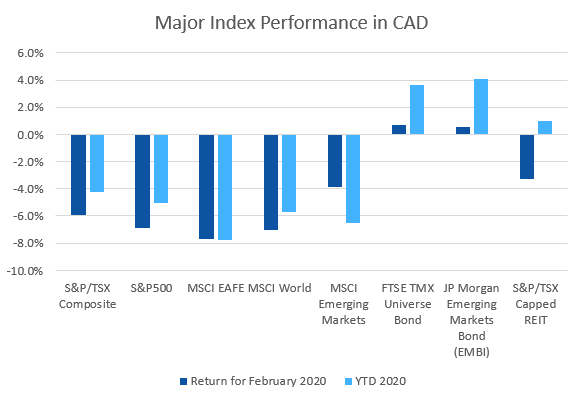

February was a down month for nearly all equity market indexes as the corona virus continued to spread around the world.

February 2020 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for February 2020 | 2020 YTD return |

|---|---|---|---|

| Oil Price (USD) | $44.76 | -13.19% | -26.70% |

| Gold Price (USD) | $1,566.70 | -1.02% | +2.86% |

| US 3 month T-bill | +1.27% | -0.28%* | -0.28%* |

| US 10 year Bond | +1.13% | -0.38%* | -0.79%* |

| USD/CAD FX rate | 1.3429 | +1.48% | +3.40% |

| EUR/CAD FX rate | 1.4766 | +0.77% | +1.25% |

| CBOE Volatility Index (VIX) | 40.11 | +112.90% | +191.07% |

*Absolute change in yield, not the return from holding the security.

February was a negative month for nearly all equity market indexes, the only positive among those I track was the Nasdaq Biotech Index, and it was only up +0.3%. The S&P/TSX Composite was down -5.9% for the month as the corona virus started to spread well beyond China. In the US, the large cap S&P500 was down -8.2%.

EAFE (Europe, Australasia & Far East) stocks were down -8.3% for February, as were European stocks specifically. British stocks fared a little worse at -9.7%. Emerging market stocks fared better than most, and were only down -3.9% in February.

Canadian bonds were up in February, both the FTSE/TMX Universe Bond Index and FTSE/TMX Short-term Bond Index rose +0.7%. Investment grade US bonds were one of the few “strong” performers at +2.5% for AAA and +0.9% for BBB. The speculative and high yield US indexes were down around -2.0%. Emerging market bonds were up +0.5%. REITs were down in February, -3.3%.

The headline commodities, oil and gold were both down in February. Oil was again down double digits at -13.2%, while gold was down -1.0%. The diversified Bloomberg Commodities Index was down -5.2% for the month.

The Canadian Dollar (CAD) lost -1.5% against the US Dollar and -0.8% versus the Euro.

Commentary – by Gordon Ross, CFA

Stock markets do not make a rational statement about our world. When they are functioning normally, they demonstrate a jumble of preferences and motivations from investors who are not always collaborating. Right now, markets are not functioning normally.

A good investment plan is more stable than trading prices in markets.

Markets will return to functioning reasonably well. All of history shows that a diversified portfolio built on good evidence withstands the stress and recovers. Long-term investors have lots of time to overcome losses and then to experience solid gains.

This example may help. If you go to a store to buy something, and find the store closed, this does not change your need for what you were going to buy. The fact that the store is not operating normally does not change demand for the item or its appropriate price.

Ticket scalpers offer another useful example. As the audience arrives to attend a performance, the scalper is selling tickets at a discount because he speculated that he could sell a certain number at a profit. His uncomfortable situation does not change the quality of the performance, or the pleasure of the audience who attends.

Global response to COVID-19 shows countries and people cooperating to an unusual extent. Because of how a virus spreads, this cooperation will make a big difference.

Here are some words from George Mavroudis, President & Chief Executive Officer, Guardian Capital Group Limited, in a message to staff Saturday March 14, 2020.

