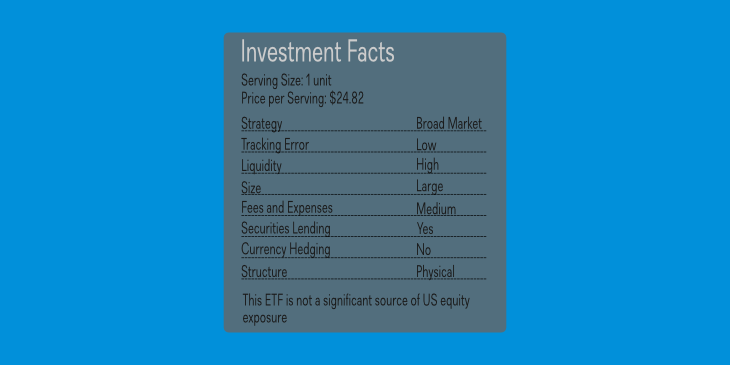

Choosing the right ETFs to implement your asset allocation strategy can be a little like choosing between foods at the grocery store, but it can make a significant difference in your investment performance. In this post I will cover the most important factors to consider when choosing an ETF:

- Strategy

- Tracking Error

- Liquidity

- Size

- Fees and expenses

- Securities Lending

- Currency Hedging

- Structure

The ETF’s Strategy

With the proliferation of ETFs in the last decade there are ETFs that track pretty much every index or asset class imaginable. One benefit of this is if there is something you dislike about a major index, perhaps too much exposure to resources or financials (I’m looking at you S&P/TSX Composite), you can customize your exposure by holding sector ETFs corresponding only to those economic sectors you want exposure to. iShares has a broad range of sector ETFs available to Canadians. Similarly, if one stock makes up a large portion of an index, you can look for a Capped version that limits the exposure to any one stock, such as the iShares Core S&P/TSX Capped Composite Index ETF (XIC).

When ETFs were first introduced, passive strategies that tracked indexes were the norm. Now there are many actively managed ETFs that trade stocks, bonds, commodities and futures. These actively managed ETFs generally have higher fees than their passive peers, but still have lower fees than most mutual funds. Horizons and Purpose Investments have ETF lineups that have more actively managed funds than passive ones.

Tracking Error

What is tracking error?

Tracking error is the difference between the return on the ETF and the return on the index it tracks. Ideally the tracking error should be as small as possible, but will always be there due to the fees and expenses.

What causes tracking error?

Tracking error occurs due to several factors: management fees charged by the ETF’s manager and the expenses of running the ETF, holding different securities than the index itself, and withholding taxes. Controlling fees and expenses is the easiest way to minimize tracking error.

The second component of tracking error, not holding the same securities as the index, is harder for the investor to control. Due to liquidity constraints and trading costs, it may not be feasible for an ETF to hold all the securities in the index. In that case other holdings will need to be held in a higher proportion than in the index.

The last component of tracking error, withholding tax, is also difficult or impossible for an investor to control. ETFs that hold foreign securities are subject to taxes on dividends and interest received on stocks and bonds from companies based in foreign countries.

Below is an example comparing two ETFs that track the same index. ETF1 closely tracks the index while ETF2 does a poor job of tracking the index, thus ETF2 has higher tracking error than ETF1 and an investor should prefer ETF1 over ETF2.

Liquidity

Unlike with stocks, low liquidity can be less of a problem for an ETF. ETFs have market makers (called authorized participants) that are allowed to create new units of the ETF by delivering the securities held by the ETF (a creation unit) in exchange for new ETF units. However, thinly traded ETFs will have wider bid/ask spreads than actively traded ETFs, potentially increasing your trading cost. If an ETF trades less than 5000 shares a day you may want to see if there is a more widely traded ETF that would provide the same exposure.

