Q1 2021 Performance Update

The first quarter of 2021 was a good one for ModernAdvisor’s portfolios; with the exception of risk level 1, all portfolios were positive for the quarter. With equity market performance being strong, you’d expect performance to be strong from portfolios that use index ETFs, so with bond markets having their worst quarter in decades that was an important factor affecting the quarter’s performance. Fortunately, our portfolios use primarily short-term Canadian bonds for fixed income exposure which helped to avoid the declines seen in the longer term sectors of the bond market that many other portfolios have exposure to.

Emerging market stocks were one of the laggards in the first quarter, so the outsized exposure there was a bit of a hindrance. Our portfolios have more exposure to emerging market stocks and less exposure to US stocks than you see in many portfolios, the reason being the US stock market continues to be very overvalued while most other equity markets are quite attractive from a valuation standpoint.

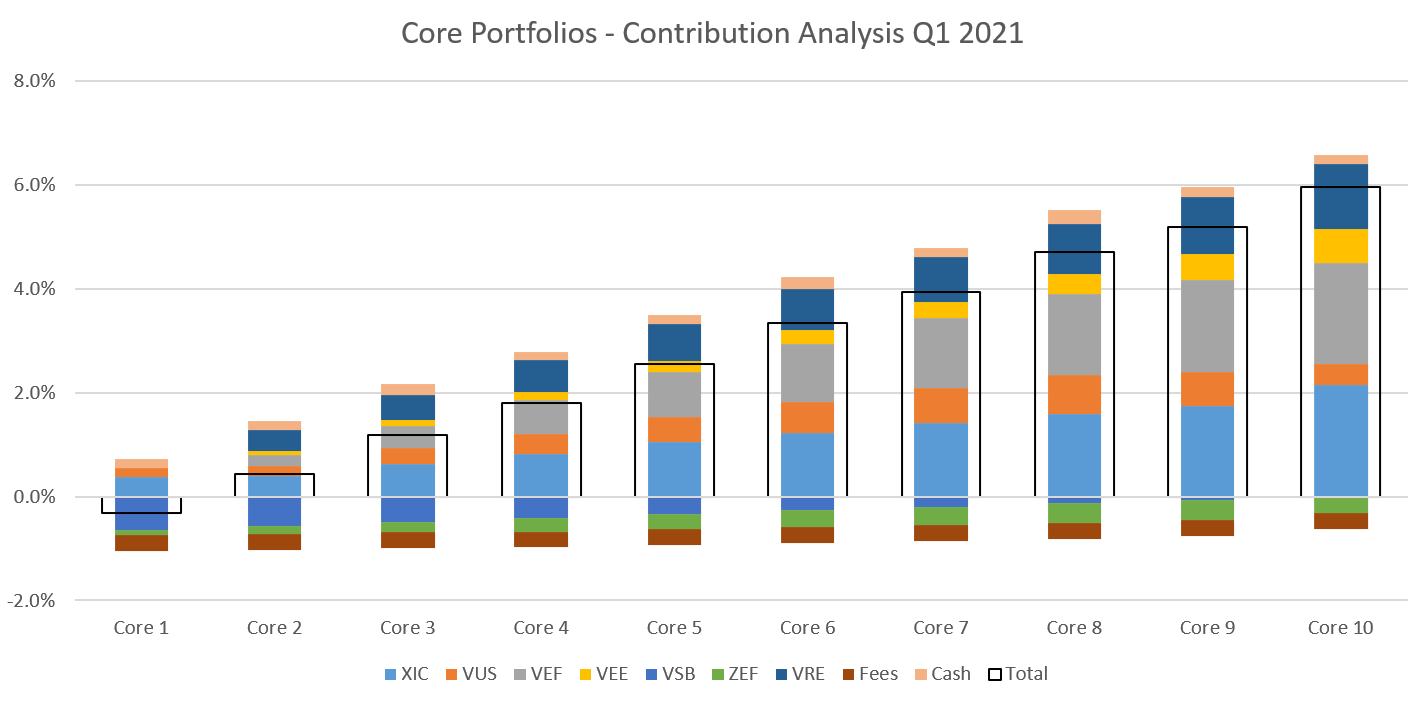

Core Portfolios:

The largest positive contributors to performance for the quarter were Canadian stocks (XIC) and international developed market stocks (VEF). Together, they accounted for two-thirds of the positive performance for the first quarter. Real estate (VRE) was the next largest performer, despite it being a small allocation in the portfolios, as it returned almost 10% in the quarter. US stocks (VUS) and emerging market stocks (VEE) also contributed positively.

The only negative contributors were the fixed income ETFs: VSB and ZEF. VSB, our Canadian fixed income ETF, was only down -0.7% for the quarter, but as it is the largest allocation in the lower risk portfolios it was the largest performance detractor for risk levels 1 to 5. When we launched the ModernAdvisor portfolios in 2016 we made the decision to not include exposure to long term Canadian bonds. This worked well in the first quarter as they dropped -5% in the quarter, their worst quarterly showing since 1994.

Emerging market bonds was the worst performing asset class in the portfolios losing more than -3%, but as it is a small allocation in the portfolios it didn’t have a large impact on performance.

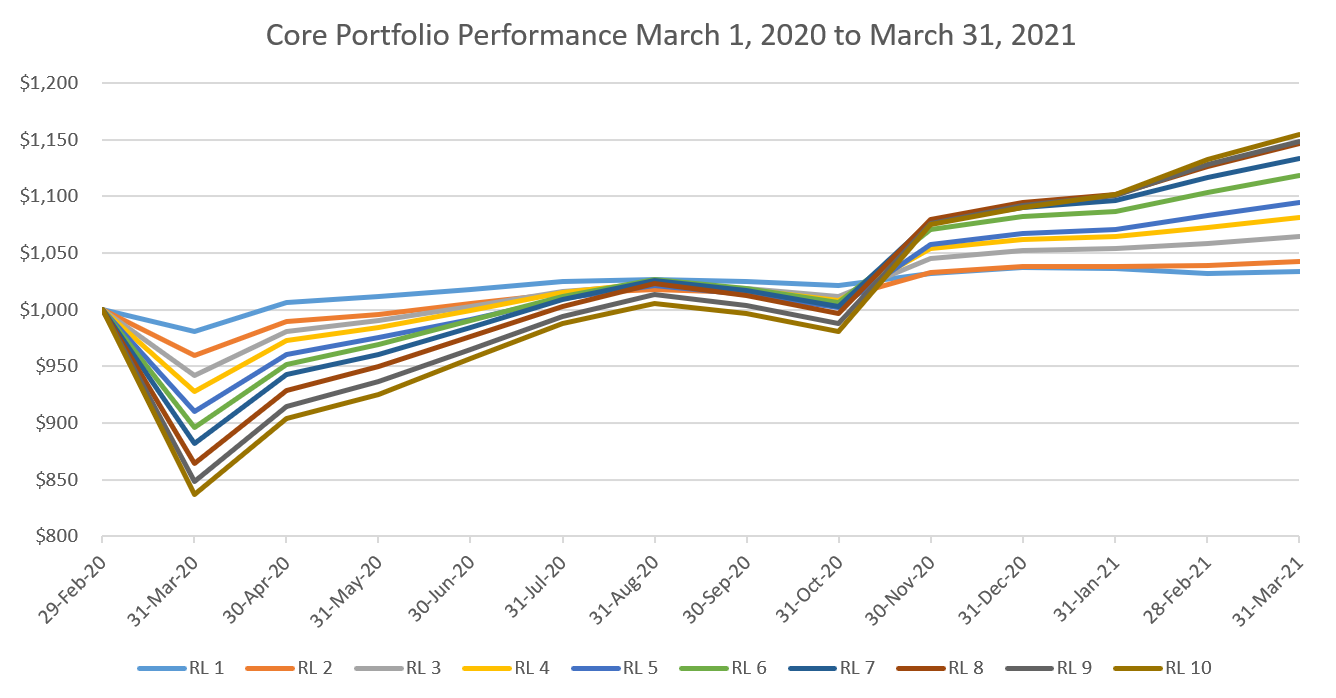

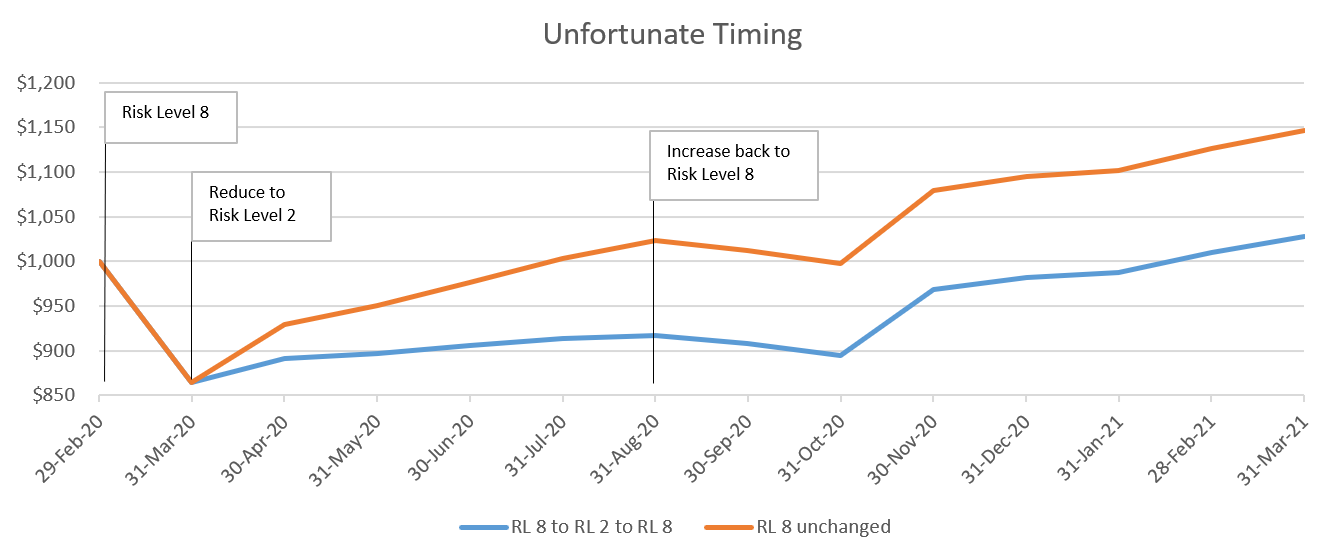

Looking back over the past thirteen months, the portfolios have performed relatively well. March 2020 was the worst month we’d seen in many years but the portfolios bounced back quickly. Even the highest risk portfolio, which declined -16.3% in March, recovered that within 5 months. If you reduced your risk level in March or April, and then waited until August or September (or even later) to increase your risk level again, you would have missed out on most of the recovery.

For example, if you were invested in our Risk Level 8 portfolio at the start of March 2020 and after being spooked by the drop in March reduced your risk level to 2 by the end of March, when would you have increased your risk level again? If you had waited until the end of August to increase your risk level back to 8, the above chart illustrates the difference from if you’d remained in Risk Level 8 throughout that period. In dollar terms, you’d be $118 dollars ahead per $1000 invested.

For example, if you were invested in our Risk Level 8 portfolio at the start of March 2020 and after being spooked by the drop in March reduced your risk level to 2 by the end of March, when would you have increased your risk level again? If you had waited until the end of August to increase your risk level back to 8, the above chart illustrates the difference from if you’d remained in Risk Level 8 throughout that period. In dollar terms, you’d be $118 dollars ahead per $1000 invested.

