Commentary

The second quarter of 2023 saw confidence return to the US banking system with volatility receding, putting the spotlight back on inflation and central bank rate increases.

The Bank of Canada (BoC) increased the benchmark interest rate in June by 0.25% after holding steady in March and April. Many had expected the rate rises to end at 4.75% but the consensus is calling for another 0.25% increase at the July 12 meeting. Inflation has been falling in most areas, except for grocery prices.

The US economy has continued to be resilient despite the Fed’s aggressive tightening policy, with labour market conditions remaining tight. May’s employment report showed more solid job growth, exceeding forecasts, despite a slight uptick in unemployment. After ten straight interest rate increases the Fed paused at its June meeting. However, Fed Chair Powell has implied additional rate hikes are on the table for this year to get inflation back down to the central bank’s target of 2%. Investors seem to be looking far into the future when rates have topped out, at least if the strong US stock market, particularly in tech stocks (which often have little to no debt) are any indicator.

In Europe, the ECB raised rates for the eighth consecutive time and hinted at more to come. Similarly in the UK, the Bank of England did its 13th hike in a row as price pressures continue due to sticky inflation.

While rising interest rates haven’t been great for mortgage holders, particularly those with variable rate mortgages, its been very good for savers. Its not hard to find 1 year GICs at or near 5% now. This has also helped savings accounts look good again, with interest rates on some products also around 5%.

ModernAdvisor is now offering a High Interest Savings Portfolio (HISP), alongside our existing Core, SRI, Harmony, BCV and Guardian Portfolios. The HISP is generally suitable for clients with short time horizons and that are conservative, but it is available to all clients. The HISP invests in the Purpose High Interest Savings Fund (PSA) and is available for all account types including RESPs and RDSPs. You can learn more about the HISP here.

If you’d like to switch an account to HISP, respond to this email or chat with us online.

Market Update

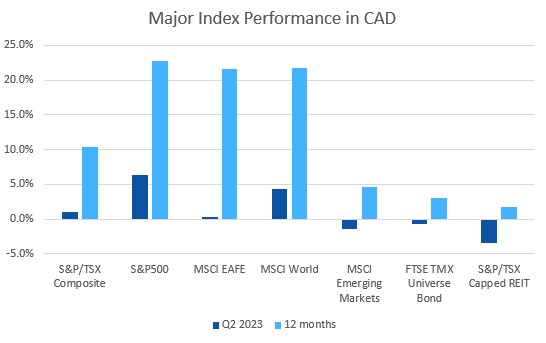

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

Canadian stocks were up and down during the second quarter; despite a loss of -5% in May, the S&P/TSX Composite Index finished the quarter up +1.1% (+5.7% for the year). The US stock market performed strongly in Q2, posting positive returns in all three months, with the US tech sector leading the way. The S&P500 gained +8.7% and the tech heavy Nasdaq gained +12.8%. The Nasdaq’s performance has been so strong and concentrated in the 5 largest stocks (Microsoft, Apple, Amazon, Nvidia and Tesla), that they accounted for 43.8% of the Nasdaq 100 index at the beginning of June. This strong outperformance is triggering a special rebalancing of the index in July, which will bring their combined weight down to 38.5%. The last time a special rebalancing occurred was in 2011.

EAFE stocks (Europe, Australasia, and Far East) are having a good year, up +10.1% for 2023 so far (3.2% in Q2); with Japan doing most of the heavy lifting, up +18.4% in the second quarter and +27.2% (!) for 2023. Emerging market stocks continued to be a laggard, gaining only +0.7% in Q2 and +4.1% for 2023 so far. Despite being a screaming bargain, many investors continue to overlook their potential.

Many analysts are forecasting that interest rate hikes are near their end, which was not much comfort for fixed income investors. The FTSE/TMX Universe Index was down -0.7% for the quarter (+2.5% YTD) and the FTSE/TMX Short Term Index was down -0.8% (+1.0% YTD). US fixed income performed similarly: the Bank of America indexes were down -0.9% and 0.0% for the AAA and BBB indexes, respectively. The riskier high yield indexes performed better, the BoA CCC index was up +4.7% (+9.8% YTD) and +1.6% (+5.4% YTD) for the US High Yield Master II. With the bulk of the interest rate hikes in the rearview mirror, the losses we saw in bonds in 2022 are unlikely to repeat in 2023.

Oil and commodities in general were again the biggest losers in the second quarter of 2023; oil was down -6.6% (-12.2% YTD) and the diversified Bloomberg Commodities Index was down -3.8% (-10.0% YTD). A big change from 2022 when both of those were among the few positive indexes.

Portfolio Performance

Performance of the ModernAdvisor portfolios was muted in the second quarter, with the lower risk portfolios held back by declines in fixed income markets. Our Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned +1.9%, +1.2%, and +1.6% in the second quarter respectively. Our balanced Core, Socially Responsible, and Harmony portfolios (Risk Level 6) returned +0.9%, +0.6%, and +0.5%, respectively. Our conservative (Risk Level 2) Core, Socially Responsible, and Harmony portfolios returned -0.3%, -0.5%, and +1.3%, respectively.

For more details about the performance of our portfolios, see our portfolio factsheets here.