When choppy market returns are accompanied by uncertainty and volatility associated with major world events, even the most experienced investors can find it difficult to tune out the noise and stay disciplined.

In the last couple of months most stock markets around the world are mostly flat or down. Investors are awaiting the outcome of the US elections and whether the US Federal Reserve will decide to raise interest rates later this year.

In the face of disappointing short-term returns and anxiety over future changes in the global political and financial regimes, it is tempting to make hasty and emotional decisions. But if history is our guide, it pays to follow your investment plan and stay the course.

If you find yourself worrying about the short-term ups and downs of your investment portfolio, consider the following:

It pays to stay the course

Investing in stocks is not risk-free and with it comes volatility. And by volatility what I really mean is the potential for your investments to decline in value in the short-term. Looking at the monthly history of Canadian stocks over the past 30 years, 39% of the months had a negative return. 30% of the calendar years also had a negative return. But for the same period, a buy and hold investor would have made 8.1% per year.

It’s not going to be a smooth ride

Depending on your portfolio’s risk level and your exposure to stocks, the investments in your portfolio could experience substantial ups and downs. Proper asset allocation can reduce your portfolio’s volatility, but it will not eliminate it. Based on our back tests, our Risk Level 5 portfolio would have lost -19.2% from the peak of the market in May 2008 to February 2009. But even with that decline, the portfolio would’ve been up 51% over the last 10 years.

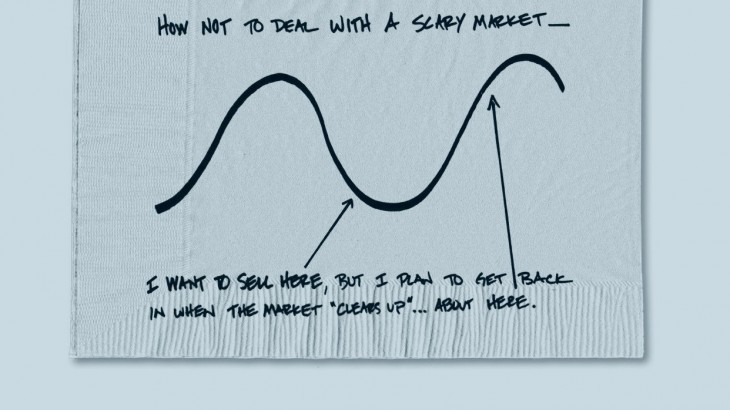

Market timing doesn’t work

In theory market timing is brilliant: you participate in the upside but sit out the downturns. In practice though, market timing rarely works.

To be a successful market timer you have to be able to make two correct calls: when to get out, and when to get back in. It may sound simple, but there are very few investors who can do this successfully and consistently. And the consequences of making of getting it wrong could be severe. Looking back at Canadian stocks over the last 50 years, if you’d missed the 10 best months (out of 600 months), your annualized return would be a mere 7.0% compared to 9.4% if you had been invested for the full 50 years.

Activity is good for your health, not your investment portfolio

In behavioral economist Meir Statman’s book, What Investors Really Want, he cites research from Sweden which showed that the most active traders lost 4% of their account value each year compared to the least active traders. Across 19 major stock exchanges, investors who traded frequently underperformed buy-and-hold investors by 1.5% a year.