Stock and bond markets were subdued, as is typical for August. The Canadian economy posted its worst quarter since the financial crisis, meaning that interest rates in Canada are unlikely to change any time soon. Meanwhile in Europe and Japan, US investors are turning negative yielding bonds into money makers.

August 2016 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for August 2016 | Return for 2016 |

|---|---|---|---|

| Oil Price (USD) | $44.70 | 7.45% | 17.32% |

| Gold Price (USD) | $1311.40 | -2.79% | +23.69% |

| US 3 month T-bill | 0.33% | +0.05%* | +0.17%* |

| US 10 year Bond | 1.58% | +0.12%* | -0.69%* |

| USD/CAD FX rate | 1.3116 | +0.46% | -5.23% |

| EUR/CAD FX rate | 1.4629 | +0.24% | -2.66% |

| CBOE Volatility Index (VIX) | 13.42 | +13.06% | -26.30% |

*Absolute change in yield, not the return from holding the security.

August was a typically quiet month with most stock market indexes around the world little changed from where they started.

The S&P/TSX Composite Index was up 0.10% for the month, while in the US, the S&P500 was down -0.12%. The only markets posting much in the way of gains were Germany, Japan, and the emerging markets.

The bond markets were also subdued. The broad FTSE TMX Universe Bond Index was up +0.1%. The government bond indexes ranged from -0.2% to +0.1% for the month, while corporate bonds fared a little better: +0.1% to +1.0%. US bonds performed similarly; US bond market indexes were up +0.3% to +3.6%. Emerging market bonds were also up in August, +2.4%.

Oil was up +7.5% in August, while gold was down -2.8%. The broad Bloomberg Commodity Index was down -1.8% for the month.

The Canadian dollar continued its slide and was down -0.5% against the US Dollar to 1.3116, and lost -0.2% against the Euro.

Commentary

When the US Federal Reserve raised interest rates by 0.25% to 0.50% in December 2015, many were expecting that it was just the start of a longer cycle of rising interest rates. So far in 2016 no central bank in a major developed country has raised interest rates, but several have cut rates further, and some into negative territory.

In August, the central banks in both the UK and Australia cut interest rates by 0.25% (to 0.25% and 1.50%, respectively). That was Australia’s second rate cut of 2016. New Zealand has also cut interest rates twice this year. Sweden, Switzerland, and Japan still have negative central bank interest rates and the European central bank rate is at zero.

Due to this sustained period of low interest rates, the amount of bonds trading at a negative yield continues to grow as more and more investors place more and more money in the “safety” of bonds.

Why would anyone want to buy bonds with a negative yield? Some investors like large pension funds are required to invest in highly rated (AA or AAA) bonds. In most countries that means government debt is most often the best option, but in many countries they have negative yields out to the 10 year bond or further. Central banks that are continuing to do quantitative easing are also buying government bonds, which helps keep bond yields in negative territory.

With bonds, the more demand there is for the bond the higher the price goes, which means that since prices can keep rising the yield can eventually go negative. Rarely are bonds issued with a negative yield, it is the trading in the secondary market that pushes the yield negative.

Even corporate bonds have negative yields now

Now it seems that even corporate borrowers have bonds with negative yields. CIBC and Deutsche Bahn both recently issued bonds in Europe at a negative yield. A recent report from Barclays that looked at the corporate bond market in Europe found that only 20% of the bonds in the Barclays EuroAggregate Corporate Index had a yield above 1%, while 15% had a negative yield.

All of the cash flooding the bond markets has led to some very creative trades by large financial institutions and money managers. A recent Bloomberg article highlights some of these trades.