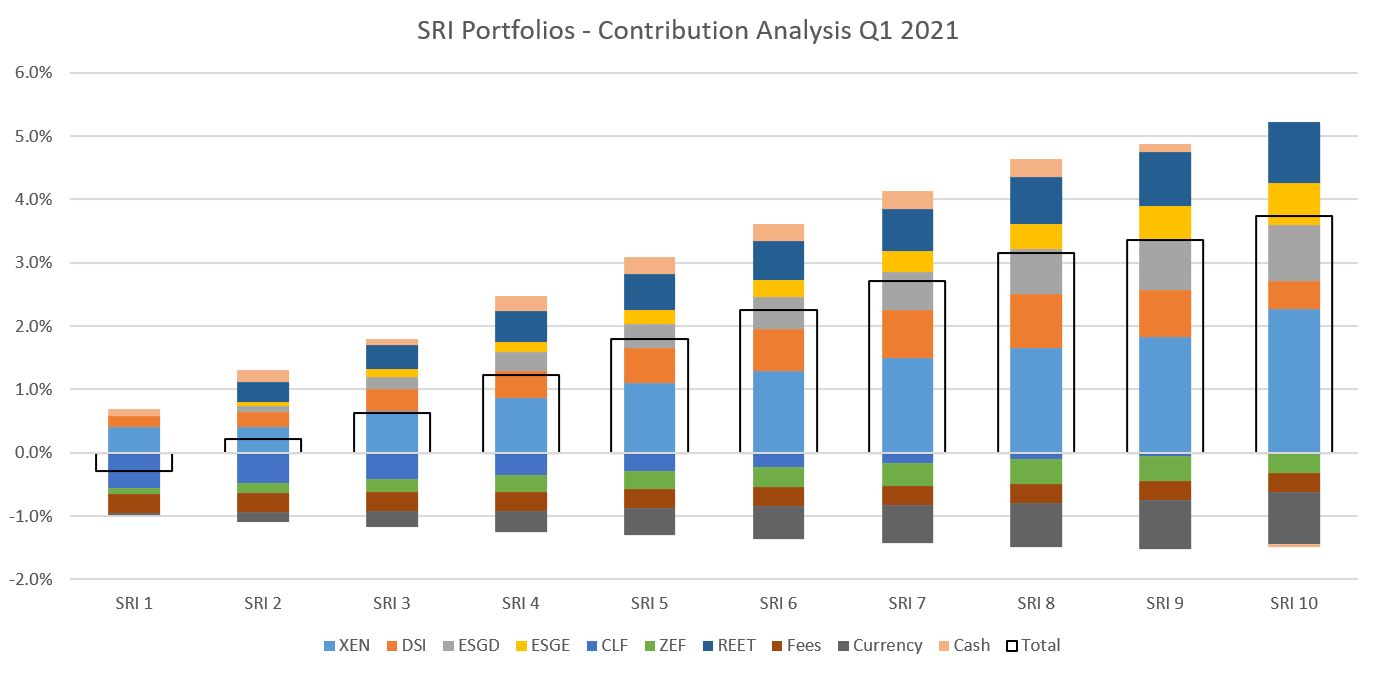

Socially Responsible Portfolios:

The largest positive contributors to performance for the quarter were Canadian stocks (XEN) and US stocks (DSI). Together, they accounted for almost all of the positive performance for the first quarter. Real estate (REET) was the next largest performer, despite it being a small allocation in the portfolios, as it returned more than 7% in the quarter. International (ESGD) and emerging market stocks (ESGE) also contributed positively.

The only negative contributors were the fixed income ETFs: CLF and ZEF. CLF, our Canadian fixed income ETF, was only down -0.6% for the quarter, but as it is the largest allocation in the lower risk portfolios it was the largest performance detractor for risk levels 1 to 5. When we launched the ModernAdvisor portfolios in 2016 we made the decision to not include exposure to long term Canadian bonds. This worked well in the first quarter as they dropped -5% in the quarter, their worst quarterly showing since 1994.

Emerging market bonds was the worst performing asset class in the portfolios losing more than -3%, but as it is a small allocation in the portfolios it didn’t have a large impact on performance.

