Commentary

Q2 GDP released in August showed the Canadian economy unexpectedly contracted at an annualized pace of 0.2%, much weaker than projections of more than 1% growth. Preliminary GDP data for Q3 also shows little growth. This suggests that rate hikes are starting to work. After a hike of 0.25% in July, the Bank of Canada left rates unchanged at their meeting on September 6. The benchmark rate now stands at 5%.

Signs of some softening in the economy and labour market make the case that the Canadian economy is slowing as households also rein in spending. However, the picture is still mixed as inflation rose in August for the second month in a row. Headline inflation was 4.0% in August year over year which was a step up from July at 3.3%. Factors behind high inflation include gasoline, shelter and food prices.

The US economy continues to be resilient despite economic uncertainties, high interest rates, and inflation above the Federal Reserve’s target of 2%. At its September meeting the Fed left interest rates unchanged and signaled for rates to stay higher for longer, forecasting one more rate hike on the table for this year. Rates in the US are already at their highest level in 22 years after the 0.25% increase in July. Headline inflation was 3.7% in August year over year (up from 3.2% in July), mainly due to higher gasoline prices resulting from oil production cuts in OPEC countries. US core inflation, which removes food and energy prices, was 4.3% on an annual basis in August (down from 4.7% in July). The August jobs report was above forecast showing more jobs created than expected. The labour market remains strong but there are some signs that it may be weakening as June and July jobs numbers were revised lower. There was an uptick in unemployment to 3.8% in August, but that is still near historic lows. Consumers have shown an ability to absorb higher prices and the Fed’s message is that rates will need to stay higher until they have the desired effect on consumption, hiring and inflation.

So how long does ‘higher for longer’ mean? The inflation picture is getting better but there is no sign of interest rates coming down any time soon. Rates have been high all year and fears of macroeconomic weakness have been lingering for some time. But there is a growing realization there won’t be a pivot to rate cuts yet, which means interest rates will remain elevated. Added to the mix are geopoliticial tensions, the Ukraine war, and China’s economic re-opening which has had a smaller impact than had been expected.

As always, staying diversified is important to navigating through the uncertainties.

Market Update

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

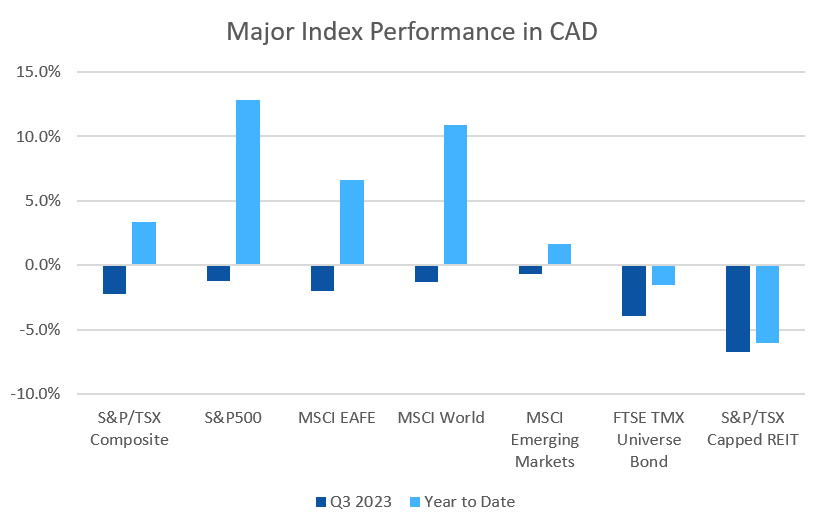

The third quarter was a negative one for nearly all markets, with losses in September and August losses outweighing the gains seen in July.

Canadian stocks were down during the third quarter, with losses ranging from -1.5% to -3.5%. The S&P/TSX Composite Index finished the quarter down -2.2% (+3.4% for the year). The US stock market also lost ground with small cap stocks being the worst performers. The S&P500 lost -1.2% and the tech heavy Nasdaq lost -4.1%.

EAFE stocks (Europe, Australasia, and Far East) were down -2.0% for the third quarter with Japan contributing a large portion of the losses (-4.0%). Despite the 3rd quarter, Japanese stocks are among the best performers in 2023, and are on track for their best year in a decade, up 22.0% YTD. Emerging market stocks continued to be a laggard, gaining only +1.7% for 2023. Despite being a screaming bargain, many investors continue to overlook their potential.

Many analysts are forecasting that interest rate hikes are near their end, which was not much comfort for fixed income investors. The FTSE/TMX Universe Index was down -3.9% for the quarter (-1.5% YTD) and the FTSE/TMX Short Term Index was down -0.1% (+0.9% YTD). US fixed income performed similarly: the Bank of America indexes were mixed: -5.2% and -2.4% for the AAA and BBB indexes, respectively, while the riskier high yield indexes performed better, the BoA CCC index was up +2.8% (+12.98% YTD) and +0.5% (+6.0% YTD) for the US High Yield Master II. With the bulk of the interest rate hikes in the rearview mirror, the large losses we saw in bonds in 2022 are unlikely to repeat in 2023.

Oil was the biggest gainer in Q3, up +28.5% (+12.8% YTD), and the diversified Bloomberg Commodities Index was up +3.3% for the third quarter (-7.1% YTD).

Portfolio Performance

Performance of the ModernAdvisor portfolios was mostly negative in the third quarter, with the lower risk portfolios experiencing relatively better performance due to their large weight in fixed income.

Our Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned -2.4%, -3.0%, and -1.1% in the quarter respectively. Our balanced Core, Socially Responsible, and Harmony portfolios (Risk Level 6) returned -1.6%, -2.2%, and -0.9%, respectively. Our conservative (Risk Level 2) Core, Socially Responsible, and Harmony portfolios returned -0.7%, -1.3%, and +0.5%, respectively.

For more details about the performance of our portfolios, see our portfolio factsheets here.