine if Canada’s stock market made up a large part of the global stock market, but it does not.

While the volatility of the Canadian Dollar can make investors nervous about investing outside of Canada, many ETF providers now offer currency hedged versions of their ETFs, removing a major obstacle for making international investments.

Canada is a very small market

The Canadian stock market makes up less than 4% of the value of all publicly traded stocks in the world. If Canadian investors held stocks from around the world in proportion to how big each market is, they would hold less than 4% of their stock allocation in Canadian stocks. Yet, surveys routinely show that Canadians hold around 60% of their stock allocation in Canadian stocks.

By exhibiting this home bias, Canadians are missing out on potential diversification benefits of having international investments.

Diversification Benefits

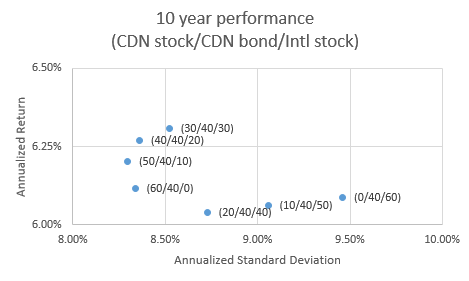

If you start with a 60% Canadian stock/40% Canadian bond portfolio and replace some of the Canadian stocks with international stocks, you can increase your portfolio’s return with little or no change in volatility. By putting just 10% of your portfolio in international stocks instead of Canadian stocks, you can increase your portfolio’s return while also reducing your portfolio’s volatility. If you increase it to 20%, your return increases further and volatility declines too. This has been the sweet spot over the last 10 years. If you increase your international exposure to 30% your return increases but your volatility increases too. An investor should prefer portfolios in the top left hand corner of a graph that compares return and standard deviation (a measure of risk) as in the graph below. Go beyond 30% international stocks and your portfolio’s return declines and its volatility increases, something no one wants.

We used the total returns on the S&P/TSX Composite to represent Canadian stocks, the total returns of the FTSE TMX Universe Bond Index to represent Canadian bonds and the returns on the MSCI World Index hedged to Canadian dollars to represent international stocks. We rebalanced the portfolios when the weights deviated from target by 5% or more.

Sector Concentration

Part of the diversification benefit comes from gaining exposure to economic sectors that Canada is lacking. The Canadian stock market is dominated by the financial services, energy, and materials sectors. The global economy is much more diversified, with larger weights in technology, consumer goods and healthcare, areas where Canada is lacking. Investing outside Canada gives you not just geographic diversification, but also economic diversification.

Stock Concentration

In addition to being concentrated in a few sectors, Canada’s stock market is also concentrated when it comes to individual stocks.

As of July 31, 2015, the S&P/TSX Composite had only 247 stocks in it. This means a few stocks have a big impact on the Canadian market; the top 10 largest stocks in the TSX account for 36% of the value. The MSCI World Index has over 1600 stocks and the top 10 are only 9% of the index.

International ETFs

If you are just starting out and have a smaller portfolio, make sure you have a broadly based ETF that covers as much of the world as possible. No need to bother with single country ETFs or regional ETFs until you have a large portfolio.

An ETF that tracks the MSCI All World Index or FTSE All-World Index would be a good choice. In Canada your choices are the iShares Core MSCI All Country World ex Canada Index ETF (XAW) or the Vanguard FTSE All-World ex Canada Index ETF (VXC).

If you would like to avoid emerging markets, consider an ETF that only invests in developed markets such as the iShares MSCI World Index ETF (XWD) or Vanguard FTSE Developed ex North America Index ETF (CAD-hedged) (VEF). When you are ready to add emerging markets exposure, you can always choose an emerging markets ETF then.

While our examples above only considered adding developed market stocks (US, UK, Japan, etc.), you should also consider adding exposure to emerging market stocks and non-Canadian bonds to gain additional diversification.