The other major negative contributor to performance was the US dollar. DSI, ESGD, ESGE, and REET are all priced in US dollars; with the Canadian dollar gaining +1.30% against the US dollar in the first quarter, the currency effect had a negative impact on performance.

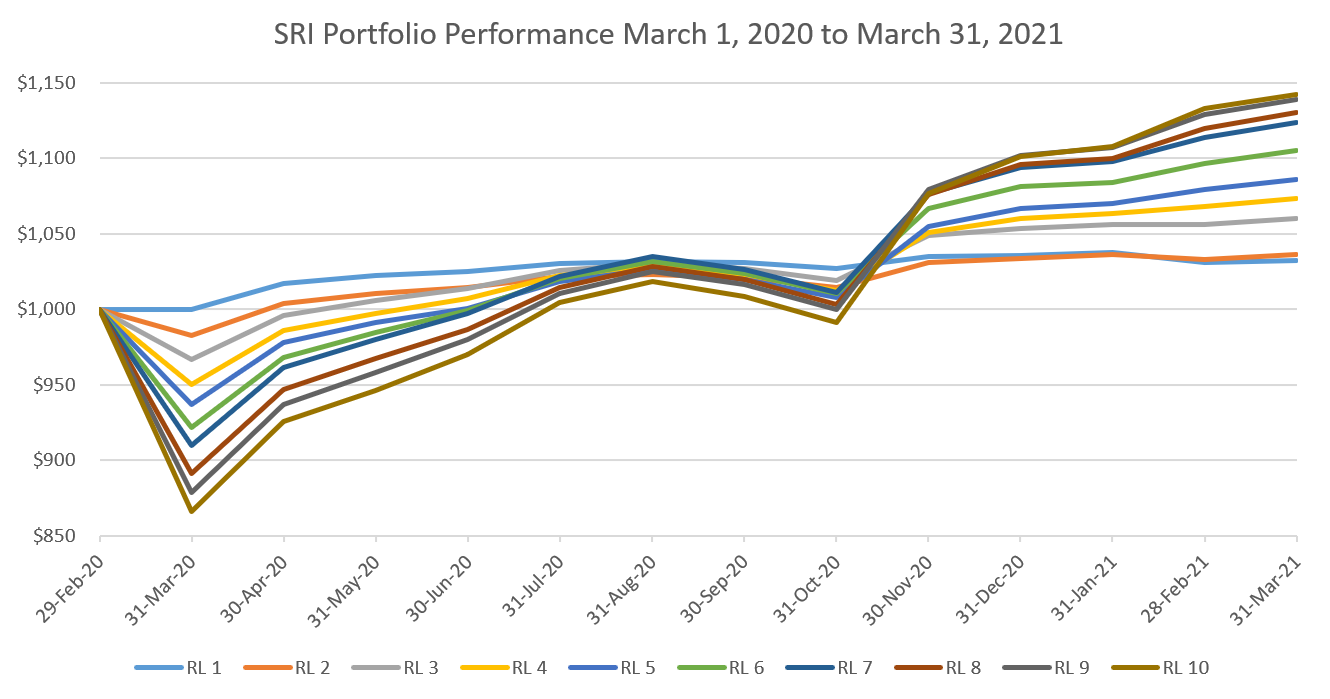

Looking back over the past thirteen months, the portfolios have performed relatively well. March 2020 was the worst month we’d seen in many years but the portfolios bounced back quickly. Even the highest risk portfolio, which declined -13.4% in March, recovered that within 4 months. If you reduced your risk level in March or April, and then waited until August or September (or even later) to increase your risk level again, you would have missed out on most of the recovery.

Looking Ahead

Since we launched the Socially Responsible portfolios in late 2016 a lot has changed. There were not that many ETFs that followed an ESG (Environmental, Social, Governance) strategy that screened out the worst offenders; there were no ETFs available to Canadians that invested in international developed or emerging market stocks. Over time we added international developed or emerging market to the SRI portfolios. Now, there are socially responsible ETFs with even stricter ESG screens than before. In the near future we will be making changes to make the ModernAdvisor Socially Responsible portfolios even better.