Size of the ETF

Unsurprisingly, newly created ETFs will have a small amount of assets under management (AUM). Be careful when investing in an ETF that has been around for more than a year with less than $50 million in assets. Funds with low AUM will often have lower trading volumes (and a wider bid/ask spread) and may have a higher management expense ratio (MER) than larger ETFs.

Fees and expenses

The lower the management expense ratio (MER), the better. ETFs that track very widely followed indexes (S&P/TSX Composite, S&P500, etc.) often have MERs as low as 0.05%. As an ETF’s investment universe becomes more specific, the MER increases. Actively managed ETFs also have higher MERs.

Some managers will list only the management fee on their website, and make it a little difficult to find the full MER. You may have to do a little digging to find the full MER, but it is worthwhile to ensure that you don’t get a fee surprise. For small funds that have low MERs, make sure to check whether or not the manager is subsidizing the costs while the ETF is small. At any time the manager could choose to discontinue their fee subsidy.

While the ETF manager may have set a very low management fee, the ETF has to pay for a custodian, auditors, fund administrator, and other required administrative functions. A larger AUM provides efficiencies of scale, reducing the cost of those services for all of the ETF’s unitholders.

Securities Lending Activities

The ETF’s manager will often lend out some of the securities held by the ETF to other market participants (usually short sellers) as part of their securities lending activities. This can be confirmed in the ETF’s prospectus and financial statements. Try to avoid ETFs where the ETF does not receive any of the securities lending fees. iShares ETFs, for example, receive 60% of the lending fees and the lending agents (receive 40%. The fees are sometimes shown as reducing the ETF’s MER in the quarterly/semiannual/annual reports or on the financial statements.

Currency – to hedge or not to hedge

In unhedged ETFs, any foreign securities that a Canadian-listed ETF holds are translated back to Canadian Dollars at the current exchange rate. For example, if during a month US Dollar stocks held by the ETF gained 5% but the Canadian Dollar rose 5% then the net result in Canadian Dollars would be roughly 0%.

Unfortunately there is no easy to use rule of thumb on whether you should prefer an ETF that hedges its non-Canadian Dollar exposures. We would suggest that if the CAD/USD exchange rate is near 1.00 then the added cost is not worth it. If, like now, the exchange rate is in the 1.25 to 1.30 range, then hedging may be worth it in case the Canadian Dollar returns to par before you sell the ETF.

The ETF’s Structure

ETFs generally come in one of two forms: physical or synthetic.

Physical ETFs

Physical ETFs are the most prevalent structure of ETFs in Canada. A physical ETF holds securities such as stocks, bonds, etc. in an attempt to match the return of the index. The securities owned by the ETF are held at a custodian and are separate from the assets of the ETF’s manager. If the ETF manager went bankrupt then a new manager would be appointed and the ETF would continue on as if nothing happened.

Synthetic ETFs

Synthetic ETFs use a total return swap to gain exposure to the securities that make up an index. The ETF buys a total return swap from a bank or insurance company (or other counterparty) and pays a fee over the life of the swap contract in exchange for a payment equal to the return on the index. The total return swap buyer depends on the other party (the seller) to perform their obligations under the swap contract. If the seller is unable to meet their obligations then the ETF could face a significant loss.

The benefits of a synthetic ETF structure are lower tracking error, greater tax efficiency and sometimes lower costs. But does the risk that the other party to the contract will default outweigh those benefits? Synthetic ETFs are less common in Canada, but over half of the ETFs in Europe are synthetic. Many of the Horizons Exchange Traded Funds are synthetic.

Exchange Traded Notes

If you trade US listed ETFs, make sure you distinguish them from exchange traded notes (ETNs). ETNs are another synthetic ETF-like structure; they are debt securities issued by a bank that promises to pay the holder the return on an index, but doesn’t hold any securities. If the issuer of the ETN went bankrupt, the notes become part of the bankruptcy and you may not receive the full value of the notes. Deutsche Bank and Barclay’s iPath are two of the largest issues of ETNs.