March was another down month for most markets. Bonds and REITs helped to provide some relief for investors.

March 2018 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for March 2018 | YTD 2018 return |

|---|---|---|---|

| Oil Price (USD) | $64.94 | +5.35% | +7.48% |

| Gold Price (USD) | $1,327.30 | +0.71% | +1.37% |

| US 3 month T-bill | +1.73% | +0.08%* | +0.34%* |

| US 10 year Bond | +2.74% | -0.13%* | +0.34%* |

| USD/CAD FX rate | 1.2894 | +0.66% | +2.78% |

| EUR/CAD FX rate | 1.5867 | +1.46% | +5.41% |

| CBOE Volatility Index (VIX) | 19.97 | +0.60% | +80.89% |

*Absolute change in yield, not the return from holding the security.

The S&P/TSX Composite was down -0.2% in March, its third negative month in a row as it was for many stock markets around the world. In the US, the S&P500 was down -2.5%, and is now down -0.8% for 2018 (in US Dollars). European stocks were down -2.2% and are down -4.9% for 2018. German stocks were down -2.7%, while UK stocks were down -2.4% and are now down -8.2%(!) for 2018. Emerging markets held up better and were only down -1.2% in March and remain +4.4% for 2018 (in Canadian Dollars).

The bond market was again one of the few bright spots. The broad index of Canadian bonds, FTSE TMX Universe Bond Index was up +0.7% in March, while the FTSE TMX Short Term Bond Index was up +0.2%. Both are up marginally for 2018. US bonds were mixed; investment grade credits were positive while the high yield indexes were down around -1.0%. Emerging market bonds were up +0.9% in March.

Canadian REITs were the top performer, up +2.2% in March and are up +1.3% for 2018.

Oil had a strong month and was up +5.4%, and is now up +7.5% for 2018. Gold was also up for the month at +0.7%. The broad Bloomberg Commodity Index was down -0.8% for March.

The Canadian Dollar continued its slide in March losing -0.7% against the US Dollar and -1.5% against the Euro.

Commentary – Q1 Performance Update

The first quarter of 2018 brought the unwelcome return of volatility. Stock and bond markets around the world were mostly negative, not helping the performance of the ModernAdvisor Core portfolios.

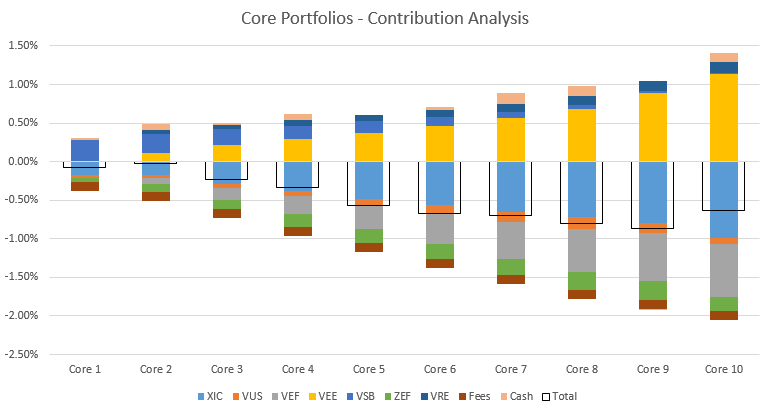

While no one likes to see a negative quarter, given the volatility of the markets over the period the portfolios held up relatively well. Strong contributions from emerging market stocks helped to offset losses on Canadian, US, and EAFE (Europe, Australasia, Far East) stocks in our more aggressive portfolios, while Canadian bonds were the largest positive contributor for our most conservative portfolios. Exposure to Canadian REITs also contributed positively, but that positive contribution was mostly offset by losses on emerging market bonds.

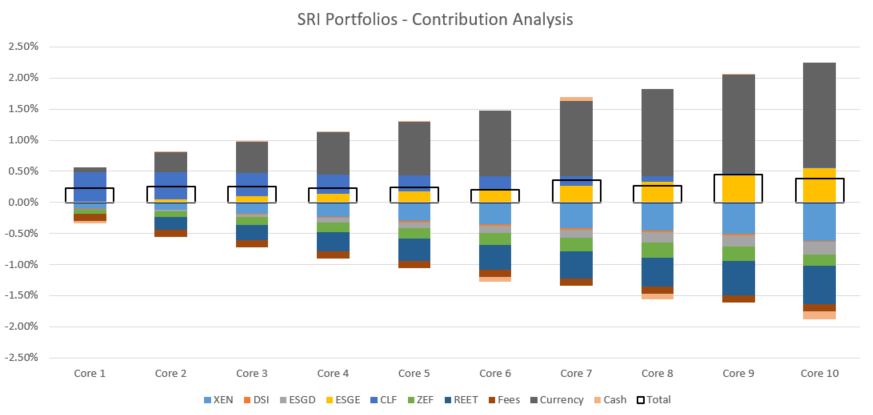

The socially responsible portfolios (SRI) performed better in Q1 than the Core portfolios and were positive across the 10 risk levels. As with the Core portfolios, emerging markets’ positive contribution offset losses on Canadian, US, and EAFE stocks in the more aggressive portfolios, while Canadian bonds were the top contributor to the conservative portfolios. Exposure to global REITs was a drag on performance as was emerging market bonds. Currency was a big positive contributor to performance for the aggressive portfolios as well.

