Market Update

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted. Sources: *Sources: MSCI, FTSE, TMX, S&P

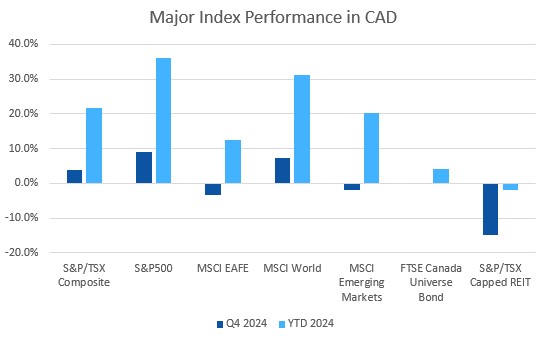

The final quarter of 2024 was a mixed bag with many market indexes ending the year on a sour note as the uncertainty of a second Trump presidency took hold.

Canadian stocks were mixed in the fourth quarter, the S&P/TSX Composite Index gained +3.8%, and finished 2024 at +21.7%. The S&P/TSX Small Cap was flat in Q4 at +0.1%, and +16.0% for the year. The US stock market indexes were more muted than they have been all year; the S&P500 gained +2.4% in the fourth quarter (+25.0% for 2024). The tech heavy Nasdaq Composite Index had a good quarter, gaining +6.2% (+28.6% for 2024), while the small cap Russell 2000 Index was flat for the quarter and finished 2024 at +10.0%.

EAFE stocks (Europe, Australasia, and Far East) finished the year at +8.4%, after losing -0.90% in the fourth quarter. European stocks had a very underwhelming 2024, gaining only +4.9%. Japan’s Nikkei 225 started the year well, gaining +20% in the first quarter but went to sleep after that, and finished the year at +16.2%. Emerging market stocks had a difficult quarter with the MSCI Emerging Markets Index losing -4.6%, the index finished the year at +10.5%.

While the Bank of Canada cut interest rates by 0.50% at the October and December meetings, fixed income markets reacted poorly to finish 2024. The FTSE Canada Universe Bond Index was flat for the quarter and finished 2024 at +4.2%, while the FTSE Canada Short Term Bond Index was up +0.6% for the quarter (+5.7% for 2024). US fixed income was weak after the US Federal Reserve slowed the pace of interest rate cuts and only cut 0.25% at their October and December meetings. The Bank of America (BoA) indexes were weak in Q4: -4.9% for the ICE BoA AAA Corporate Index (-0.8% for 2024) and -2.5% for the ICE BoA BBB Corporate Index (+3.6% for 2024). The riskier high yield indexes performed better: the ICE BoA CCC Corporate Index was up +2.5% (18.2% for 2024) and +0.2% for the US High Yield Master II (+8.2% for 2024).

Real Estate Investment Trusts (REITs) did not respond well to the larger interest rate cuts and had a very difficult fourth quarter. The S&P/TSX Capped REIT Index gained lost -14.7% (their fifth worst quarter since 1998), wiping out all of the positive performance from earlier in the year, finishing 2024 down -2.0%.

Oil finished the year roughly where it started; oil gained +5.2% for the fourth quarter and +0.1% for 2024. The diversified Bloomberg Commodities Index was down -1.4% in Q4 as losses on other commodities offset the rise in oil prices. It also finished the year up +0.1%.

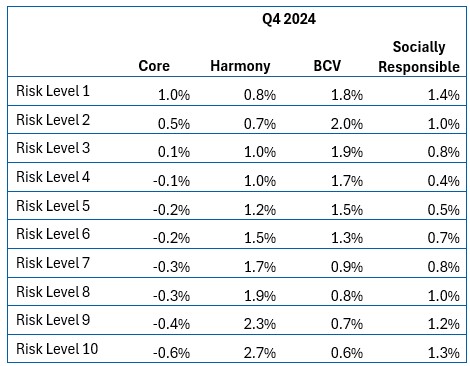

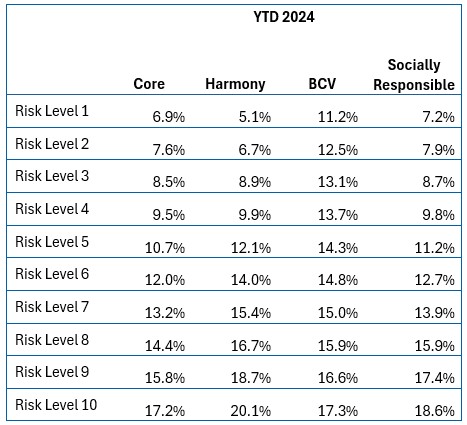

Portfolio Performance

Performance of the ModernAdvisor portfolios was positive decent performance from equities offset declines in fixed income.

The high interest savings portfolio returned +0.9% in Q4 and +4.4% for 2024.

For more details about the performance of our portfolios, visit our website or see our portfolio factsheets here.

Disclosure:

The performance figures above are a time weighted composite of all accounts being managed to the stated risk level, and include ModernAdvisor management fees plus GST/HST, where applicable. Personal portfolio performance experience may vary. All returns are stated in Canadian dollar terms unless indicated otherwise.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy. These sources include the websites of MSCI, FTSE Canada, ICE Indices and Yahoo! Finance for the relevant periods cited in this commentary. Modern Advisor Canada Inc. provides discretionary portfolio management services through an online investment management platform and is a subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital Group Limited and its affiliates, please visit www.guardiancapital.com. For further information on Modern Advisor Canada Inc., please visit www.modernadvisor.ca. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.