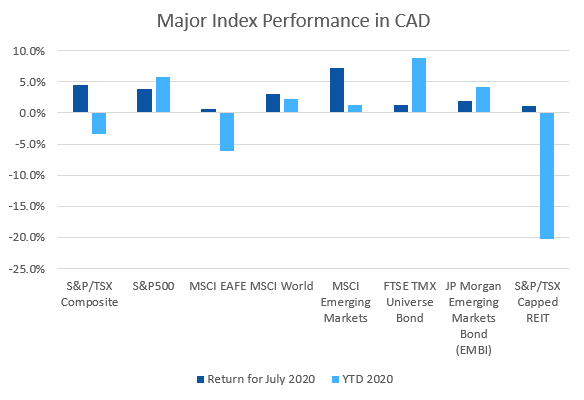

July saw equity markets continue their recovery, with some even turning positive for the year.

July 2020 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for July 2020 | 2020 YTD return |

|---|---|---|---|

| Oil Price (USD) | $40.27 | +2.55% | -34.05% |

| Gold Price (USD) | $1,962.80 | +9.01% | +28.87% |

| US 3 month T-bill | +0.09% | -0.05%* | -1.46%* |

| US 10 year Bond | +0.55% | -0.11%* | -1.37%* |

| USD/CAD FX rate | 1.3404 | -1.64% | +3.20% |

| EUR/CAD FX rate | 1.5831 | +3.44% | +8.56% |

| CBOE Volatility Index (VIX) | 24.46 | -19.62% | +77.50% |

*Absolute change in yield, not the return from holding the security.

Most major equity markets continued to recover from the difficult first quarter of 2020.

The S&P/TSX Composite was up +4.5% for July, cutting the YTD decline to -3.3%. The S&P/TSX Small Cap Index was up +7.2% and the speculative S&P/TSX Venture Index was up +16.3%. In the US, the large cap S&P500 was up +5.6% and is now positive for 2020 at +2.4%. The US’ main small cap index, the Russell 2000, was up +2.7% but remains down -11.3% for 2020.

EAFE (Europe, Australasia & Far East) stocks were one of the few indices down in July. EAFE was down -1.9% for July and -13.5% for 2020. European and British stocks were down for July, -1.6% and -4.4%. For the year those markets are down -14.2% and -21.8%, respectively. Japanese stocks were up +2.1% for July, cutting the YTD loss to -3.8%. Emerging market stocks were one of the best performers in July at +7.6%, which returned those markets to the positive for 2020, albeit only slightly at +0.6%.

Bonds have been fairly steady performers for 2020, with only March being a down month for some indices. Canadian bonds were positive in July; the FTSE/TMX Universe Bond Index was up +1.3% and the FTSE/TMX Short-term Bond Index rose +0.5%, its 7th positive month in a row. Those indices are up +8.9% and +4.5% for 2020. All of the Merrill Lynch US bond indexes we follow were up for July; the investment grade indexes were up 3-4% while the speculative and HY indices were up more than +4%. The AAA index is up more than +13% for 2020, while the highly speculative end of the credit spectrum, CCC, remains down -11% for the year. Emerging market bonds were up +2.0% in July and are up +4.2% for 2020.

Oil was up +2.5% in July, but remains down -34.0% for 2020, a far cry from the decline of -69% seen in April. Gold, has seen a resurgence in interest, gaining +9.0% in July and is now up +28.9% for 2020. The diversified Bloomberg Commodities Index was up +5.7% for the month but remains down -15.1% for the year.

The Canadian Dollar (CAD) has recovered much of the ground lost during the worst of the pandemic as oil prices have recovered. In July CAD gained +1.6% against the US Dollar and lost -3.4% against the Euro. For the year CAD remains down -3.2% and -8.6% compared to those currencies.

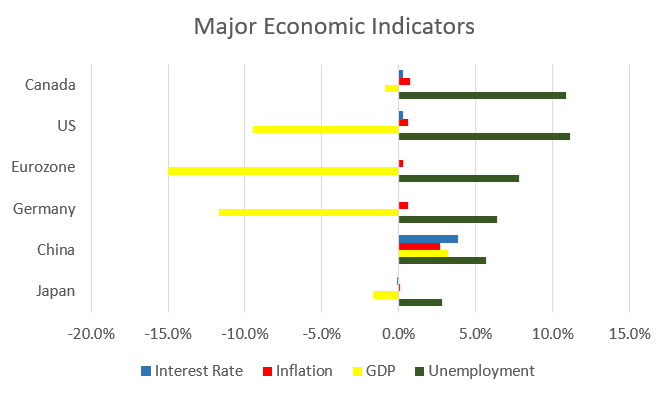

July 2020 Economic Indicator Recap

Below are the readings received in July for the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

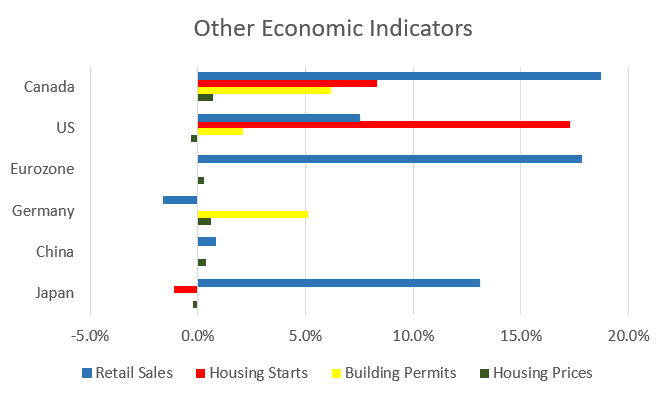

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined to 12.3% in June after peaking at 13.7% in April, but still a far cry from the 5.6% seen before the pandemic. The economy added 952,900 jobs in June with the split roughly 50/50 between full and part time work.

Housing prices across Canada were up +0.7% in June, as 9 of the 11 major Canadian markets were up for the month. Halifax was the top performer at +2.7%, followed by Winnipeg and Hamilton at +1.8% and +1.7%, respectively. Edmonton and Calgary were the two negative markets, down -0.7% and -0.1%, respectively.

The level of new housing starts rose +8.3% in June to 212,100 units after cratering to 164,800 in April. All of the growth came from multifamily urban construction as single family home construction declined. The value of building permits issued in June rose +6.2%, down from the +21.6% gain in May. Residential permits value was $5.3 billion, while non-residential building permit value was $2.7 billion.

The inflation rate for June was +0.8%, and +0.7% on an annual basis. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.1%. Prices were one of the few economic measures that didn’t see substantial declines during the worst of the pandemic.

Retail sales were up +18.7% in May, after posting a month over month decline of -25% in April; compared to a year ago retail sales were down -18.4%, an improvement (!) from -31.2% in April. Higher sales were reported at motor vehicle & parts dealers (+66.3%), clothing stores (+92.6%), sporting goods, hobby, book and music stores (+101.2%). Sales declined at grocery stores by -2% following a record increase of +23.2% in April..

Canada’s GDP was up +4.5% in May, the strongest monthly increase on record, following a decline of -11.7% in April. 17 of 20 industrial sectors posted gains in May, while retail trade posted its largest gain on record +16.4% as 11 of 12 subsectors gained.

As expected, the Bank of Canada left its benchmark interest rate at 0.25% at the July 15 meeting. The BoC continues to purchase at least 5 billion in Federal government securities per week. The central bank’s other quantitative easing measures were reduced or ended in June and July.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics