A question most people with a mortgage have is: if I have extra money, should I invest it or make a prepayment on my mortgage? There is no easy to use rule of thumb and what works for you might not work for someone else.

When you make a mortgage prepayment you are getting a guaranteed risk-free return equal to the interest rate on your mortgage. There are significant interest savings to be had, especially if you are in the early years of your mortgage. However if you compare making the mortgage prepayment to investing in a diversified portfolio, that guaranteed risk-free return might not look as attractive. Your risk tolerance and appetite can play a big role.

For very conservative investors the guaranteed return is very attractive. However, if your mortgage rate is 3%, a balanced portfolio that earns 6% clearly outperforms paying off the mortgage. Investors with a long term investment horizon that are comfortable staying invested through the ups and downs of the market would invest before prepaying their mortgage.

To help you decide where you fit, consider the pros and cons of each alternative.

| Pros and Cons of Prepaying Your Mortgage | |

| PROS | CONS |

|

|

| Pros and Cons of Investing the Money | |

| PROS | CONS |

|

|

An Example

Let’s consider a concrete scenario for both alternatives. Our hypothetical mortgage holder starts with a net worth of $70,000 and a 25 year $250,000 mortgage at a 3% interest rate. We are assuming that the individual will either make a $10,000 prepayment at the end of every year or invest the money in a balanced portfolio that is targeting a 6% annual return. Since the return on the balanced portfolio is not guaranteed, we have included a below expectations case at 2% and better than expected case at 10%. Any appreciation in the home is the same in each scenario, so it has not been included in the net worth calculations. The net worth calculation includes the mortgage principal that is paid as part of the regular mortgage payments.

If you prepaid or invested $10,000 at the end of every year, this would be the resulting net worth in each scenario.

Prepaying $10,000 on the mortgage every year reduces the amortization from 25 years to slightly less than 13 years and saves $53,574 in interest. Without making the prepayments, at the end of the 13th year $143,075 would be remaining on the mortgage, however the resulting net worth is greater in all but the worst case scenario that averages a 2% return.

Still Unsure?

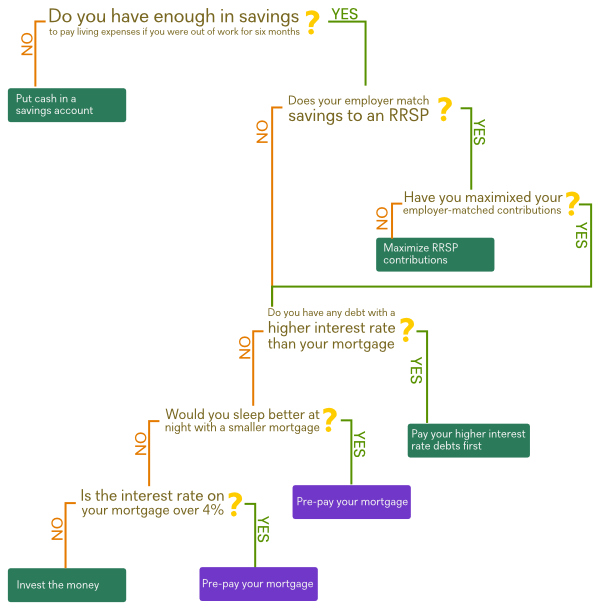

We have created a handy decision tree to help you decide which course of action makes the most sense for you.

As stated in the beginning of the post, there is no one solution that fits all people. Personally, I prefer to have more of my net worth in liquid investments. Only after I have met my savings target do I consider making a mortgage prepayment.

If you can’t decide, why not diversify and do a little of both?