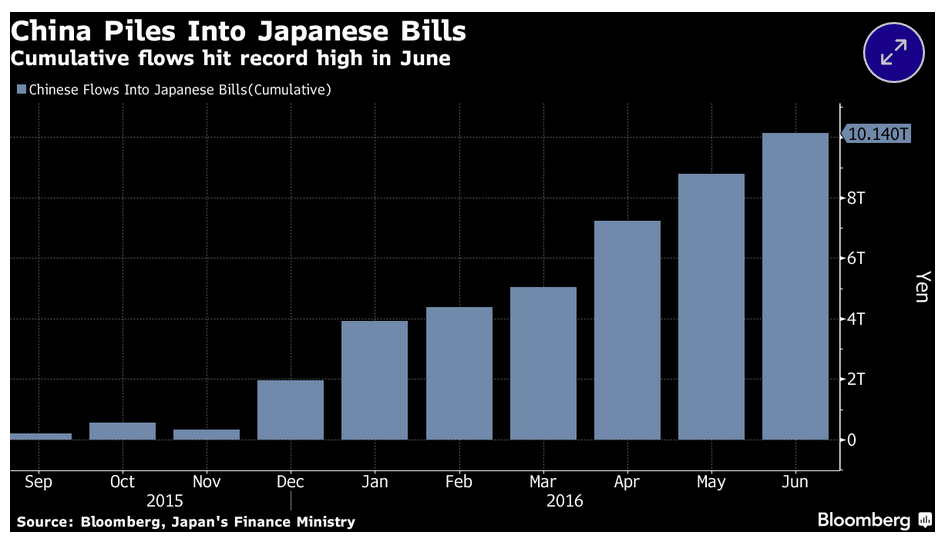

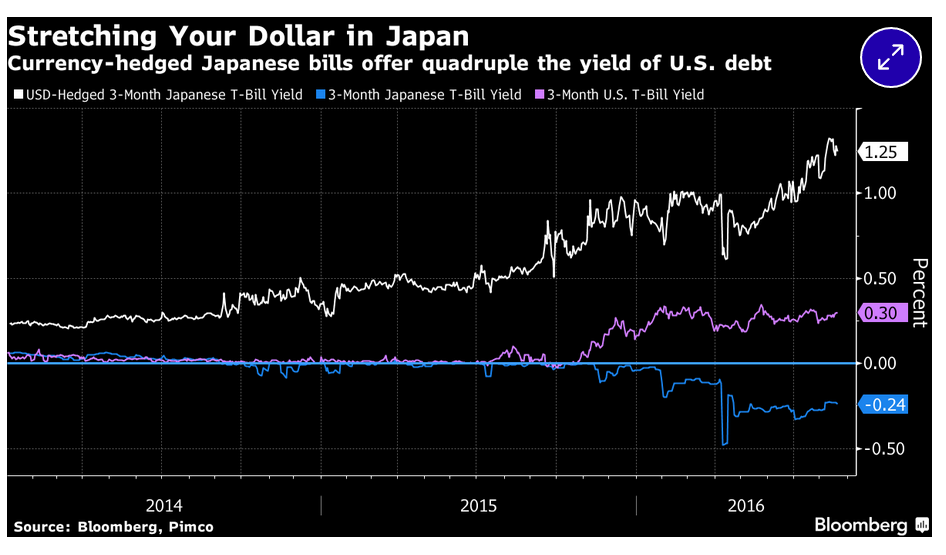

Pimco (one of the largest bond fund managers in the world) and China (the largest holder of US bonds) have been buying Japanese bonds with a negative yield and then using a swap contract to turn that negative yield into a positive return. It seems that with US government bonds one of the few left with positive yields, the demand for US dollar denominated bonds is quite high.

So investors like Pimco and China that have large holdings of US bonds can provide liquidity to the market by lending them out, and are making a decent return doing it. The use of a swap lets them essentially lock in their return, so there is no risk (other than if the party on the other side of the swap stops paying, which is known as counterparty risk). The money manager borrows Yen to buy the Japanese bond and lends US Dollars in return (they pay the 3 month Yen Libor rate of -0.02% on the Yen borrowed and receives 0.82% on the US Dollars they lend). All in, after the cost of the swap, you can earn 1.24% doing this, the highest its ever been. Similar profits can be made in Euros. While that doesn’t sound like much, quadrupling the return on your US bonds without using leverage is huge. Unfortunately, unless you have hundreds of millions or billions in the bank, this risk-free return is out of reach.

August Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate rose slightly in July to 6.9% as 31,200 jobs were lost; 40,200 part time jobs were added, not enough to offset the 71,400 full time jobs lost.

Real estate is always a hot topic, especially after the provincial government in BC instituted an extra 15% property transfer tax on homes sold to foreign buyers in Greater Vancouver in July. For more on that check out last month’s update. Housing prices across Canada in July rose 2.0% according to Teranet. Victoria (+3.8%), Toronto (+3.1%), Hamilton (+2.4%), and Vancouver (+2.3%) all posted monthly gains that were above the national average. Quebec City was the laggard at -1.6%.

The number of new housing starts rose to 198,400 in July, a decline of -9.1% from June. Building permit activity in June declined by -5.5%.

Inflation was -0.2% in July. On an annual basis, the inflation rate rose +1.3%, and remains under the Bank of Canada’s target rate of 2%. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was up +2.1% for the last year. Retail sales were down -0.1% in June, but were up +2.7% for the past year.

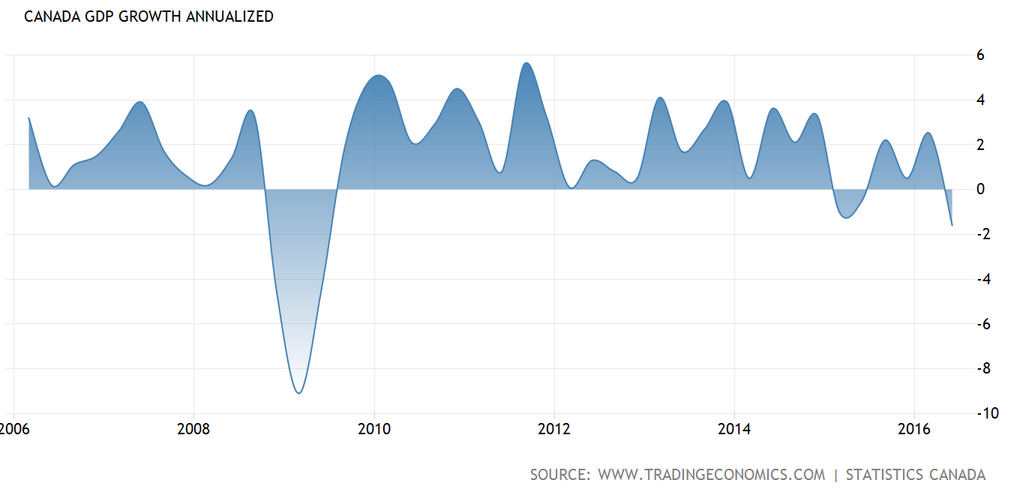

GDP was up 0.6% in June, recovering the drop of -0.6% from May. The drop and subsequent recovery can both be attributed to the shutdown and restart of the oil sands operations in Fort McMurray. For the second quarter of 2016 the decline was -1.6% (annualized), the largest drop since the end of the financial crisis in 2009.

This weak showing has some economists forecasting that the Bank of Canada’s benchmark interest rate will remain unchanged through the end of 2017. The BoC next meets on September 7.

This weak showing has some economists forecasting that the Bank of Canada’s benchmark interest rate will remain unchanged through the end of 2017. The BoC next meets on September 7.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics