At ModernAdvisor we take keeping fees low seriously. The same cannot be said of the mutual fund industry. The majority of mutual funds in Canada sold by advisors have fees of over 2% per year. The proponents of actively managed mutual funds often argue that the reason the fees are what they are is you are paying for that active management team which is led by an experienced fund manager with years or a few decades of experience. But is that what you are getting?

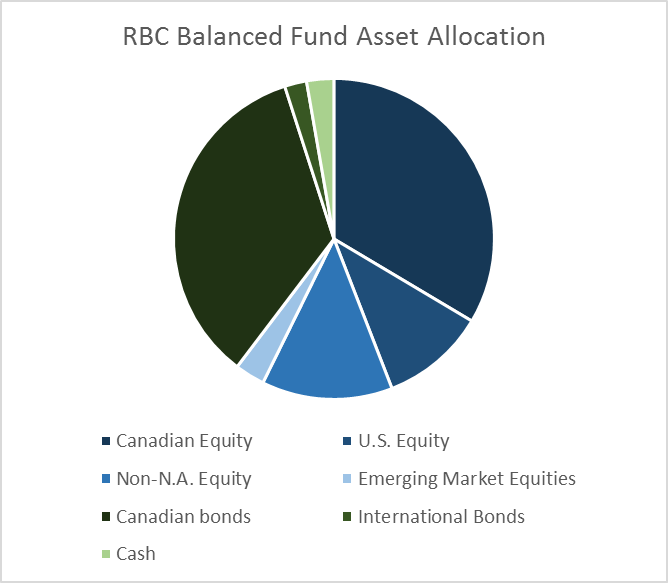

RBC’s Balanced Fund is one of the largest balanced funds in Canada with $5.9 billion in assets. Like most balanced funds it is diversified across Canadian stocks, US stocks, international stocks, and bonds. Its MER of 2.18% is near the average of mutual funds in Canada; it has by no means the highest fees in its category but it’s not the lowest.

Asset Allocation Comparison

RBC’s Balanced Fund has roughly 60% in stocks and 40% in bonds, which is similar to ModernAdvisor’s Risk Level 7 portfolio. Below are the asset allocations for both as at the end of February 2016.

While the broad asset allocations to stocks and bonds are similar, where we differ is geographic diversification. The ModernAdvisor portfolio is much less concentrated in Canadian Equities and Canadian Bonds. We have much more in international/emerging market bonds and equities, and we also include a moderate amount of REIT exposure. The allocations to US Equities and Non-North American Equities are pretty much the same.

Performance Comparison

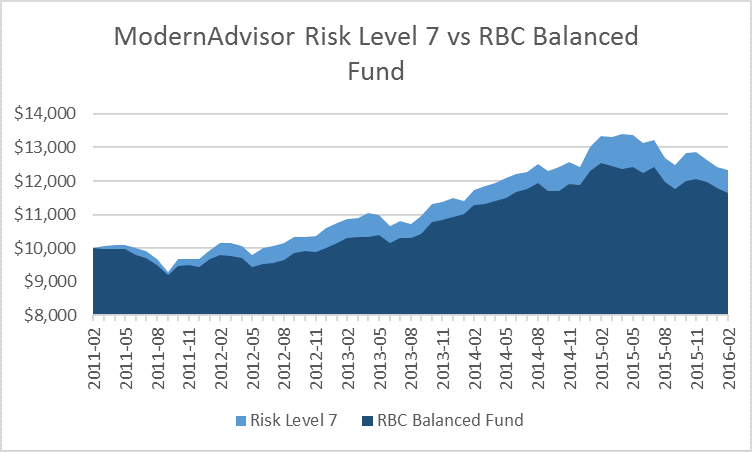

If we had ‘invested’ $10,000 each in the RBC Balanced Fund and the ModernAdvisor Risk Level 7 portfolio 5 years ago, which would have done better?

As you can see below, the $10,000 ‘invested’ in the ModernAdvisor portfolio would have done better, and was ahead of the RBC Balanced Fund by almost $700 after 5 years. See the backtest disclaimer at the end of the post for more information on how the ModernAdvisor Risk Level 7 portfolio was constructed.

The main difference between RBC’s Balanced Fund and our Risk Level 7 portfolio: the fees. The management expense ratio (MER) on RBC’s Balanced Fund is 2.18%; our Risk Level 7 portfolio has an all in fee of 0.70%: the MER on the ETF portfolio we use is only 0.20% and our highest management fee rate is 0.50%. The difference in fees mean that over 5 years on that initial investment of $10,000 in the RBC Balanced Fund you would have paid approximately $1,200 in fees, compared to around $400 on the Risk Level 7 portfolio. The other $100 of the performance difference can be attributed to the difference in the asset allocations of the two options,

Keeping your investment fees low is the easiest and most likely way to ensure that your investments will get you to your investment goal.