Market Update

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted. Sources: *Sources: MSCI, FTSE, TMX, S&P

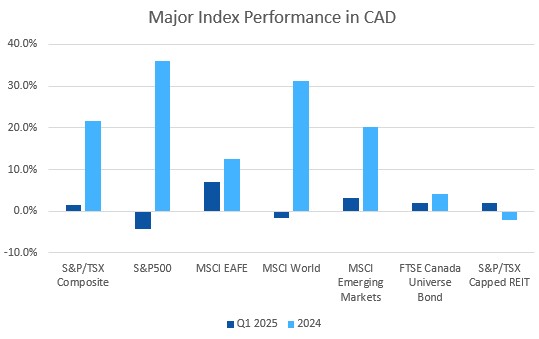

The first quarter of 2025 has certainly been an interesting one as markets have tried to determine what the new normal will look like with Trump in office for the next 4 years.

Canadian stocks were able to hold steady in the first quarter, the S&P/TSX Composite Index was flat, and the S&P/TSX Small Cap lost 0.3%. The US stock market indexes had a volatile quarter; the S&P500 lost 4.6% in the first quarter. The tech heavy Nasdaq Composite Index had a rough quarter, losing 10.4%, while the small cap Russell 2000 Index declined 9.8% in the quarter.

EAFE stocks (Europe, Australasia, and Far East) started the year on the right foot as they gained 6.2% in the quarter, with European stocks gaining 7.8%. Japan’s Nikkei 225 lost 10.7% in the first quarter and emerging market stocks had a good start to the year with the MSCI Emerging Markets Index gaining 4.5%.

While the Bank of Canada cut interest rates by half a percentage point in the quarter, fixed income markets saw little growth as The FTSE Canada Universe Bond Index gained 2.0% for the quarter, while the FTSE Canada Short Term Bond Index was up 1.7% for the quarter. US fixed income saw positive movement as the Fed held interest rates steady. The Bank of America (BoA) indexes saw little growth in the quarter as the ICE BoA AAA Corporate Index gained 2.6% and the ICE BoA BBB Corporate Index gained 2.3%. The riskier high yield indexes performed worse as the ICE BoA CCC Corporate Index was down 0.7% and the US High Yield Master II increased 1.0%.

Real Estate Investment Trusts (REITs) were able to stay out of the red as the S&P/TSX Capped REIT Index increased 0.5%.

Oil started the year with a 0.3% loss and the diversified Bloomberg Commodities Index was up 7.7% in the quarter.

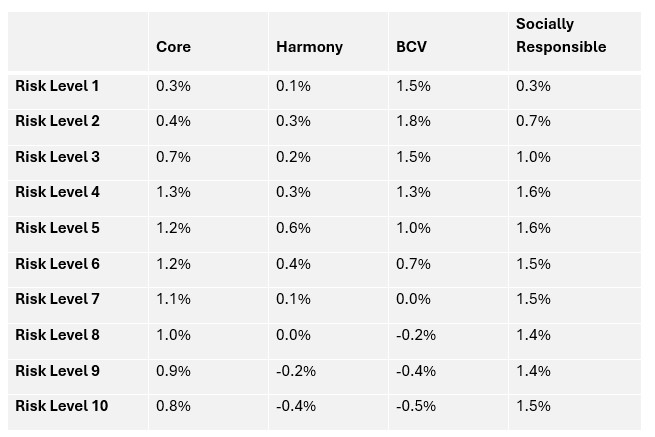

Portfolio Performance – Q1 2025

Performance of the ModernAdvisor portfolios were predominately positive as the BCV portfolios were the top performer in the quarter for risk levels 3 and below, and the SRI funds were the top performers in the quarter for risk levels of 4 and above.

The high interest savings portfolio returned +0.7% in Q1 2025.

For more details about the performance of our portfolios, visit our website or see our portfolio factsheets here.

Disclosure:

The performance figures above are a time weighted composite of all accounts being managed to the stated risk level, and include ModernAdvisor management fees plus GST/HST, where applicable. Personal portfolio performance experience may vary. All returns are stated in Canadian dollar terms unless indicated otherwise.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy. These sources include the websites of MSCI, FTSE Canada, ICE Indices and Yahoo! Finance for the relevant periods cited in this commentary. Modern Advisor Canada Inc. provides discretionary portfolio management services through an online investment management platform and is a subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital Group Limited and its affiliates, please visit www.guardiancapital.com. For further information on Modern Advisor Canada Inc., please visit www.modernadvisor.ca. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.