Volatility continued its decline in November from the high levels seen in August and September. Performance was flat to negative on most stock markets and commodities had difficult month.

November 2015 Market Performance

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

| Other Market Data | Month-end Value | Return for November |

2015 YTD Return |

| Oil Price (USD) | $41.65 | -10.60% | -21.81% |

| Gold Price (USD) | $1,065.80 | -6.62% | -9.99% |

| US 3 month T-bill | +0.22% | +0.14%* | +0.18%* |

| US 10 year Bond | +2.21% | +0.05%* | +0.04%* |

| USD/CAD FX rate | 1.3353 | +2.13% | +15.10% |

| EUR/CAD FX rate | 1.4107 | -1.88% | +0.49% |

| CBOE Volatility Index (VIX) | 16.13 | +7.03% | -15.99% |

*Absolute change in yield, not the return from holding the security.

Equity markets had a relatively quiet month in November. With a few exceptions, most markets were flat to negative. The standouts were German and Japanese stocks which when measured in their home currencies, were up 4.9% and 3.5% respectively.

Volatility in Canada and the US declined while both country’s stock markets produced little in the way of gains.

Canadian corporate bonds performed reasonably well, up 0.2%-0.8% depending on the sector. The broad FTSE/TMX Universe Bond Index was up 0.1%. Investment grade bonds in the US performed well, but high yield had a very difficult month. Canadian high yield was also negative for the month.

Commodities continued to slide with oil down -10.6% and gold -6.6%. And gold was the ‘top’ performer on the metals markets as silver, copper, platinum and palladium futures all performed much worse (palladium was down almost 20%!). Oats, orange juice, sugar and cocoa were the lone commodities up more than 2% for the month. The broad Bloomberg Commodity Index was down -7.3%.

The Canadian Dollar weakened against the US dollar, dropping to 1.3353 to close the month. Against the Euro, the Canadian Dollar strengthened to 1.4107.

Market Commentary

November was a quiet month with little in the way of major market moving news. Terrorism like that which occurred in Paris does little to rattle financial markets any more. Likewise, the reports of Turkey shooting down a Russian fighter jet also had little effect.

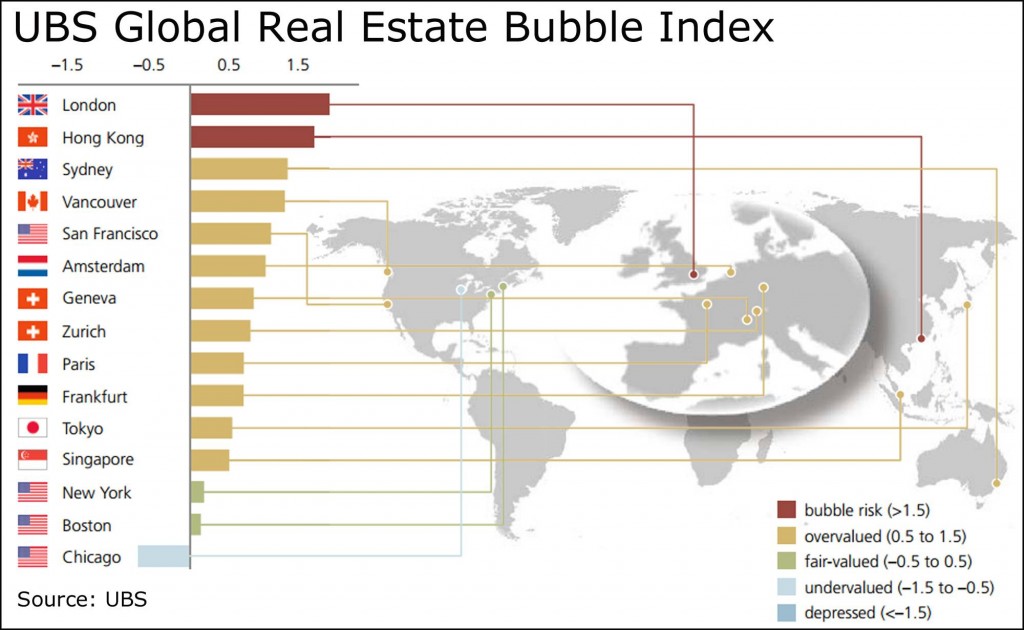

Canada’s housing market continues to show strength, driven as always by Vancouver and Toronto. A recent report by the investment bank UBS put Vancouver in the ‘overvalued’ category along with other major cities like Sydney, San Francisco, Geneva, Amsterdam, and Frankfurt. Only London and Hong Kong met UBS’ bubble criteria.

In the summer, alternative lender Home Capital Group announced it was cutting ties with dozens of mortgage brokers over irregularities in the paperwork provided to it for residential mortgages. The Globe and Mail covered the problem in a recent article. Apparently the falsification of information submitted on mortgage applications is more widespread in Canada than is commonly thought. Most of this is not from criminals looking to scam the banks, but from mortgage brokers trying to help their clients qualify for a mortgage, in what has been called “soft fraud” or “fraud for shelter”. With home prices continuing to rise, and incomes not, more people are altering their reported income to qualify for larger mortgages as their desired home becomes ever more expensive.

That sounds very reminiscent of ‘Ninja’ (no income, no job or assets) mortgages from the U.S. While most lenders require a prospective borrower to provide proof of their income, employment, and assets and liabilities, some brokers and lenders in the U.S. did not verify this information leading up to the subprime crisis. Hopefully that is not occurring in Canada right now.

November Economic Indicator Recap

Below are the current readings on the major economic indicators: central bank interest rates, inflation, GDP and unemployment.

Below are the current readings on a few other often followed economic indicators: retail sales and housing market metrics.

A Closer Look at the Canadian Economy

Canada’s unemployment rate declined -0.1% in October to 7.0% as both full time and part time jobs were added.

New housing starts dropped 14% in October, but were close to the estimated 200,000. Building permit activity, which was reported for September, was down -6.7%, unsurprising given the decline in housing starts the following month. Housing prices rose +0.1% for the month of September and were up +1.3% over the last year.

Inflation for October was +0.1%, or +1.0% over the last year. Core inflation which excludes more variable items such as gasoline, natural gas, fruit & vegetables and mortgage interest has remained steady for the last 3 months at +2.1%. Retail sales in September declined -0.5%, and were up +1.2% over the past 12 months.

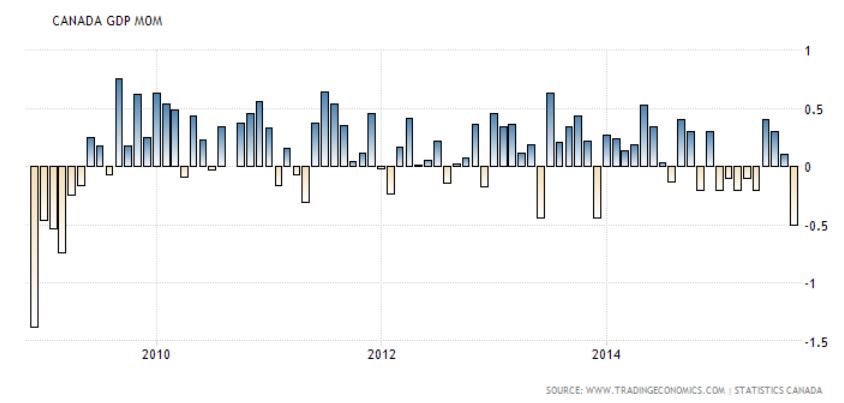

The September GDP report for Canada was surprisingly negative at -0.5%, the worst monthly report since 2009. Despite the drop in September, the Q3 GDP report was positive at +0.6%. The Bank of Canada meets on December 2 and is expected to leave interest rates unchanged at +0.5%.

*Sources: MSCI, FTSE, Morningstar Direct, Trading Economics