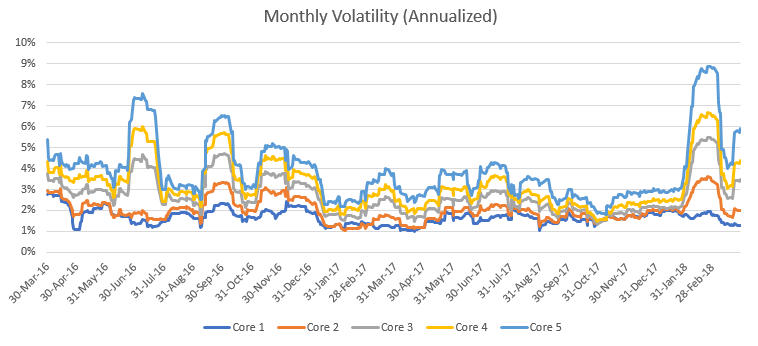

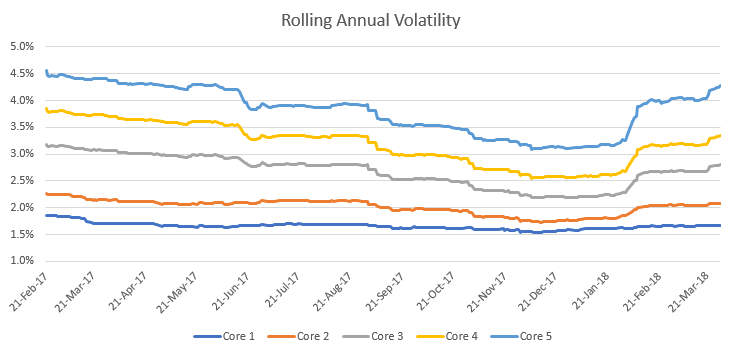

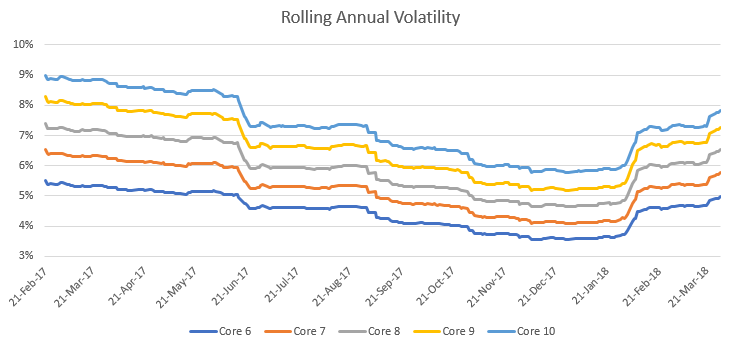

The volatility of the stock markets in the first quarter also shows up in the daily performance of our portfolios. Looking at rolling monthly periods, we see a few spikes in volatility for the Core portfolios: mid 2016, September 2016 and February 2018, but we also see how calm most of 2017 was, particularly the fall of 2017. With monthly periods we see a lot of noise, most of which disappears with annual periods.

With the annual measurements what is surprising is just how low the annualized volatility got. On the more aggressive portfolios, the annualized volatility declined by 30-40% from the beginning to the end of 2017. Even the conservative portfolios saw relatively large declines in their annual volatility. As a comparison, the long run average monthly volatility of the S&P/TSX composite is 4%; even our more aggressive portfolios came close to that in the fall of 2017 on an annual basis. This unusually low volatility quickly mean-reverted in the first quarter of 2018.

Some of our clients have commented about waiting until volatility declines to add to their accounts at ModernAdvisor. Unfortunately, when markets are volatile is usually the best time to invest. You can often buy at a discount, especially when other investors are panicking about relatively minor declines.

March 2018 Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment declined -0.1% to 5.8% in February as 54,700 part time job gains partly offset the loss of 39,300 full time jobs.

Housing prices across Canada declined -0.1% in February, as only 3 of 11 metropolitan areas were positive, the fewest since October 2014. The three positive markets were Halifax (+0.8%), Vancouver (+0.4%) and Hamilton (+0.2%). Most of the gain was the result of a +1.2% rise in Vancouver. Victoria was up +1.0%, Toronto +0.2% and Montreal +0.1%. Quebec City was again the largest decliner at -1.5%, followed again by Winnipeg at -1.0%.

The level of new housing starts rose +6.7% in February to 230K, while the value of building permits issued in January rose +5.6%.

The inflation rate for February +0.6%, and +2.2% on an annual basis, the highest level since 2015. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was+1.5%. The tick-up in inflation makes it more likely that the Bank of Canada will raise interest rates at their next meeting.

Retail sales were up +0.3% in January; compared to a year ago, retail sales were up a healthy +3.6%.

Canada’s GDP growth was -0.1% for January 2018, below expectations. The Bank of Canada met on March 7, and as expected left the benchmark interest rate at +1.25%.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics