Baby on the way? A little financial planning goes a long way.

As you already know, having a baby is going to bring substantial change to your life. You can expect your expenses to increase, while your income will most likely decrease (at least in the first few months). The best way to prepare for these changes is to plan ahead.

Adjust to a lower income

Your income is likely to decrease when you are on maternity or paternity leave. You should check the EI benefits and other benefits that you might receive from your employer and calculate how much your income is likely to decrease. The best way to prepare for this decrease is to get used to living on a lower income. Try setting up an automatic savings plan that transfers an amount equivalent to the expected decrease in your earnings while you are taking care of your baby to a high-interest savings account.

If you do this, not only will you start adjusting to the lower income, you will build a small emergency fund that can be used to pay for child care or unexpected expenses.

Make a shopping list

You can save yourself a lot of stress, and potentially lots of money, if you make a shopping list of everything you need to buy for when your little bundle arrives. I’m not suggesting you go out and buy everything you need at once – in fact that’s likely not a good idea. But by making a list, you can watch out for deals and make your purchases when you come across a good sale. You can also create a registry and have friends and family help out with buying some of the items on your list for you.

We’ve created a list in the resource section of our eBook that you can use as a reference. Keep in mind that the list is just a guide. You may be able to live without some of the items on the list, and save yourself some money. Try to price out the larger purchases to get a sense of how much money you need to set aside.

To save some money, you could consider buying some of the items second hand. However, it is not recommended to buy second hand cribs and car seats due to safety issues.

Look into child care early

Unless you plan to stay home to take care of your little bundle yourself, you should look into child care providers before your baby is born. In many major metropolitan centres there could be long wait times – sometimes more than a year – for a daycare that you like and is close to you. Costs could also be quite high and need to be planned for.

With the exception of Quebec, child care is not universally subsidized by the provincial governments in Canada. As such, you will be responsible for the cost of daycare.

The cost of daycare varies from region to region and also depends on the age of your child. Infant daycare is usually more expensive than daycares for toddlers and preschoolers. In major metropolitan centres, daycare costs can be as high as $2,000 per month for an infant.

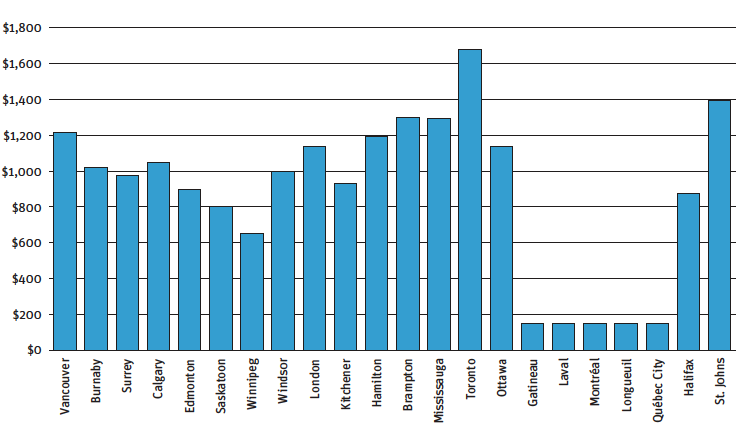

Figure 1 – Median cost of daycare for infants

Source: Canadian Centre for Policy Alternatives

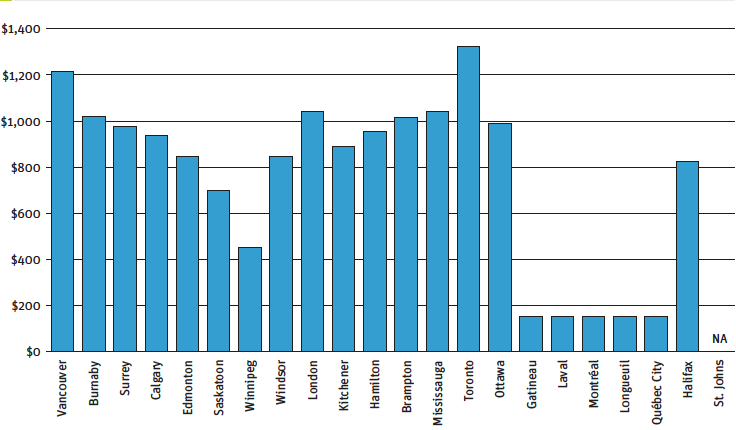

Figure 2 – Median cost of daycare for toddlers

Source: Canadian Centre for Policy Alternatives

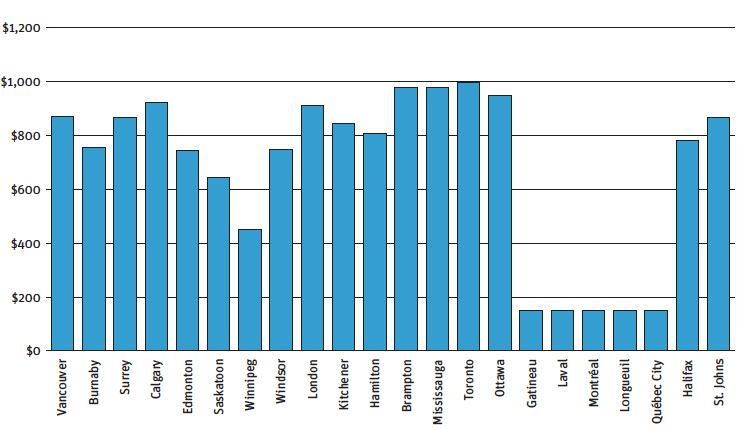

Figure 3 – Median cost of daycare for pre-schoolers

Source: Canadian Centre for Policy Alternatives

When looking for a daycare, look for an option that you are comfortable with and that you can afford. You can choose between home daycares or daycare centres. Home daycares are usually less expensive than daycare centres. Some home daycares are licensed by provincial governments, and follow the same rules and regulations as daycare centres.

There are also unregulated home daycares that are perfectly legal to operate in Canada. Often unregulated home daycare are run by young mothers that have decided to take care of their own children. Unregulated daycares are usually less expensive. However keep in mind that these daycares are not regulated by the government, and do not undergo regular inspection. The only regulation that applies to these daycares is the maximum number of children.

Keep in mind that daycare expenses are tax deductible. Make sure you use a licensed provider – whether it is a home daycare or a centre – if you intend to claim the deduction. You have to report her or his Social Insurance Number (SIN) to the CRA when you file your taxes.