Commentary

In Q1, US-based Silicon Valley Bank (SVB) and Signature Bank experienced bank runs as clients withdrew billions of dollars in deposits. Those were the 2nd and 3rd largest banks to fail in US history (neither were in the top 10 largest banks though). Then one of the largest Swiss banks, Credit Suisse, was forced to merge with UBS after efforts to raise additional capital failed.

SVB’s issues were largely a result of good old fashioned bad investments. In the old days, banks would lend out a multiple of their deposits on hand. As long as all of their depositors didn’t want to take all of their money out at the same time, it was fine. Nowadays most banks fund their operations through a mix of assets, short term (often overnight funding), and trading operations. In SVB’s case, most of its assets were invested in long term bonds. As we all know, interest rates rose dramatically in 2022. What doesn’t perform well when interest rates rise? Long term bonds. Interest rates were so low that there was really nowhere else to go but up. It’s a mystery why SVB didn’t have interest rate hedges in place, or why exposure to long term bonds wasn’t reduced after the first or second rate hike.

At ModernAdvisor, we’ve purposely avoided having exposure to long term bonds in our clients’ portfolios. While that hasn’t always paid off (the return on short term bonds has been low the last 5 years) our primary goal was to avoid the large losses that were expected in long term bonds when interest rates inevitably rose.

What can we expect going forward? Recent market volatility will continue for some time as investors continue to digest every bit of news around interest rates, inflation and the economy. It wouldn’t be surprising to see another mid to large bank fail in North America or Europe. Rising short term interest rates tend to cause stress in the banking sector as margins shrink, and lending volumes decline.

Canadian banks appear to be in a better financial position than some of their smaller US regional counterparts. It is also worth noting that Canadian bank accounts are protected up to $100,000 by the Canada Deposit Insurance Corporation (CDIC), and accounts at credit unions are protected up to $250,000 in many provinces. Investment accounts (including those at ModernAdvisor) are protected up to $1,000,000 by the Canadian Investor Protection Fund (CIPF).

Market Update

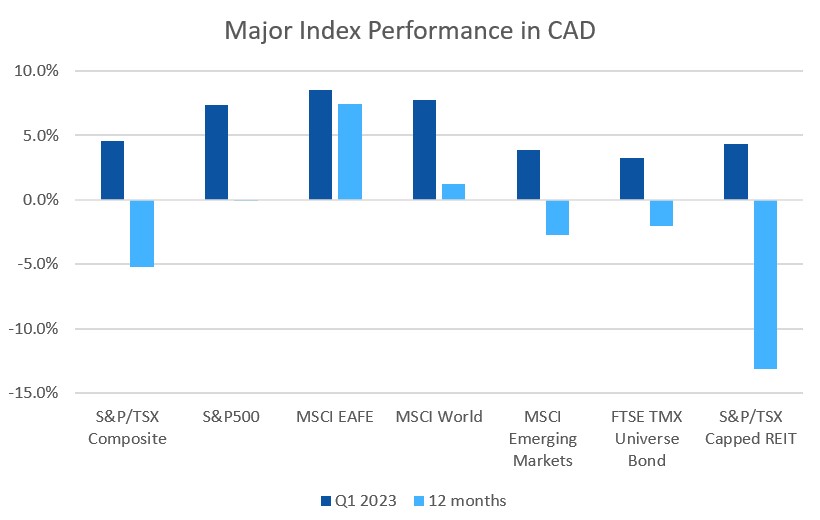

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

Stock and bond markets around the world actually had a pretty decent quarter as the negative headlines associated with US and Swiss bank failures were more than offset by signs of slowing inflation during the quarter.

Canadian stocks posted strong gains in January with a little give back in February and March, finishing the first quarter up +4.5% for the S&P/TSX Composite Index. The US economy and financial markets are much less dominated by the financial sector than Canadian markets, helping the US stocks to outperform for the quarter. The S&P500 gained +7.5% and the tech heavy Nasdaq gained +16.8%. EAFE stocks (Europe, Australasia, and Far East) continued the theme of the quarter, posting gains of over +6.6%; with Europe and Japan contributing most of those gains. Emerging market stocks continued to be a challenging area to invest in. Despite being a screaming bargain, many investors continue to overlook their potential. The MSCI Emerging Markets Index gained +3.4% for the quarter.

With interest rate hikes seemingly slowing, fixed income markets performed well in the first quarter. The FTSE/TMX Universe Index was up 3.2% for the quarter and the FTSE/TMX Short Term Index was up +1.8%, their best quarters in over two years. US bonds also performed well: the Bank of America indexes were up +4.5%, +3.6% and +4.8% for the AAA, BBB and CCC indexes, respectively. With the bulk of the interest rate hikes in the rearview mirror, the losses we saw in bonds in 2022 are unlikely to repeat in 2023.

Oil and commodities in general were the few losers in the first quarter of 2023; oil was down -6.0% and the diversified Bloomberg Commodities Index was down -6.5%. Both of those were among the few positive indexes in 2022.

Portfolio Performance

ModernAdvisor portfolios benefited from the rise in stock and bond prices and generally had a strong quarter. Our Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned 6.4%, 6.3%, and 6.9% in the quarter respectively. Our balanced Core, Socially Responsible, and Harmony portfolios (Risk Level 6) returned 4.4%, 4.5%, and 4.9% respectively. Our conservative (Risk Level 2) Core, Socially Responsible, and Harmony portfolios returned 2.4%, 2.6%, and 2.0% respectively.

For more details about the performance of our portfolios, see our portfolio factsheets here.