“We will ultimately overcome this period and return to a more stable environment but it’s imperative that we all do our part to shorten this period of anxiety by heeding the advice of our Government Health Agencies and the recommendations for best practices from the Company.

“We should all take comfort in knowing that the virus can be contained and normal day to day life can return in relatively short order as we are currently witnessing in China. It will require all of us to do our part so as to ensure the chain link connecting us is as strong as possible. In the meantime, our thoughts are with those who have been seriously impacted by COVID-19 and we are deeply grateful to the many health care workers on the frontline assisting those in need.”

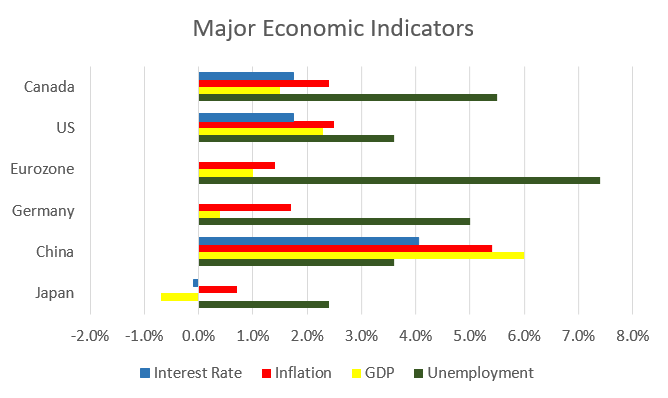

February 2020 Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

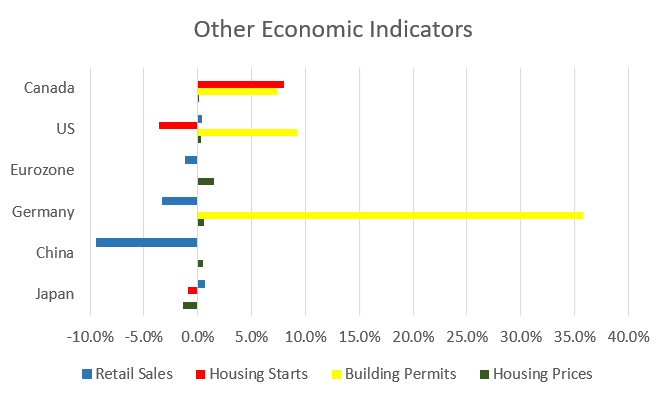

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate fell slightly to 5.5% in January as 34,500 jobs were added, beating expectations of 15,000. 35,700 of those jobs were full time, while 1,200 part time jobs were lost. Employment increased the most in Quebec while Alberta posted the largest job losses.

Housing prices across Canada were up +0.1% in January. Hamilton and Montreal were the top performers at +0.8% and +0.5%, respectively. Quebec City was the worst performer at-1.4%, followed closely by Calgary at -1.1%.

The level of new housing starts rose +8.0% in January to 213,000 units, ahead of expectations of 205,000. The value of building permits issued in December rose +7.4% to $8.7 billion. The value of residential building permits for single family homes declined -3.2% and multi-family permits increased +15.9%

The inflation rate for January was +0.3%, and +2.4% on an annual basis, an 8 month high. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest was +1.8%. The increase in the annual inflation rate was driven largely by a transportation costs, specifically an 11.2% rise in gasoline prices.

Retail sales were flat in December; compared to a year ago retail sales were up +2.4%. Higher sales were reported at building material and garden stores, health and personal care and grocery stores. Sales declined at new car dealers and used car dealers and at gasoline stations.

Canada’s GDP rose +0.3 in December, the strongest growth since May 2019. Goods producing industries and the services sector both grew. Transportation and warehousing rose +1.5%, and mining and resource extraction gained +1.3%.

As expected the Bank of Canada left its benchmark interest rate unchanged at their January 22 meeting. No interest rate changes were expected, but as this was being written the BoC cut rates by 0.5% for the third time bringing the benchmark rate to 0.25% in an attempt to provide support in what is expected to be an historic decline in inflation rates and economic activity with the COVID-19 pandemic.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics