Commentary

As expected, the Bank of Canada left the benchmark rate at 5% at their last meeting and maintained the stance that it needs to see further progress that inflation is on the right path. Results from the Bank of Canada’s Q4 Business Outlook Survey released in January showed that high interest rates continue to soften consumer demand, but firms expect inflation to remain above the Bank of Canada’s 2% target for some time. The Bank of Canada has said it needs to see continued downward momentum in inflation before conditions exist for interest rate cuts.

With that in mind, there have been two months of subdued inflation reports. The CPI inflation figure for February rose at a lower than expected 2.8% annual rate, down from the previous month’s 2.9%. While the inflation data is encouraging in terms of potential rate cuts at some point this year, the Canadian economy continues to hold on. Unemployment is hovering around 6.0% as job creation fails to keep pace with population growth. Data from Statistics Canada stated that the population grew by 3.2% in 2023, the fastest annual pace of growth since the 1950s.

In the U.S., the Federal Reserve is also taking a slow and steady approach to rate cuts. The Fed left interest rates unchanged at its latest meeting and struck a similar tone to the BoC, saying they need to become more confident that inflation will continue its trend lower towards the 2% target. The latest CPI report showed inflation is still above 3%. Although the Fed has signalled rates should come down at some point this year, U.S. economic growth continues to expand at a solid pace. Q4 GDP in the U.S. grew at a 3.3% annualized rate, faster than expected. Job gains remain strong, and unemployment is below 4.0%. Fed Chair Powell reiterated that the policy rate is likely at its peak for this cycle, and rate cuts could be appropriate at some point this year, putting greater importance on future upcoming inflation reports. The market continues to rally despite having to adjust rate cut expectations as the U.S. performs better than other major economies.

The European Central Bank and the Bank of England have also reflected the view that as they become more confident inflation is heading back to the 2% target, and wage growth moderates, that rate cuts potentially are possible sometime this year.

With inflation moderating and many developed economies performing stronger than predicted, optimism for the so-called soft landing remains intact. In that environment, economies may be able to support ‘higher for longer’ rates. Does 3% become the new 2% inflation target? It remains to be seen where things may go from here. For now, interest rates are one of the key factors moving financial markets, but it’s important to remember the many geopolitical risks. As always, staying invested and diversified is the key to navigating through it. At ModernAdvisor, we offer a range of broadly diversified passive and active portfolios of equity and fixed income for a variety of risk tolerance levels.

Market Update

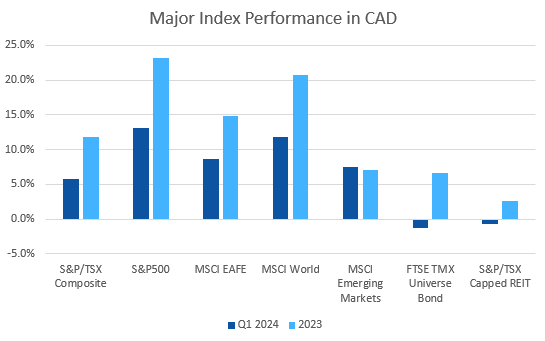

All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted.

The first quarter of 2024 was a welcome follow on from 2023, with most equity market indexes continuing to perform well.

Canadian stocks were up strongly, with the S&P/TSX Composite Index gaining +6.7% in the quarter, and +14.0% over the last 12 months. The S&P Small Cap performed a little better, gaining 7.2% for the quarter. The US stock market indexes continued to surge higher; the S&P500 gained +10.6% in the first quarter (+29.9% over the last 12 months). The tech heavy Nasdaq gained +9.1% for the quarter, while the small cap Russell 2000 index was a relative laggard at +4.8%.

EAFE stocks (Europe, Australasia, and Far East) had their best quarter in several years, gaining +9.2% (+15.7% over the last 12 months). European stocks were a little weaker than EAFE overall while Japan was the standout, gaining +20.0% in the first quarter. Emerging market stocks continued to be a laggard, gaining only +4.0% in the first quarter of 2024 (+7.7% over the last 12 months). Despite being a screaming bargain, many investors continue to overlook their potential, maybe the analysts will be right in 2024.

Many analysts now believe that interest rates have peaked and are forecasting several interest rate cuts in the second half of 2024. The FTSE/TMX Universe Index was down -1.2% in the first quarter and the FTSE/TMX Short Term Index was up +0.3%. US fixed income performed similarly: the Bank of America indexes were mostly positive for Q1: -1.1% for the AAA index and 0.2% for the BBB index. The riskier high yield indexes performed better, the BoA CCC index was up +3.2% and +1.5% for the US High Yield Master II.

REITs performed poorly with the S&P/TSX REIT down -0.7% in the first quarter and -2.4% for the last 12 months.

Oil performed well for the quarter, gaining +16.1%, while the diversified Bloomberg Commodities Index was up only +0.9% as losses on other commodities offset the strength in oil prices.

Portfolio Performance

Performance of the ModernAdvisor portfolios was strong in the first quarter, with higher risk portfolios performing better, as expected with strong equity markets.

Our Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned +7.6%, +6.4%, and +8.5% in the quarter respectively. For the previous 12 months Risk Level 10 Core, Socially Responsible, and Harmony portfolios returned +13.1%, +13.4%, and +17.7% respectively.

Our balanced Core, Socially Responsible, and Harmony portfolios (Risk Level 6) returned +4.7%, +4.0%, and +5.5%, respectively. For the last 12 months Core, Socially Responsible, and Harmony portfolios Risk Level 6 returned +10.3%, +9.2%, and +12.9%, respectively.

Our conservative (Risk Level 2) Core, Socially Responsible, and Harmony portfolios returned +1.8%, +1.5%, and +2.8%, respectively. For the last 12 months Core, Socially Responsible, and Harmony portfolios Risk Level 2 returned +2.4%, +4.6%, and +8.0%, respectively.

The high interest savings portfolio returned +1.2% in Q1 and +4.7% over the last 12 months.

For more details about the performance of our portfolios, see our portfolio factsheets here.

Portfolio Changes

In March 2024 we made a change to our Core and Socially Responsible portfolios. We removed the allocation to emerging market bonds (BMO Emerging Markets Bond ETF) from the Risk Level 3 through 9 portfolios (it wasn’t included in the Risk Level 1, 2 or 10 portfolios). This was a small allocation, less than 5%, that was no longer contributing meaningfully to the performance of the portfolios overall. In the past, the higher yield on emerging market bonds made them an attractive addition to the portfolios. With interest rates in Canada and the US rising to levels not seen in many years, the yield differential has shrunk dramatically, making the higher risk of the emerging market bonds much less attractive. The allocation previously devoted to emerging market bonds was added to the Canadian short-term bond allocation.